The US Dollar Index has increased since the third quarter of this year. It’s now back to the same value as in December of last year. The Federal Reserve (US central bank) has been increasing interest rates.

In their meeting in September, the Federal Reserve decided not to change the interest rates. But they said they might increase them again if they think it’s necessary for the economy. The head of the Federal Reserve, Chair Powell, said they will be very careful when deciding if they need to increase interest rates. He said the same thing at a recent big meeting called the Jackson Hole Symposium. This means they might not change the rates for the rest of the year if they think it’s unnecessary.

US Dollar Index Analysis – Is the Increase Slowing Down?

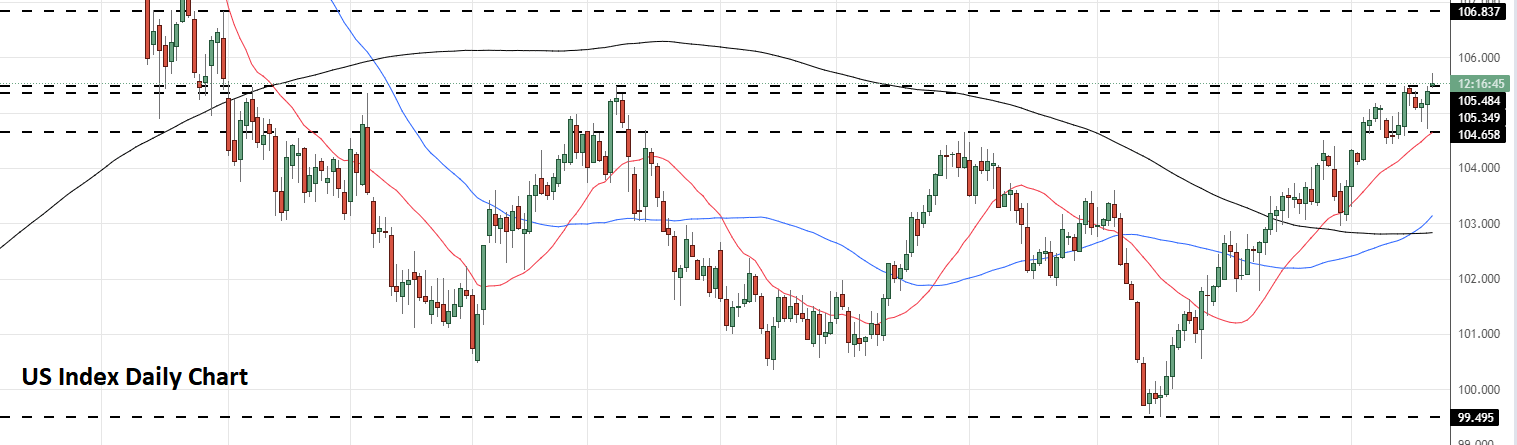

Bloomberg—The value of the US Dollar Index has been rising steadily since July. It has increased by over 6% from its lowest point of 99.49. The value of the US dollar compared to other currencies (called the US dollar index) has been helped by a weak Euro and a weak Japanese Yen. The Euro accounts for about 58% of this index, and the Yen for about 13.5%.

The Bank of Japan said that by the end of this year, it might start to reduce its very loose monetary policy (which means it has been trying to increase spending and investment by making borrowing cheaper). This would make the Yen more valuable. The European Central Bank might raise its interest rates again this year. This might not make the Euro much more helpful, but if it stays around its current value for a few months, it could stop the US dollar from increasing much more.

It’s always risky to try and guess what central banks will do in the future. But recently, some bankers from G7 countries (seven of the world’s largest economies) have suggested that interest rates worldwide are close to their highest point.

US Dollar Index Analysis

If you look at a daily chart of the US dollar index, it seems it could keep increasing. But there might be a limit to how much it can grow. There is a resistance level (a point where it becomes harder for an asset to increase in value) around 106.84, a high point in November 2022. This level will likely hold under current market conditions. It’s hard to sell something when its value increases, even if you think it will decrease soon. But if it increases to 106.84, this could be a good chance to sell your US dollars in the next few months.