Market News—As a new week unfolds, U.S. stock markets exhibit an uptick in activity, with investors poised for significant events. Amid these developments, the Dow Jones Industrial Average climbed by 292 points, equivalent to 0.9%, as of 09:42 ET (13:42 GMT). Complementing this rise, the S&P 500 advanced by 1%, and the NASDAQ Composite saw an increase of 1.3%.

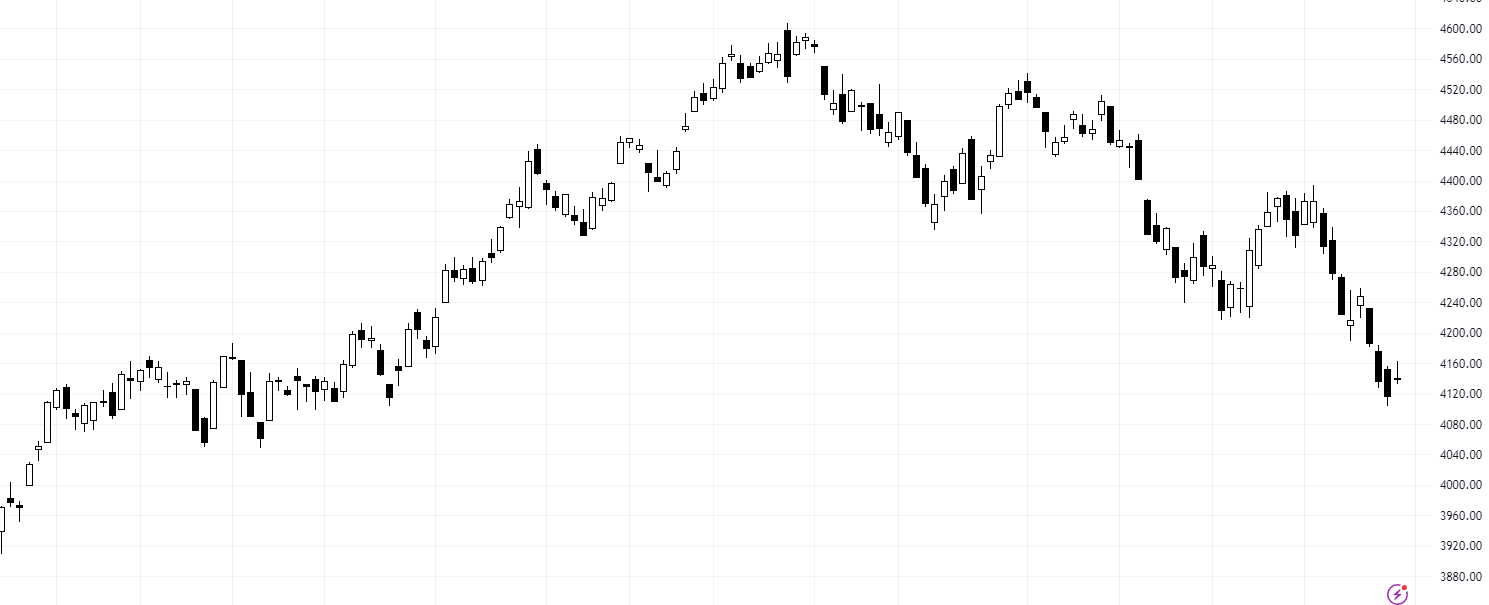

S&P 500 Enters Correction Zone

Bloomberg – The previous week saw the S&P 500 retract by 2.5%, dipping over 10% from its peak in 2023 and entering a correction phase. This downward trend sets the stage for a potential third consecutive month of declines, a sequence not witnessed since the tumultuous times of the pandemic in 2020.

The Federal Reserve Meeting in Focus

The upcoming Federal Reserve meeting is set to significantly influence market sentiment after a surge in Treasury yields sparked concerns among traders. With the economy’s tenacity, speculation abounds that high-interest rates might persist. After peaking above 5% for the first time since 2007, the benchmark 10-year Treasury yield has slightly pulled back to 4.87%.

Investors are keenly awaiting insights from Wednesday’s Federal Reserve meeting, which will shed light on the economic outlook and the direction of interest rates. Despite Fed Chair Jerome Powell suggesting that long-term yield increases may lessen the necessity for rate hikes, the possibility of an uptick in December remains contentious.

Jobs Report on the Horizon

Monday’s economic calendar appears sparse, with the prime event slated for Friday when the nonfarm payrolls report for October is due. Forecasts point to the addition of 182,000 jobs, indicative of a stable job market, following September’s robust gain of 336,000 positions. Expectations include an unchanged unemployment rate of 3.8% and a deceleration in wage growth to 4% year-on-year.

The week’s earnings reports also command attention, with McDonald’s surpassing revenue expectations, fueled by price hikes and a same-store sales increase. Meanwhile, the automotive sector is buzzing with activity following labor agreements by General Motors Company, potentially resolving strikes, and Ford Motor, along with Stellantis, also reaching settlements.

However, all eyes are on Apple as it prepares to unveil its fourth-quarter earnings, especially after mixed financial disclosures from prominent tech firms like Alphabet and Tesla.

Crude Oil Prices Dip

In the commodities market, crude oil prices have declined at the week’s commencement, signaling a cautious approach from traders. This comes as they brace for the Federal Reserve’s decisions and await economic indicators from China. The prior week’s price drops were influenced by geopolitical tensions that, despite ongoing conflicts in the Middle East, have not escalated into a broader war.