In today’s comprehensive EURNZD forecast, we will first examine New Zealand’s current economic conditions. Then, we will meticulously examine the EURNZD pair’s technical analysis.

New Zealand Stocks Hit 4-Month High

Bloomberg—Monday saw New Zealand’s stock market climb by 14.78 points, a modest increase of 0.13%, culminating in a nearly four-month high of 11,564.98. This uptick was primarily fueled by a significant rise in US futures, spurred by Wall Street’s consecutive seven-week rally. The optimism in the market is partly due to expectations that the Federal Reserve may reduce interest rates three times in the coming year, with an additional four cuts anticipated in 2025.

Domestically, New Zealand’s service sector experienced its most substantial expansion in six months, and consumer confidence reached a near two-year high. This positive shift in sentiment is primarily attributed to the increased stability following the formation of a new government in Wellington. In international news, significant monetary injections were noted in China, with the central bank infusing an unprecedented CNY 800 billion into the economy. Policy relaxations in home-buying in Beijing and Shanghai also contributed to this economic stimulus.

Sector-wise, energy, non-energy minerals, and healthcare were the primary drivers of these gains. Notable performers included Ebos Group, surging by 3.7%, Fletcher Building by 3.2%, Mercury NZ Ltd. by 2.8%, and Mainfreight Ltd. by 1.9%.

EURNZD Forecast – A Closer Look at the Key Support

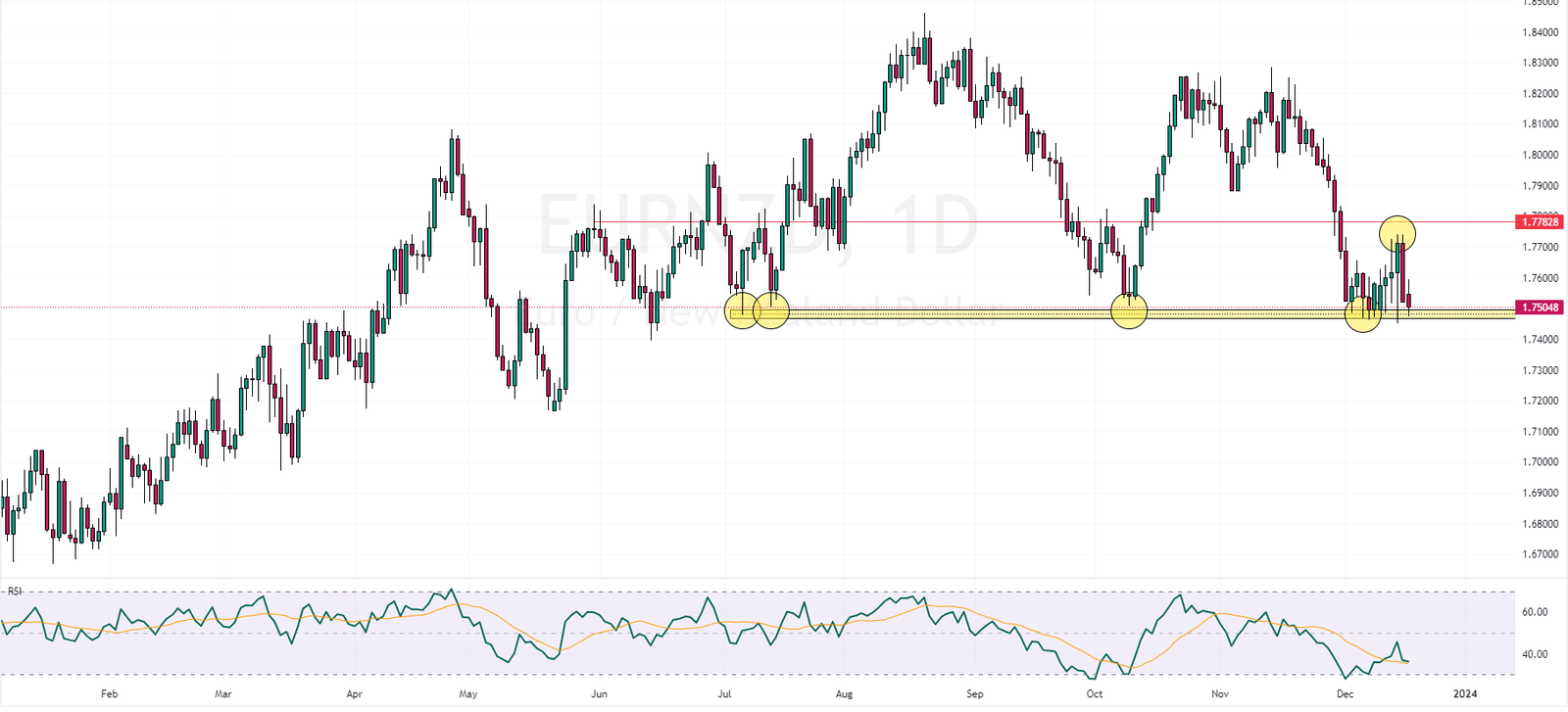

FxNews – The EURNZD currency pair has recently returned to a significant support zone, ranging narrowly between 1.7497 and 1.7467. This particular level has been tested four times in 2023, and notably, it has remained unbreached thus far.

From a bullish technical analysis perspective, if this support level holds firm, we can anticipate a rebound of the EURNZD pair from this formidable point. This potential bounce-back is a key aspect for traders monitoring this currency pair.

Conversely, if the bears consistently keep the EURNZD price below this resistance level, it could signal the continuation of the current downtrend, potentially ushering in a new bearish phase. Confirming that the price has decisively crossed below the support and established stability there is crucial. This is important because, in such scenarios, false breakouts are frequent, which can mislead traders regarding the true market direction.

Therefore, carefully observing the EURNZD pair’s behavior around this crucial support level will be essential in determining the currency pair’s future trajectory.