Litecoin Technical Analysis – 6-June-2024

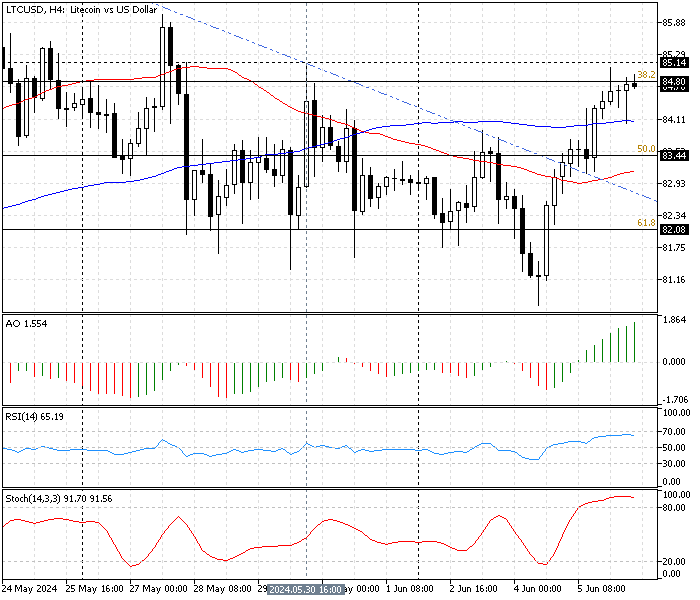

FxNews—In the 4-hour chart, Litecoin crossed above the descending trendline against the U.S. Dollar. As of writing, the LTC/USD pair trades at about $84.8, testing the 38.2% Fibonacci resistance level.

The Litecoin 4-hour chart below demonstrates the current price, Fibonacci retracement levels, and the technical indicators involved in our analysis.

Litecoin Technical Analysis – 6-June-2024

Litecoin Technical Analysis – 6-June-2024

Immediate support is slightly above the 38.2% Fibonacci at $85.1. This ceiling is in conjunction with the May 30 high at $85.14. The technical indicators suggest the market is bullish but might become overbought soon.

LTC/USD Price Trends Upward

- The awesome oscillator value is 1.55, with green bars above the zero line and increasing. This growth in the AO value signifies that the bull market prevails over the bear market.

- The relative strength index indicator is above the median line, showing a value of 66 in the description. This means the market is bullish and strengthening because it has room to become overbought.

- The stochastic floats in the overbought territory, recoding 91 in the description. This indicates that Litecoin could be overpriced and might lose some of its recent gains against the U.S. Dollar in the form of consolidation.

Furthermore, the LTC/USD price is above the simple moving averages of 50 and 100, meaning we are in a bull market, and the cost of Litecoin will likely increase.

Litecoin Forecast – 6-June-2024

Litecoin Forecast – 6-June-2024

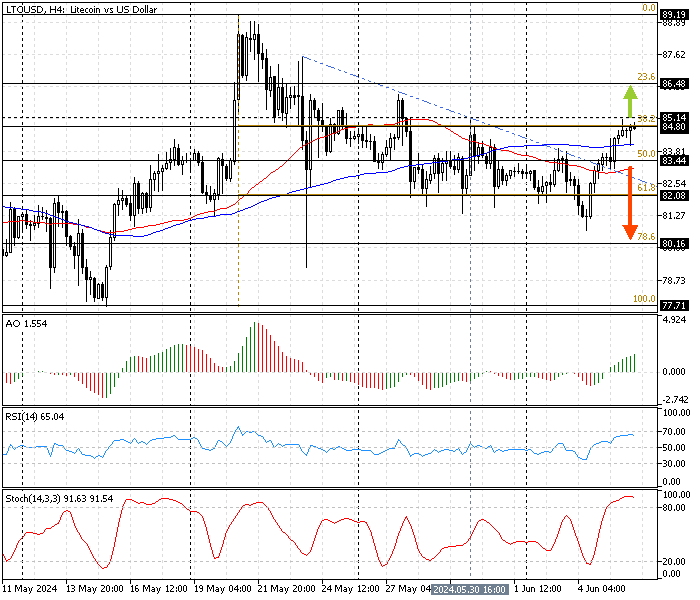

From a technical perspective, LTC/USD is in a bull market with an immediate barrier at $85.14. The uptrend will likely continue if the buyers cross above the immediate resistance. If this scenario unfolds, the next bullish target could be the 24.6% Fibonacci at $86,48.

Please note: The SMA 50, depicted in red in the chart, supports the bullish strategy, and the uptrend perspective should be invalidated if the price dips below the simple moving average.

Bearish Scenario

The simple moving average of 50 and the 50% Fibonacci level at approximately $83.15 play the pivot between the bull and bear markets.

If the Litecoin price dips below the SMA 50 and stabilizes itself below the Fibonacci level in the subject, the trend will likely reverse. In this scenario, the bears could initially target the 61.8% Fibonacci at $82.0. Furthermore, if the selling pressure exceeds $82.0, the bear’s road to the $80.16 resistance will likely be paved.

Litecoin Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $83.4 / $82.0 / $80.16

- Resistance: $85.14 / $86.48

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.