In today’s comprehensive GBPUSD technical analysis, we will scrutinize the price action in the 4-hour chart and then meticulously delve into the currency pair’s fundamental analysis.

GBPUSD Technical Analysis – Poised for Bullish Surge

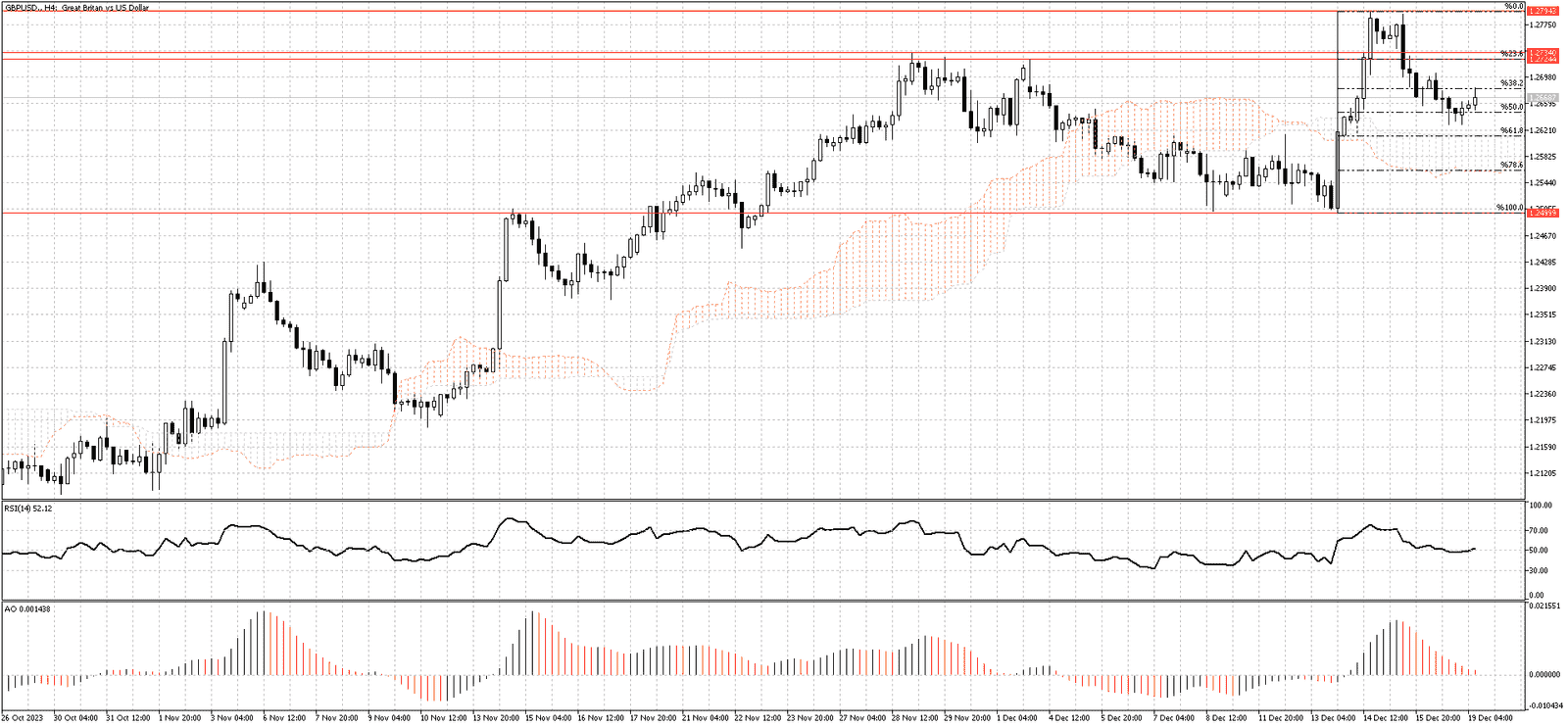

FxNews—The currency pair shows signs of entering a new bullish phase. Recently, the market approached the Ichimoku cloud, aligning with the 61.8% Fibonacci retracement level. This convergence has led to an increase in the value of the British Pound in today’s trading session. Additionally, the Relative Strength Index (RSI) indicator is climbing above 50, further supporting our bullish technical analysis.

The Ichimoku cloud reinforces this bullish outlook. If the pair remains above the cloud, we can target the narrow resistance zone between 1.2724 and 1.2734. The 23.6% Fibonacci resistance level also strengthens this resistance area. If the pair manages to break through this barrier, it could pave the way to reaching the highs seen in December.

FTSE 100 Edges Up Amid Policy Speculation

Reuters – On Tuesday, the FTSE 100 index experienced modest gains, moving towards the 7,650 level. This uptick followed a similar rise in the previous session, nearing the two-month high reached last week. Investors continue to evaluate the potential policy directions of the Bank of England (BoE) and the Federal Reserve in the coming year.

Tomorrow’s opening is anticipated to bring the domestic inflation report, likely to indicate a slight deceleration in both headline and core inflation rates. However, these rates are expected to stay significantly above the BoE’s target, reinforcing the central bank’s firm stance established in last week’s meeting.

Despite this, Gilt yields dropped by about five basis points, which supported rate-sensitive businesses in London. Among these, Ocado Group saw an increase of over 3%. Additionally, Flutter Entertainment gained 2% following an upgrade from brokerage firm Peel Hunt. On the flip side, energy giants BP and Shell experienced declines. Their stocks were affected by falling oil prices and escalated shipping expenses as tankers were compelled to reroute from the Red Sea.