FxNews—On Tuesday, the price of Gold climbed to approximately $2,735 per ounce, hitting a new high. This increase is largely because Gold is considered a secure investment during uncertain times.

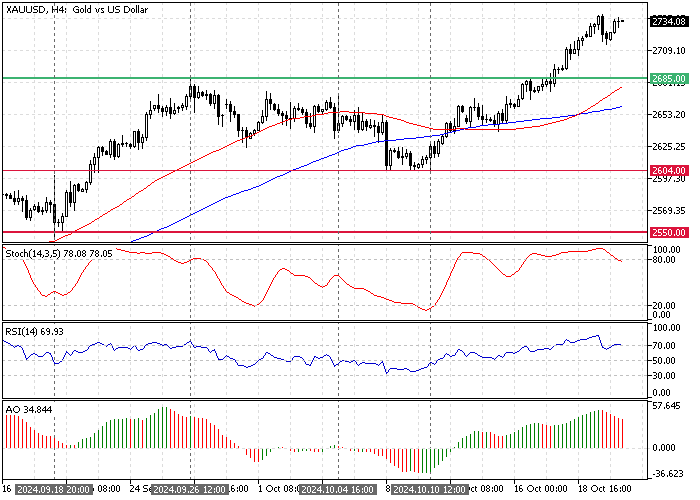

The 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators utilized in today’s analysis.

Israeli Strikes and Iranian Drone Incident Raise Tensions

Recent developments have contributed to this perception, including actions by Israel targeting areas connected to Hezbollah’s financial activities in Beirut. This has heightened fears of a growing conflict. Additionally, the possibility of Israel responding to an Iranian drone incident near Prime Minister Netanyahu’s home has brought more tension.

Investors are turning to Gold as a safer option as the US presidential election is approaching in just a few weeks.

- Author’s pick: NATGAS at Key Resistance as Cold Weather Looms

PBoC and ECB Rate Reductions Strengthen Gold

At the same time, major global banks like the People’s Bank of China (PBoC) and the European Central Bank (ECB) are reducing their main interest rates, which also helps to boost the value of Gold.

Meanwhile, in the United States, Federal Reserve officials have differing opinions on monetary strategy. Jeffrey Schmid from the Kansas City Fed suggests a more cautious approach to reducing rates. At the same time, San Francisco Fed President Mary Daly believes more aggressive cuts are needed to support the job market.

- Good read: Silver Demand Soars with Solar Panel Growth

Gold Technical Analysis – 22-October-2024

In today’s trading session, the XAU/USD pair trades in a strong bull market at approximately $2,735. Meanwhile, the Stochastic Oscillator hovers inside the overbought territory, signaling that Gold is overpriced, backed by RSI 14 recording 71, and highlights the overbought situation.

At the same time, the Awesome Oscillator‘s histogram demonstrates signs of bearish bias. The bars are red and declining, meaning XAU/USD could dip and consolidate before the uptrend resumes.

Overall, the technical indicators suggest the primary trend is bullish but Gold is overpriced, hence, it might step into a consolidation phase.

Gold Price Forecast – 22-October-2024

Currently, Gold is overbought, and it is not advisable to join a bull market when it is saturated with buying pressure. Therefore, we suggest traders and investors wait patiently for the XAU/USD pair to consolidate near-immediate support at $2,685, the September 26 high.

Traders should monitor the $2,685 closely for bullish signals such as a hammer or bullish engulfing candlestick pattern.

Furthermore, the bullish outlook should be invalidated if the price dips below the 50-period simple moving average at $2,685.