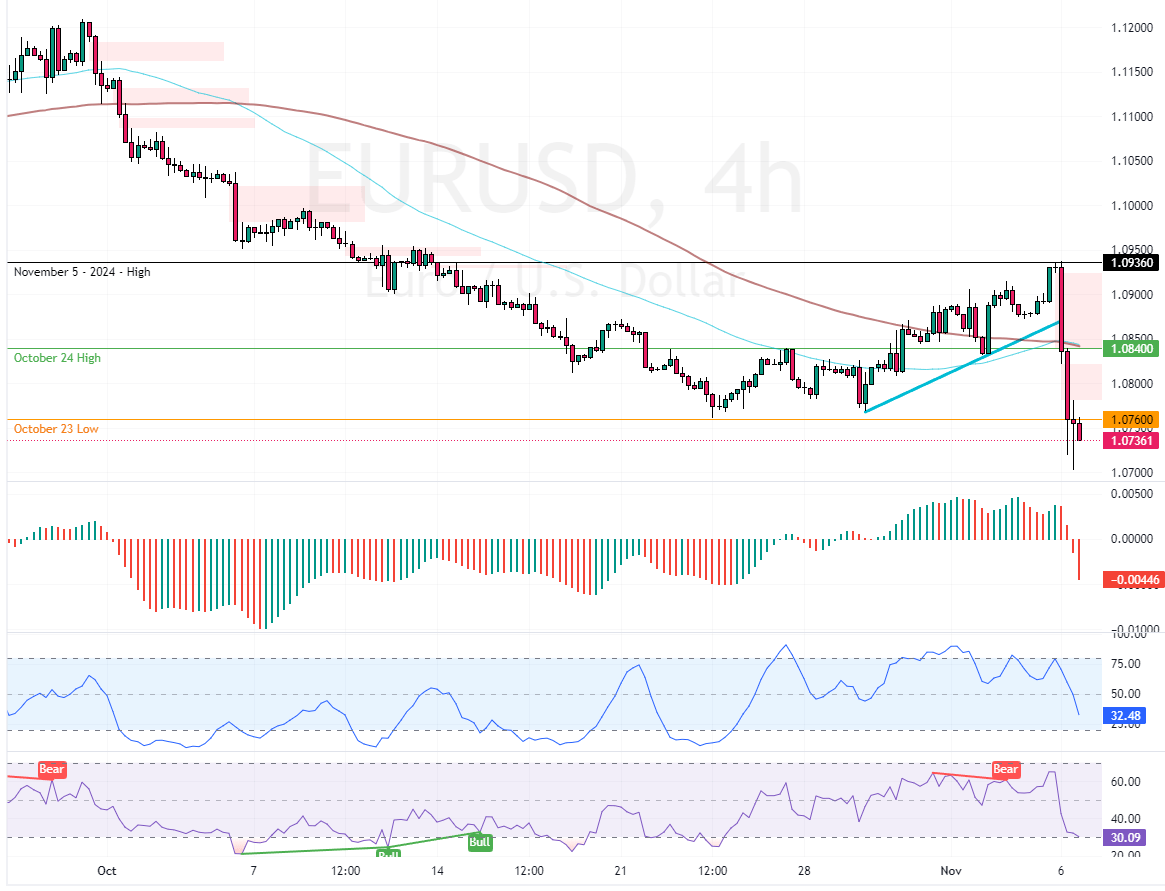

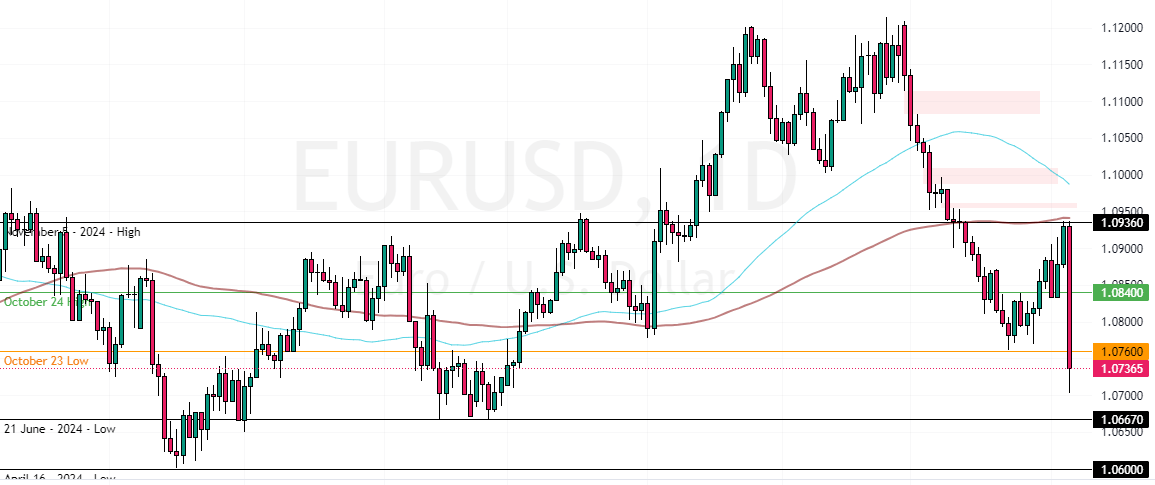

FxNews—The EUR/USD bearish trend resumed after the price broke below the 100-period simple moving average at approximately $1.084. Due to the robust bearish pressure, the European currency experienced more losses, dropping below the $1.076 resistance, the October 23 Low.

As of this writing, the EUR/USD currency pair trades at approximately 1.074, testing the October 23 low as resistance.

EURUSD Technical Analysis – 6-October-2024

The primary trend is bearish because the price is below the 50- and 100-period SMAs. That said, the Awesome Oscillator flipped below the signal line, indicating the bear market should prevail. However, the RSI 14 is nearing oversold territory, meaning the U.S. dollar could become overpriced in the short term.

Overall, the technical indicators suggest while the primary trend is bearish, EUR/USD has the potential to consolidate before the downtrend resumes.

EURUSD Bearish Target Set at 1.066

The critical resistance level dividing the bear market from the bull market is $1.084. The bearish outlook remains valid as long as EUR/USD trades below that level. In this scenario, the next bearish target could be the June 21 low at $1.0667.

Please note that the bearish outlook should be invalidated if EUR/USD exceeds $1.084 or the 100-period simple moving average.

- Support: 1.066 / 1.060

- Resistance: 1.076 / 1.084 / 1.093