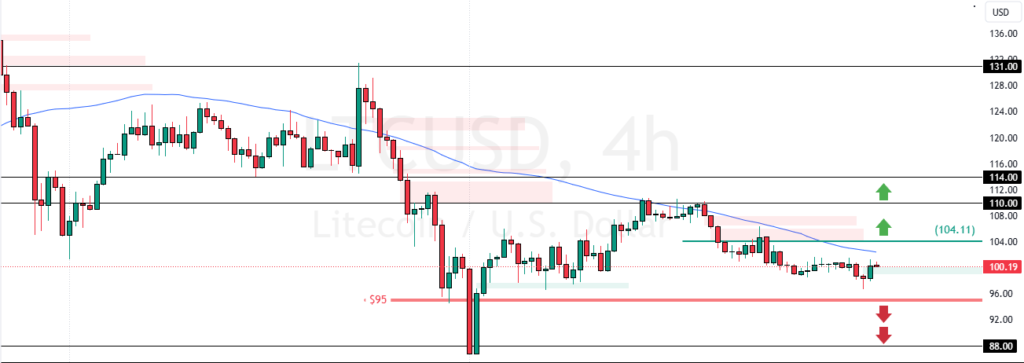

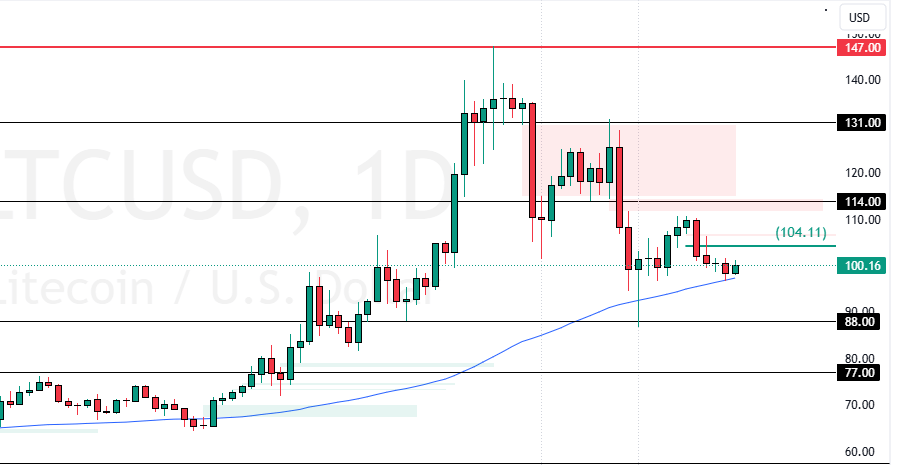

Litecoin stabilizes at $100, trading sideways in a bear market below the 75-period SMA. A close above the immediate resistance at $104.0 can trigger the uptrend, targeting $110.0, followed by $114.0.

Litecoin Technical Analysis – 30-December-2025

Litecoin has been in a bear market, below the 75-period simple moving average, and has lost 9.0% of its value since December 24. However, the selling pressure eased at the $95 support. As of this writing, the cryptocurrency trades at approximately $100.0, testing the 75-SMA as resistance.

Regarding the technical indicators, the RSI and Stochastic records show 46 and 39 in the description, respectively, which can be interpreted as the bull market strengthening. Additionally, the Awesome Oscillator is below zero with green bars, meaning the bear market weakened.

Overall, the technical indicators suggest that while the primary trend is bearish, LTC/USD has the potential to erase some of its losses.

Litecoin Stabilizes at $100: What’s Next?

The immediate resistance is at $104.0. From a technical perspective, the current uptick in momentum could extend to higher resistance levels if bulls (buyers) push LTC/USD above $104.

If this scenario unfolds, the next bullish target could be $110.0, followed by $114.0.

- Bitcoin Analysis: Technical, Fundamental & News

- Litecoin Gained 7.1%: What’s the Next Target?

- Bitcoin is up 6.6% Amid Divergence Signals: What’s Next?

The Bearish Scenario

The immediate support is at $95.0. From a technical perspective, the downtrend from $110 will likely resume if the value of Litecoin falls below $95.0. In this scenario, the next bearish target could be the December low at $88.0.

Litecoin Support and Resistance Levels – 30-December-2025

Traders and investors should closely monitor the LTC/USD key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

| Litecoin Support and Resistance Levels – 30-December-2025 | |||

|---|---|---|---|

| Support | $95.0 | $88.0 | $77.0 |

| Resistance | $104.0 | $110.0 | $114.0 |