In this comprehensive EURSGD analysis, we will first scrutinize the current economic conditions in Singapore. Following that, we will meticulously delve into the details of the technical analysis of the EURSGD pair.

EURSGD – Singapore NODX Takes a Thrilling U-Turn

Reuters – In September 2023, Singapore’s exports of goods (excluding oil) fell by 13.2% compared to the same month last year. This drop was less than what people had predicted (14.7%). This export fall was the smallest since April, even though exports decreased in the 12th month. The fall was seen in both electronic and non-electronic goods. Electronic goods like computer chips and parts of PCs saw a decrease of 11.6% compared to last year. Non-electronic goods like gold (not used as currency), medicines, and food also saw a decline of 13.6%.

Sales to countries like Indonesia, Taiwan, Thailand, and South Korea decreased but increased to the US and China.

However, when we adjusted for seasonal factors (like holiday periods when sales might be expected to go up or down), exports increased by 11.1% in September 2023. This big jump from the 6.6% drop in August is better than the predicted increase of 3.2%. So, despite the overall decrease, there are some positive signs too.

EURSGD Forecast: A Technical Analysis

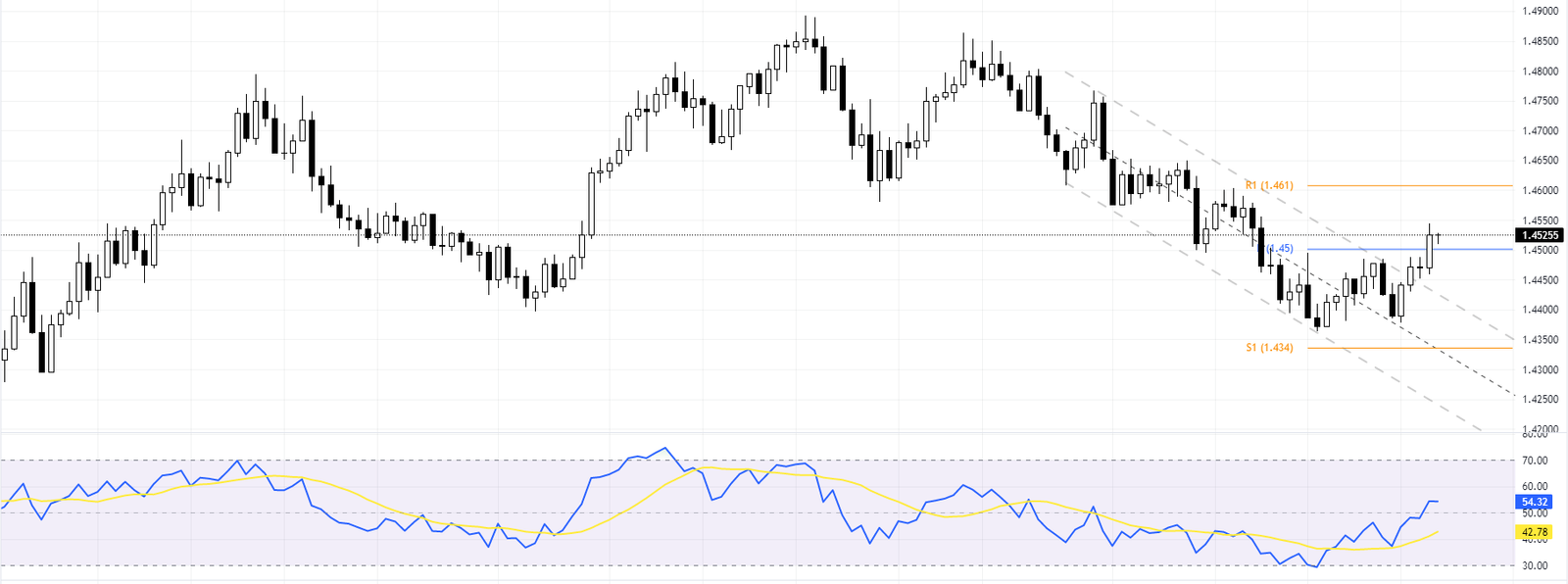

In a significant development, the EURSGD pair has successfully broken out of the bearish channel, closing above the crucial 1.45 pivot point on the daily chart. This shift is further confirmed by the RSI indicator, which has flipped above 50, indicating a bullish bias.

Given these factors, the EURSGD pair is anticipated to continue its upward trajectory, potentially gaining value and reaching the R1 support level around 1.461.

The pivot point serves as a strong support for the bullish scenario in the EURSGD market. However, the decline could continue if the bears push the EURSGD pair to close below this level. The next target for the pair would be the S1 support level, situated around the 1.434 area. Monitor these key levels in the EURSGD market for potential trading opportunities.