FxNews – What an eventful week it was for market news! The ADP employment change took a hit with a significant miss, only to bounce back on Friday with the government NFP number, which came out as a substantial beat. Thanks to these developments, the market managed to end the week on a slightly positive note, with the S&P 500 SPY index closing up around 0.5%.

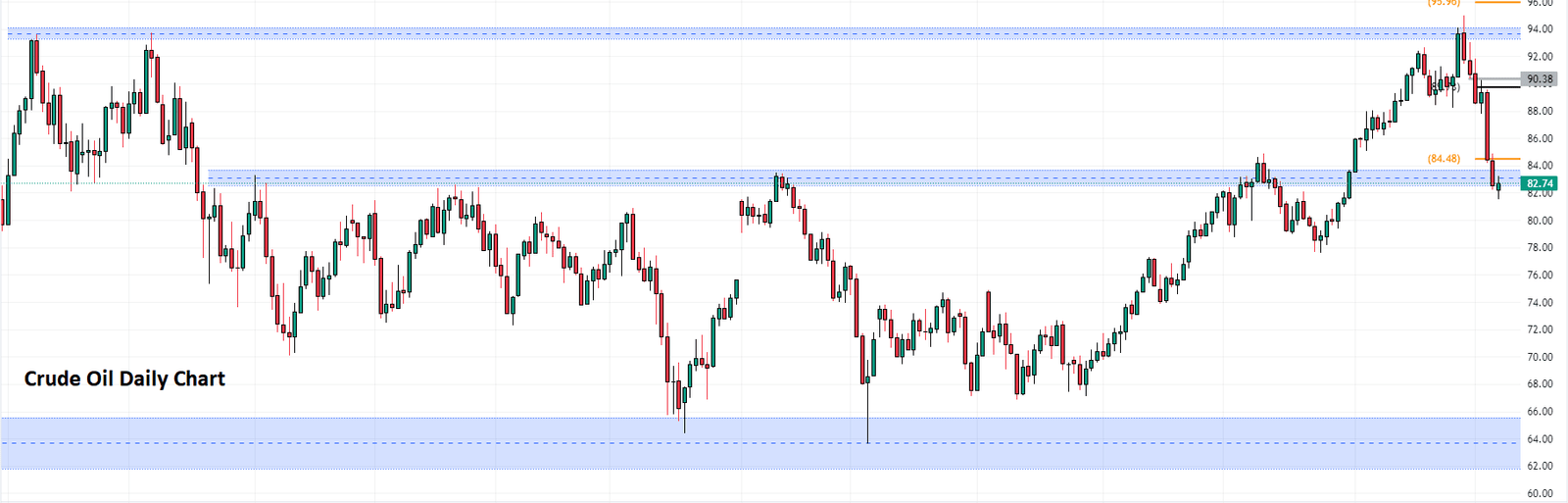

Oil took a beating this week, closing down almost 9% in the energy sector, and many energy stocks followed suit. Hopefully, this downturn will translate into good news for energy prices.

This week promises to be packed with PPI, CPI, FOMC Minutes, and more. Here are five things to keep an eye on in the markets this week:

Bank Holiday

Bloomberg – On Monday, US and Canadian banks will be closed in observance of Columbus Day and Thanksgiving Day, respectively. While this will impact commercial and personal banking, the markets will remain open for trading as usual. However, it could affect Monday trading volumes in futures, stocks, and options.

FOMC Minutes

The minutes from the last FOMC rate announcement often cause some volatility in the market. We already know the rate decision, but investors usually dig through the meeting minutes for insights into future rate decisions. Powell has already hinted that another hike could be on the horizon this year, so these minutes will likely be scrutinized closely.

PPI

The Producer Price Index (PPI) measures the change in the price of finished goods producers sell. Given all the inflation over the past few years, a negative number here would likely produce a positive reaction in the market. The last few have come in significantly higher than expected, which could be seen as a sign that the Fed doesn’t have inflation under control.

CPI

The Consumer Price Index (CPI) measures inflation from the consumer’s perspective. If PPI comes in hot, we may also see CPI come in hot. With last week’s incredible NFP report, the Fed will likely keep a closer eye on these reports.

Bond Yields

Bond yields will likely take center stage in the coming weeks or months. Why is this important? As rates rise, private and public debt become more expensive. This happens because those replace bonds with lower rates with higher rates.

Now, let’s break it down a bit. Most creditors will probably want to sell their longer-dated bonds. Instead, they’ll opt for shorter-dated ones that offer a higher yield. This shift could stir up some waves in the bond markets.