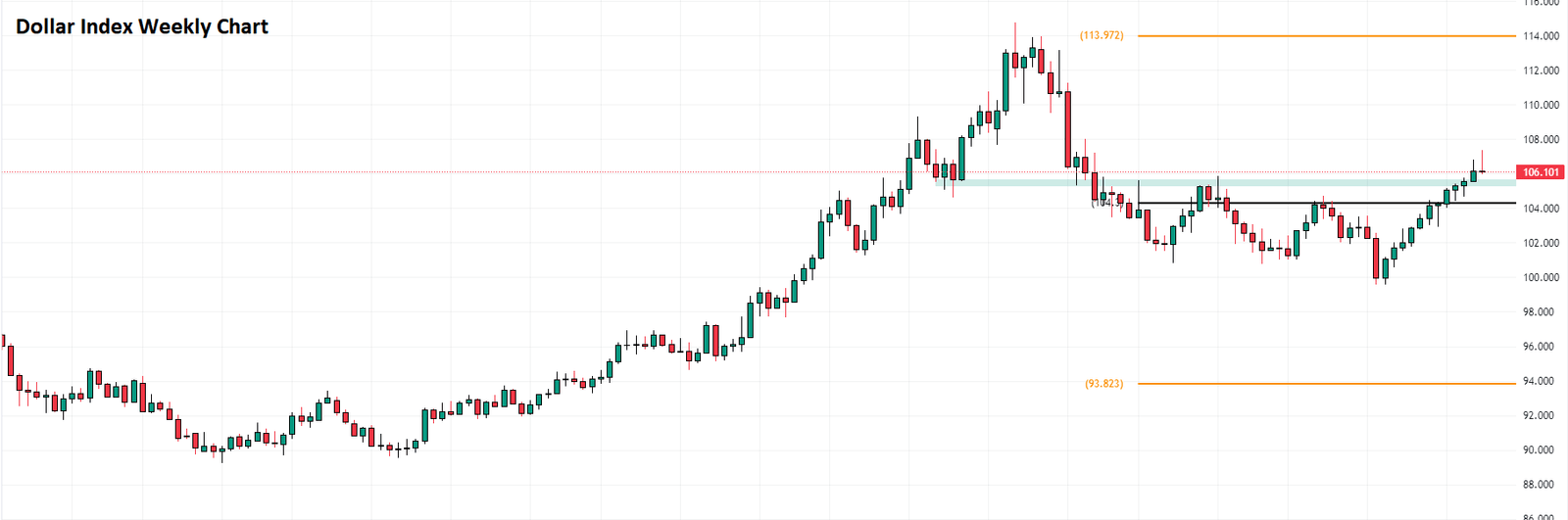

Bloomberg – The US Dollar demonstrated a strong performance in the third quarter of 2023, with the DXY Dollar Index rallying for an impressive nine consecutive weeks. This matches its performance from 2014. The key driver behind this surge was the rise in long-term Treasury yields, which were influenced by increasing expectations of a higher terminal Federal Funds Rate. In simpler terms, this means tighter for longer. The question is, will the currency maintain its strength in the fourth quarter?

