FxNews – The EURUSD currency pair is making some exciting moves. In this article, we meticulously explore the intricacies of EURUSD analysis. Despite a slight increase during the American trading session, the currency pair remained below the closing price of the previous Friday.

The US Dollar’s weakness wasn’t enough to push the pair above 1.0600, and the Euro was the weakest among the G10 currencies on Monday.

EURUSD Analysis – The Pair Navigates Lower Terrain Near

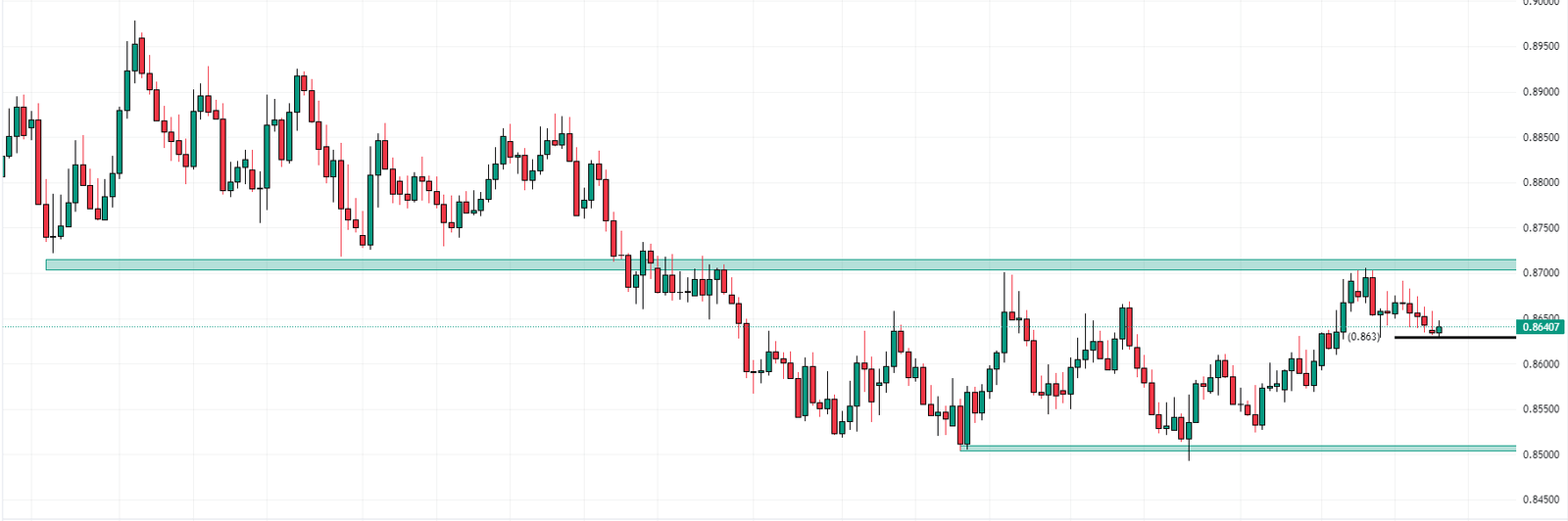

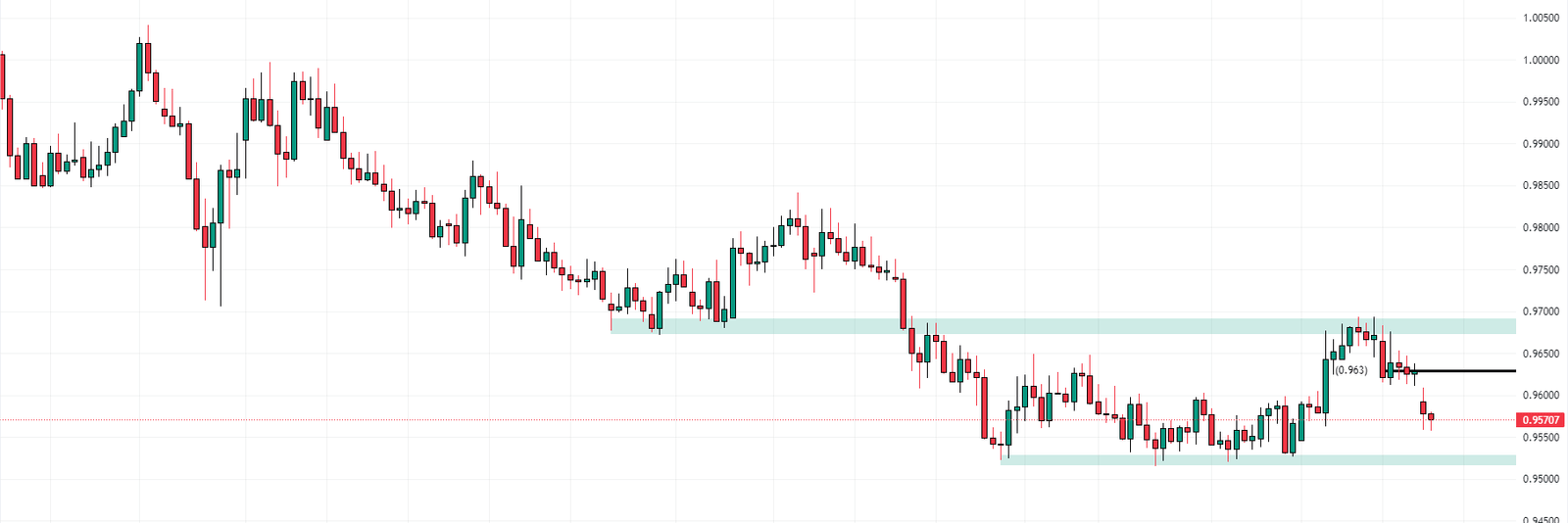

New geopolitical concerns particularly affected the Euro, causing it to fall against other major currencies. This was evident in the 10-year German bond yield, which dropped significantly more than 4.50% to 2.76%. The EURCHF moved towards 0.9550, and EURGBP dipped below 0.8640.

The EURUSD Analysis also revealed that German Industrial Production slightly declined by 0.2% in August, worse than the anticipated decrease of 0.1%. The Eurozone Sentix Investor Confidence dropped in October to -21.9, higher than the market consensus of -25.

Looking ahead, no significant reports are scheduled for release in either the Eurozone or the US on Tuesday. However, traders will keep a close eye on the US Consumer Price Index, which will be released on Thursday and is considered a key indicator for the week.

During the American session, the US dollar strengthened across all fronts, benefiting from an improvement in risk sentiment following the market opening after an attack in Israel by Hamas. The US Dollar Index (DXY) peaked at 106.60 but then pulled back to 106, ending with modest losses due to a decline in US bond yields.

- Next read: Stock Market Analysis: US Yield Increases

EURUSD Analysis: A Technical Perspective

The EURUSD currency pair is currently demonstrating a bullish trend, as it trades above the pivot point and the median line of the descending channel on the 4-hour chart. This upward momentum is further supported by the Relative Strength Index (RSI), which maintains a position above the crucial 50 lines, indicating a certain robustness in this bullish scenario.

Should the EURUSD price sustain its position above the pivotal 1.054 mark, it could open up an opportunity for bullish traders to drive the price toward the resistance level at 1.064. This scenario could unfold as a testament to the strength and resilience of the bulls in the forex market.

However, every coin has two sides in this EURUSD analysis. In contrast to the bullish outlook, if the EURUSD price experiences a drop and closes beneath the median line, it could signal a continuation of the downward trend for this currency pair. In such a case, the first line of defense for the bulls could be found at 1.045.