In today’s comprehensive GBPHKD forecast, we will first examine Hungary’s current economic conditions. Then, we will meticulously delve into the details of the technical analysis pertaining to the GBPHKD pair.

Hungary Retail Sales Dip

Bloomberg—In September 2023, Hungary’s retail sales experienced a downturn, falling by 7.3% compared to the same month in the previous year. This followed a 7.1% decrease in August, marking the tenth month of declining retail activity.

A Closer Look at the Sales Components

The decline was more pronounced in certain sectors. Sales of automotive fuel saw a further decrease, dropping by 19.9% compared to an 18.1% decrease in August. Non-food products also saw a significant decrease in sales, falling by 7.5% compared to a 5.2% decrease in the previous month.

On the other hand, the sales of food, beverages & tobacco fell at a slower rate of 2.3%, improving from a 4% decrease in August.

Monthly Sales and Year-to-Date Comparison

On a month-over-month basis, retail sales increased slightly by 0.1% in September, bouncing back from a 0.5% decrease in August. However, when considering the January-September period, retail trade was down by 9.3% compared to the same period in the previous year.

GBPHKD Technical Analysis and Forecast

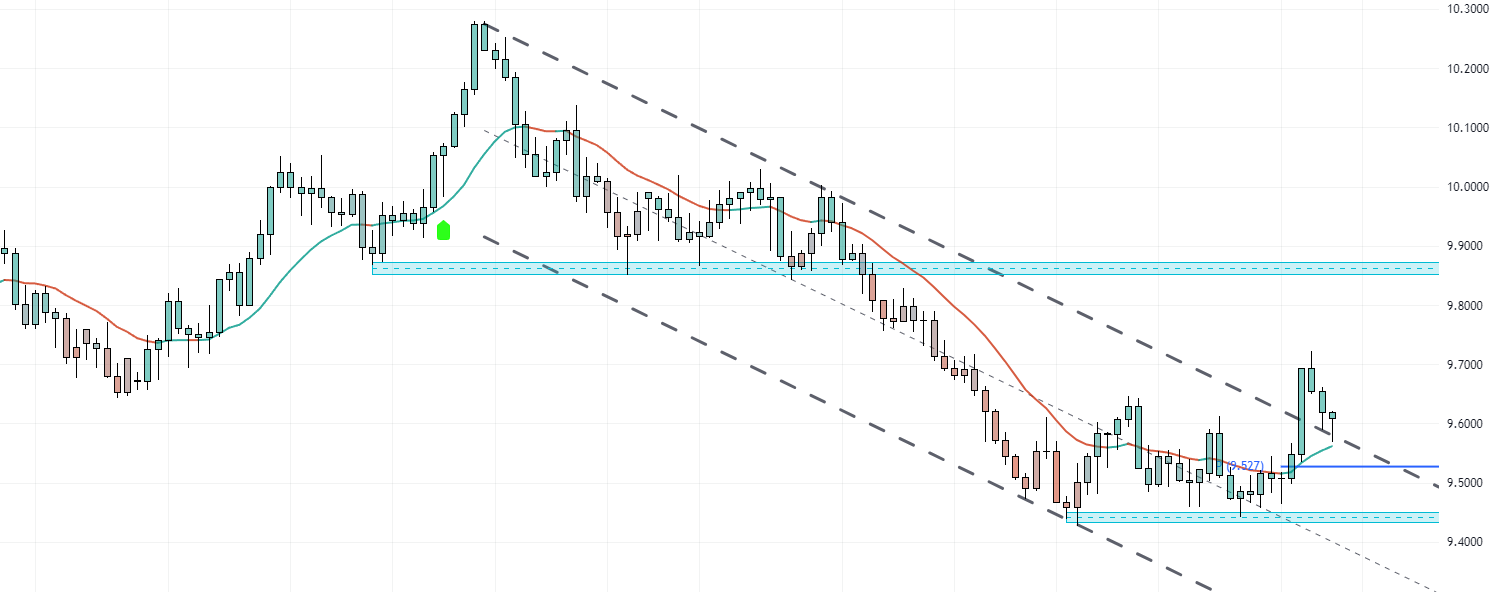

The GBPHKD currency pair is currently in a testing phase. It’s challenging the upper line of the previously broken bearish channel, as seen on the daily chart. The market sentiment leans towards the bullish side, with the pair comfortably hovering above the pivot point. Consequently, we anticipate an upward trajectory for the GBPHKD price, potentially targeting the 9.8 resistance level.

