FxNews—The pound sterling has been bearish against the U.S. Dollar since August 27 ($1.326). The downtrend eased on Wednesday when the GBP/USD price dipped to as low as 1.3; the currency pair is currently trading at approximately 1.306.

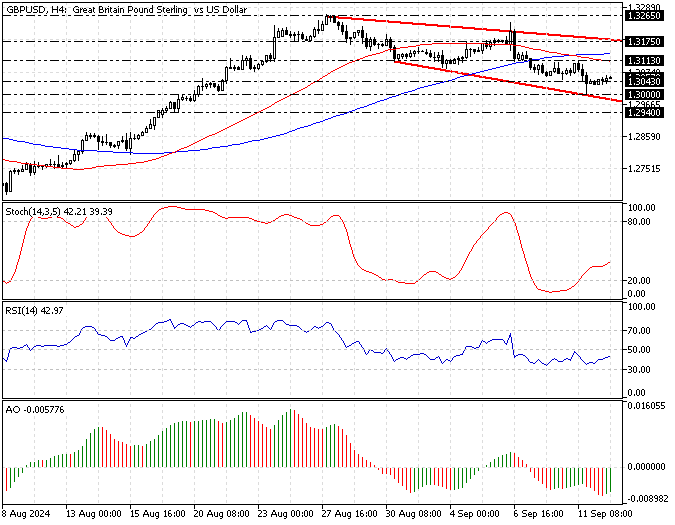

The 4-hour chart below demonstrates the price, critical support and resistance levels, and indicators used in today’s analysis.

GBPUSD Technical Analysis – 12-September-2024

The currency pair’s price in discussion is below the 50- and 100-period simple moving average, meaning GBP/USD is in a bear market. In addition to the moving averages, the Awesome oscillator bars are below the signal line, adding credit to the current downtrend.

- The Stochastic oscillator stepped outside the oversold territory, signaling the bear market cool-down.

- The relative strength index indicator records 42 in the description and below the median line, inclining the bear market is actively present.

Overall, the technical indicators suggest the primary trend is bearish, but the pound sterling could erase some of its recent losses against the Dollar before the downtrend triggers again.

GBPUSD Forecast – 12-September-2024

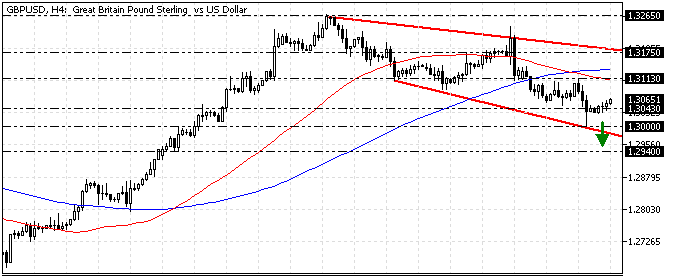

As explained earlier in this article, the primary trend of the GBP/USD pair is bearish. That said, the critical support rests at $1.30. From a technical perspective, the GBP/USD downtrend will likely be triggered if the bears or sellers close and stabilize the price below $1.30.

If this scenario unfolds, the downtrend began from $1.326 and could extend to the July 16 low at $1.294.

Please note that the critical resistance level for the bearish scenario lies at $1.311 (September 11 High), in conjunction with the 50-period simple moving average. The bearish scenario should be invalidated if the GBP/USD price exceeds 1.311.

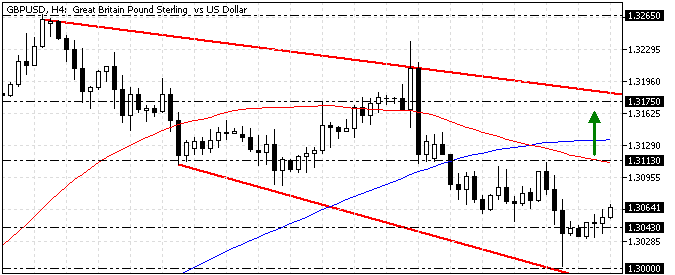

GBPUSD Bullish Scenario – 12-September-2024

The September 11 High at $1.311 is the main barrier for the bulls. However, if the buyers close and stabilize the price above $1.311, the weak uptick momentum that began today can potentially extend to the August 27 low at $1.317, in conjunction with the descending trendline.

Furthermore, if the buying pressure leads to the price exceeding $1.317, the next resistance area will be 1.326, and the trend direction should be considered reversed from a bear market to a bull market.

It is worth mentioning that the 100-period simple moving average will support the bullish scenario.

GBPUSD Support and Resistance Levels – 12-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $1.30 / $1.294

- Resistance: $1.311 / $1.3175

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.