The Importance of Monitoring CPI Shelter

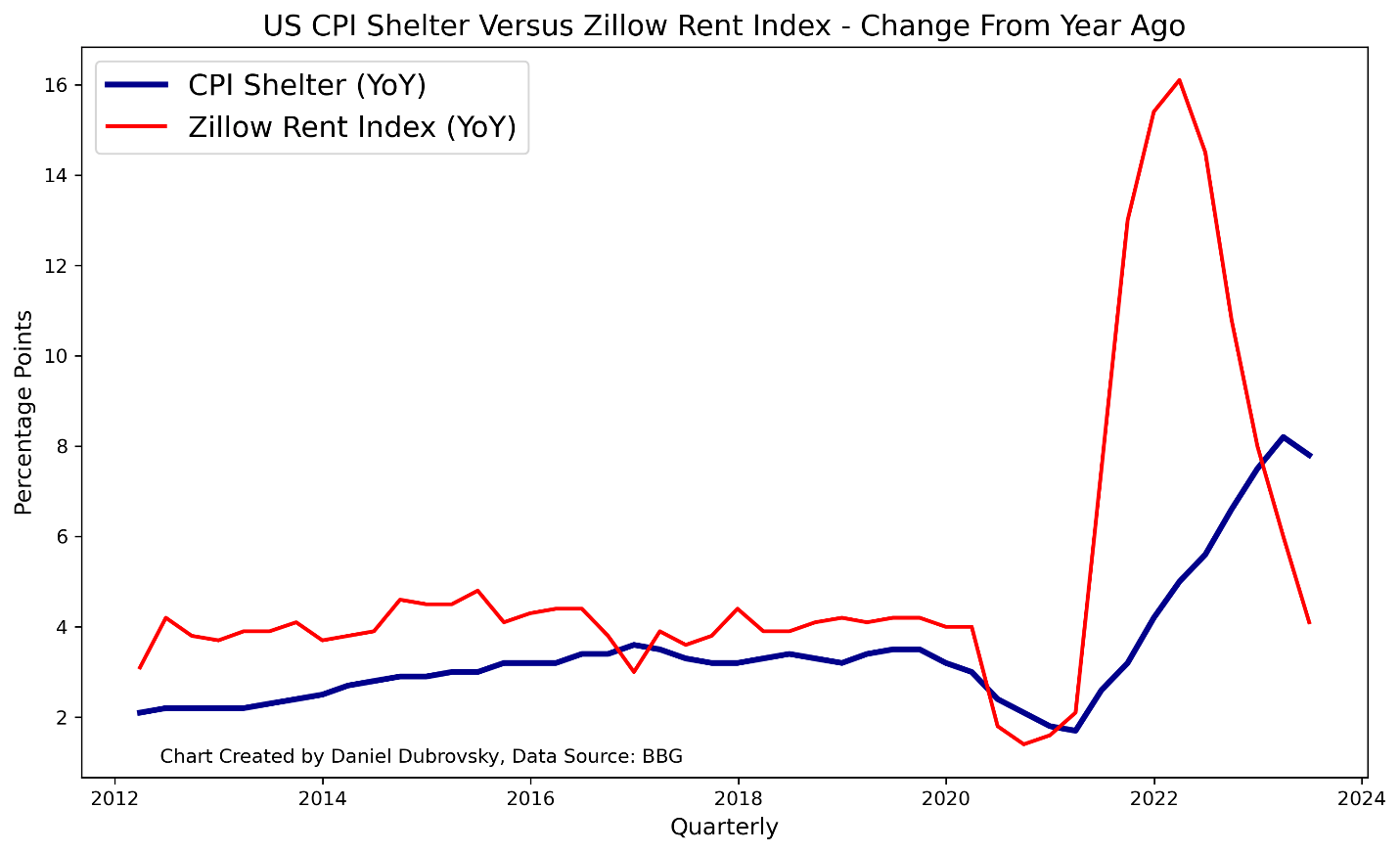

One fundamental factor that will likely influence the Federal Reserve and, consequently, the US Dollar is the trajectory of inflation. The chart below overlays the Zillow Rent Index and the Consumer Price Index (CPI) shelter component – a change from a year ago, quarterly data since 2012. As evident, there is a significant lag in CPI shelters.

After months of slowing rent growth, CPI shelter is just beginning to dip. This is significant because shelter constitutes the largest segment of CPI and, therefore, has a major influence on US monetary policy. Consequently, monitoring this dynamic is crucial as it could significantly impact future interest rates.

