Stock Market Analysis: US Yield Increases

Stock Market Analysis – As we see US yields increase, which has led to a change in perspective among several members of the Federal Reserve, traders are speculating that the Fed’s actions may be coming to a halt. However, with numerous Fed speakers scheduled to address the public this week, it might be wise for investors to wait and see if this is the new narrative from the Fed before hopping onto the Eldorado bandwagon for stocks.

To complete this beneficial cycle for stocks, it would be ideal if yields in the middle of the curve decreased further. This and an upgrade in earnings expectations could potentially drive stocks beyond their current trading range. For systematic investors, the relatively stable VIX suggests a high likelihood of a low-volatility regime. This is characterized by decreasing macroeconomic uncertainty as we near the end of the Fed’s hiking cycle.

The unfortunate reality of war is that unless it directly impacts their region or their global GDP, neither investors nor central banks tend to pay much attention. This was evident in the recent events in the Middle East. Apart from the Bank of Israel’s foreign exchange intervention, there was no policy response from the Federal Reserve or the European Central Bank.

Geopolitical risk is decreasing as the Israel Defense Forces extinguishes remaining threats. Consequently, cross-asset and oil traders gradually relinquished their long positions with WTI and Brent. This is in anticipation of this week’s inventory reports, which are expected to be closely watched.

Stock Market Analysis: US yields increase Affecting Oil

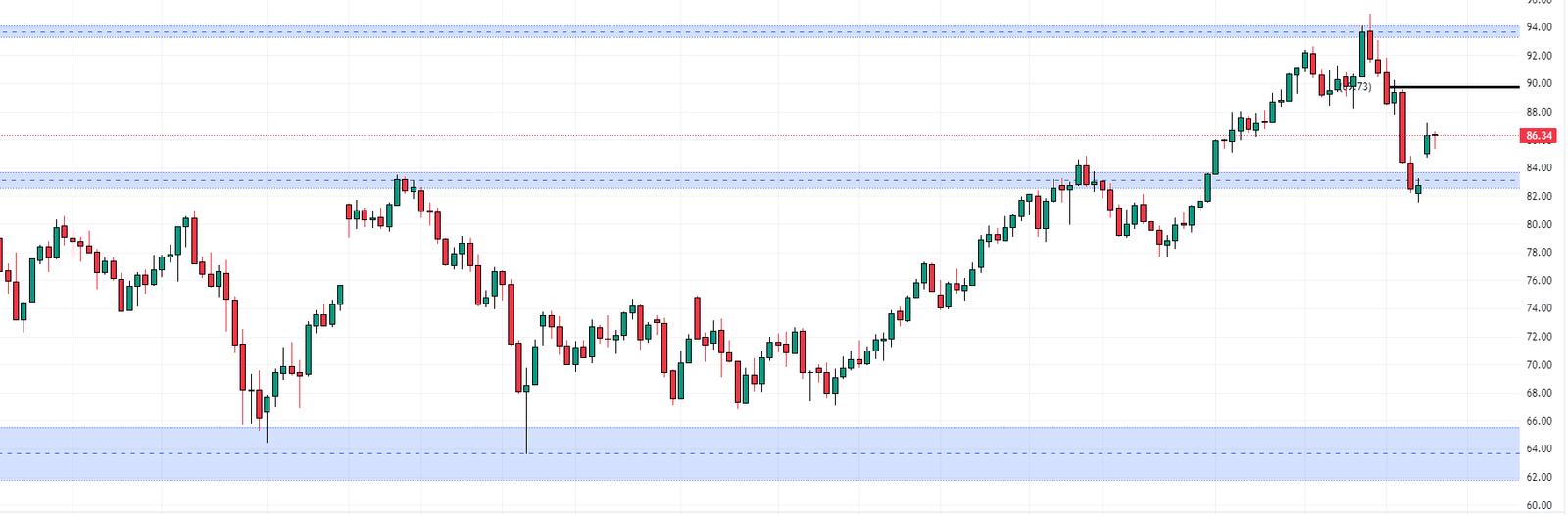

US Index – Daily Chart

Oil traders often use a four-week average to balance out weekly demand fluctuations and better understand the physical market’s condition. However, even when looking at these four-week figures, it’s clear that gasoline consumption remains significantly weaker than pre-pandemic levels. There has been a 10% decrease from 2019 and a 5% decline compared to last year.

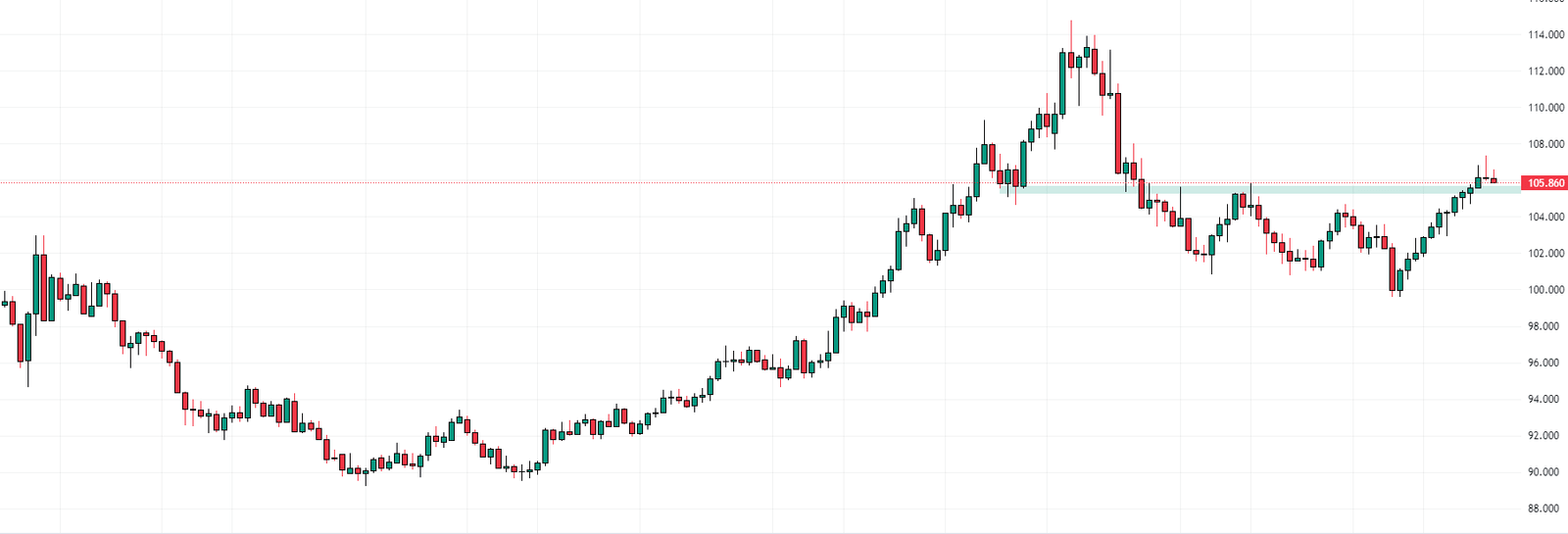

US Index Weekly Chart

Following a significant dollar rally, foreign exchange markets are adopting a wait-and-see approach. They are keen to see if Asia’s policy anchors by the Bank of Japan and People’s Bank of China will continue to limit any drastic Dollar movements.

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.