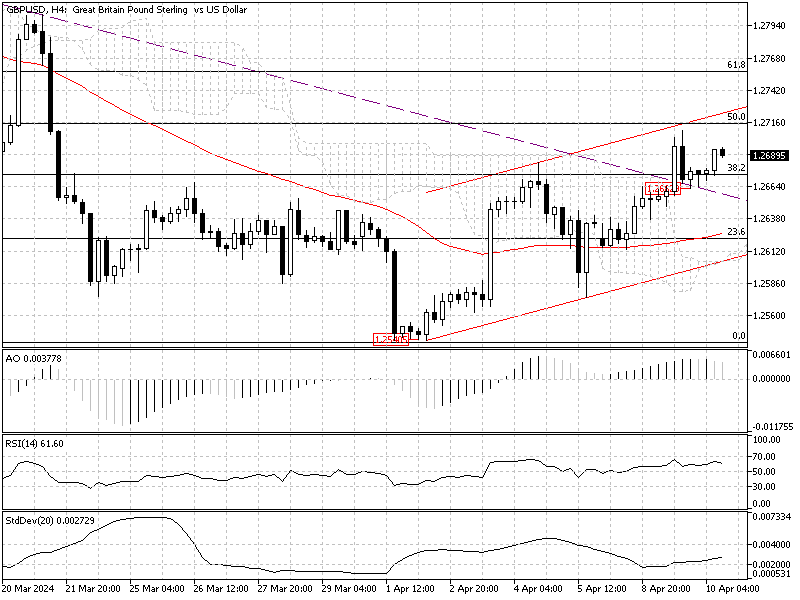

FxNews – The pound sterling broke out from the descending trendline against the U.S. dollar on April 9, as shown in the 4-hour chart below. At the time of writing, the GBPUSD pair trades at about 1.269, and it’s on its way to testing the 50% Fibonacci resistance level for the second time this week.

GBPUSD Technical Analysis: Mixed Signals

The technical indicators provide mixed signals. We will review each separately and then conclude what these tools are trying to tell us in today’s trading session.

The Awesome Oscillator is declining while showing divergence in its bars. This can be interpreted as a trend reversal or a consolidation phase might be on the horizon. The second indicator we’ll look at today is the RSI, which hovers above the 50 level, which is construed as a bullish trend. Lastly, the Standard Deviation indicator is rising and currently hovers around 0.0027, which signals that market volatility is increasing.

The conclusion is that the technical indicators point towards continuing the uptrend but warn us of a consolidation phase.

GBPUSD Technical Analysis

From a technical standpoint, the pair hovers above the broken trendline and the Ichimoku cloud; this indicates that the bear market, which began at 1.2893 on March 8 last month, has ended or paused, and the uptick momentum could extend further to the 61.8% Fibonacci resistance, the 1.2758 area.

On the flip side, if the GBPUSD price dips below the EMA 50 (1.2624 mark), the bull market should be canceled, and in this scenario, the downtrend will extend further, targeting April’s low of 1.254.

FTSE 100 Hits New High With Boost From Mining and Energy

Bloomberg – On Wednesday, the FTSE 100 experienced a 1% increase, reaching its highest point since February 2023. Notable mining, energy, and banking successes mainly fueled this rise. Energy shares went up by 1%, following an increase in oil prices after they dropped for two consecutive days. Shares in companies that mine industrial metals also saw an uplift of 0.9%, with copper prices hitting their peak in over a year.

Companies involved in precious metals, banking, and the automotive industry also increased stock prices. Notably, Tesco’s stock rose by 1% due to a surge in demand and an influx of new customers, leading to predictions of higher profits in the next fiscal year. In separate corporate developments, Warren East, who previously led Rolls-Royce and ARM, has been appointed the chairman of NATS, effective from September 1. His main goal is to enhance the UK’s air traffic systems, which have faced challenges under Paul Golby’s direction.