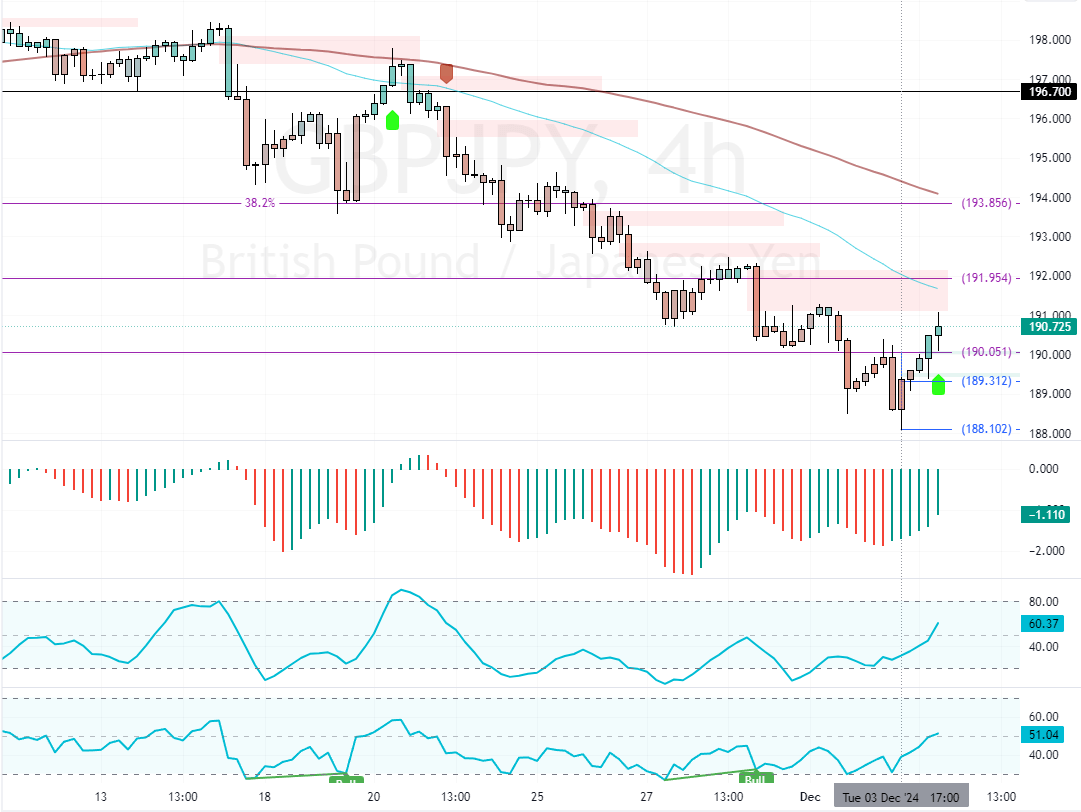

FxNews—The GBP/JPY pair trades in a robust bear market. However, the downtrend eased after the prices declined to as low as 188.1 on December 3rd. As of this writing, the currency pair trades at approximately 190.5, gaining 0.5% in today’s trading session.

GBPJPY Eyes Gain as It Nears Resistance

As for the technical indicators, the Stochastic and RSI 14 depict 61 and 52, respectively; the values are on the rise. Meanwhile, the Awesome Oscillator histogram is green, below the median line, indicating that the bear market weakened.

Overall, the technical indicators suggest that while GBP/JPY is below the 50-period simple moving average, the prices could rise toward the upper resistance level.

Watch GBPJPY Resistance for Bearish Signs

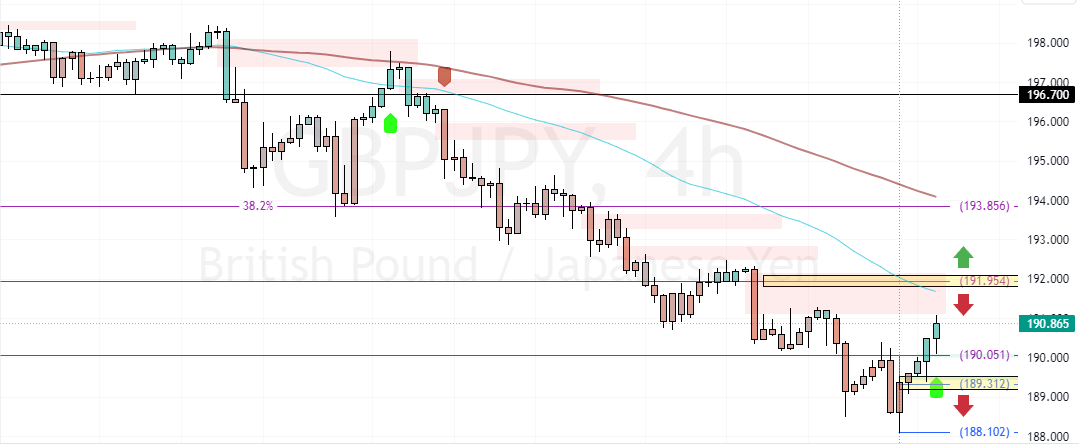

The immediate resistance is at 191.9, backed by the bearish fair value gap. From a technical perspective, the GBP/JPY trend outlook remains bearish below this barrier.

Additionally, the 191.9 mark can potentially provide a decent ask price to plan a selling strategy. Therefore, monitoring this resistance for candlestick patterns is crucial. In this scenario, the downtrend will likely resume, targeting 188.1 if GBP/JPY remains below the 191.9 mark.

- Also read: EURJPY Pulls Back from 156 record lows

The Bullish Scenario

Please note that the bearish outlook should be halted if GBP/JPY prices exceed the immediate resistance (191.9).

If this scenario unfolds, the current uptick momentum could extend to the 100-period simple moving average at approximately 193.8, backed by the 38.2% Fibonacci resistance level.