Today’s EURPLN forecast will examine Poland’s economy and detail the technical aspects of the pair.

EURPLN – A Month of Declining PPI in Poland

Bloomberg – In September 2023, the cost of goods produced by companies in Poland fell by 2.8% compared to last year. This drop follows a slightly larger decrease of 2.9% in August. Market experts expected this change. The cost of manufacturing goods went down further by 5.6%, while the costs for mining, quarrying, water supply, and waste management activities saw a slight decrease.

On the other hand, the cost of electricity, gas, steam, and air conditioning services increased by 9.2%. From August to September, the Producer Price Index (PPI), which measures these changes, increased by 0.3%.

EURPLN Forecast: A Technical Outlook

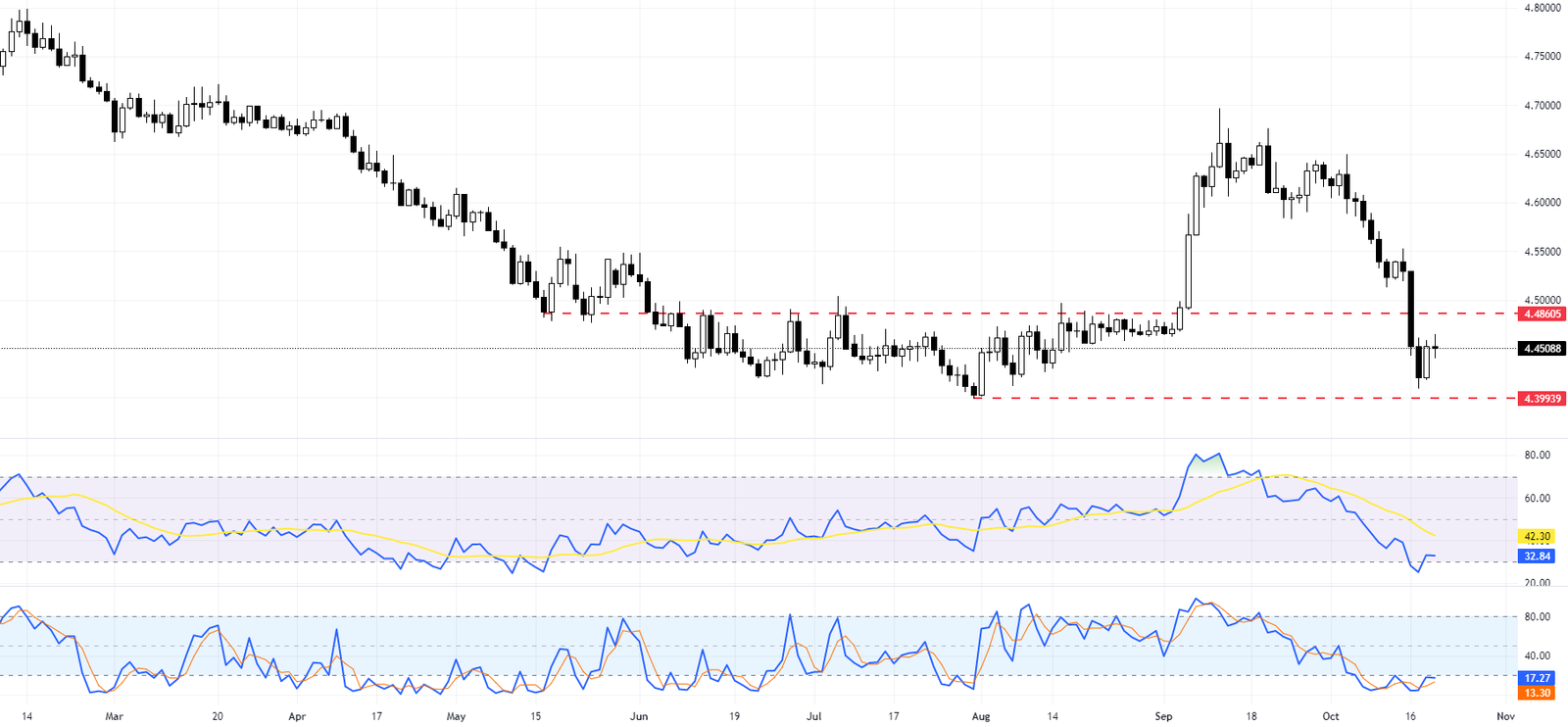

Recently, on October 17, the currency pair experienced a significant slump, extending its downward trajectory to reach a support level of 4.399. The considerable downturn triggered the Relative Strength Index (RSI) and the Stochastic Oscillator to enter the oversold territory, indicating potential buyer opportunities. Given these signals from the momentum indicators, there is a strong possibility that the EURPLN price might experience a correction in the upcoming sessions.

This potential rise could lead to the currency pair testing the broken support level around 4.486. If this resistance level is broken, it could signal a further upward trend for the EURPLN pair.

On the other hand, more decline in the currency pair will be seen if the bears close below the 4.399 support.