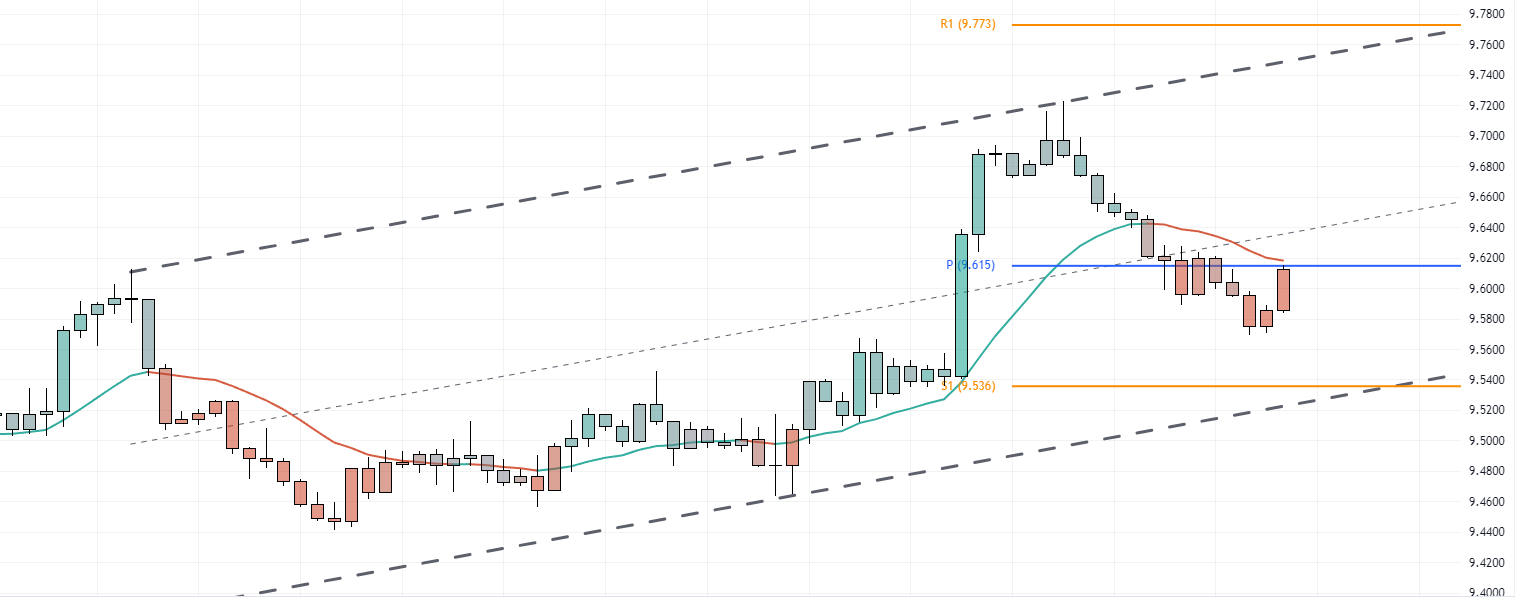

Now, let’s broaden our perspective and zoom in on the 4-hour chart to identify potential triggers for this bullish scenario. If the pair manages to close above the 9.61 weekly pivot and the kernel line, this could serve as a strong signal that the uptrend is set to continue. In such a case, the next target would likely be the R1 level around the 9.773 resistance.

The 9.536 level supports this bullish scenario. However, it’s crucial to note that if this level is breached, it would invalidate the current uptrend scenario. Therefore, keeping a close eye on these key levels is essential for understanding the potential future movements of the GBPHKD pair.