Predicting Core CPI’s Direction

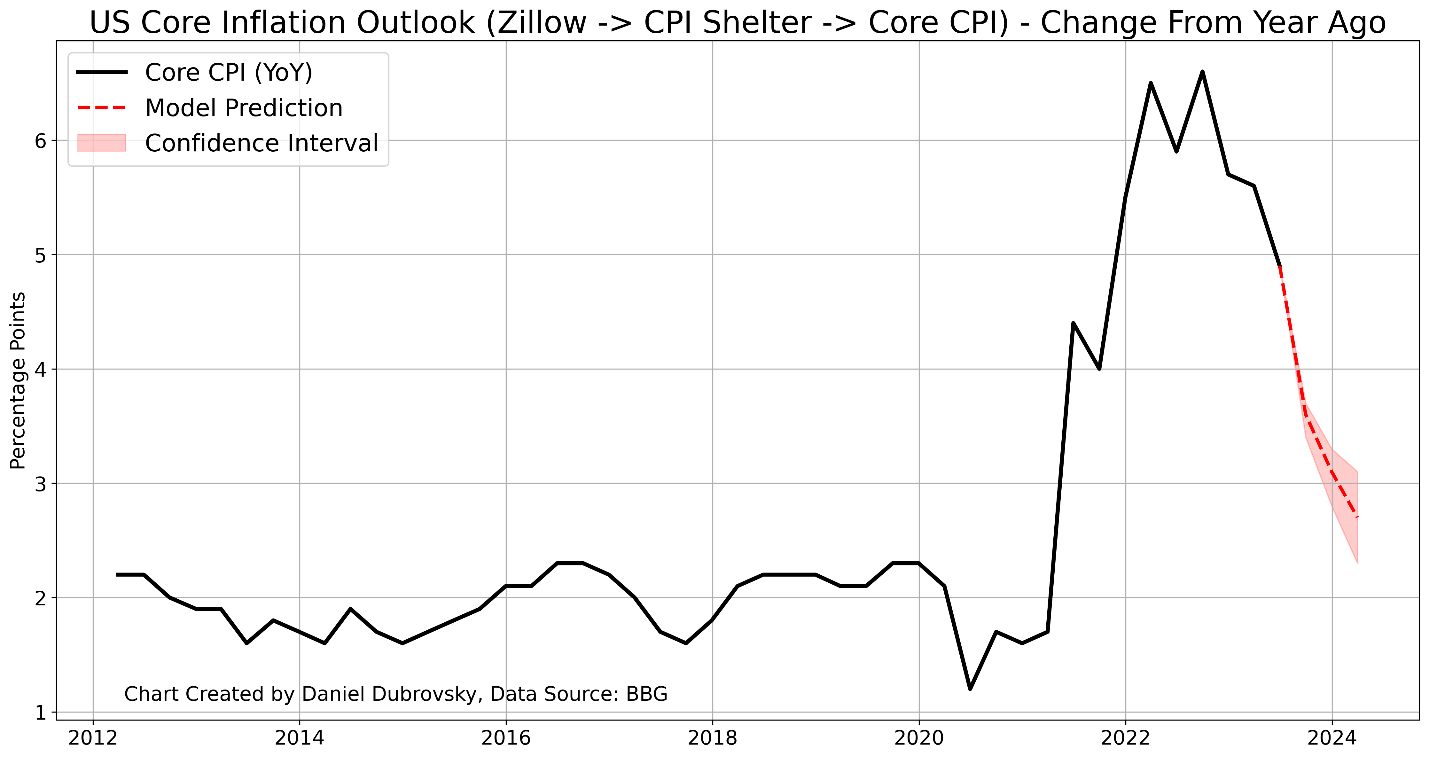

We can use the timelier Zillow data to predict core inflation in the upcoming quarters. The chart below shows the estimated trajectory of Core CPI based on the expected effect of the lag in Zillow data driving CPI shelter, which heavily influences underlying inflation. As expected, the slowdown in rent growth is predicted to reduce underlying price pressures.

This should be welcome news for the Federal Reserve, which aims to bring inflation down to target levels. However, this is just one component of many that factor into monetary policy. For instance, this analysis does not account for recent increases in oil prices or changes in labor market outlooks. With these considerations in mind, a vigilant Federal Reserve could continue to bolster the USD.