FxNews—U.S. natural gas futures have fallen below $2.5 per MMBtu after hitting their highest point since October 11. This decline is due to predictions of mild weather, which is expected to lower the need for heating.

Warmer US Weather Boosts Gas Storage Options

Meteorologists forecast warmer-than-usual temperatures across the Lower 48 states until at least November 9. As a result, utilities can store more gas than they typically would during this period.

This is a change from recent weeks, where utilities are likely to increase gas injections for the second week in a row, following 14 weeks of below-normal injections due to reduced drilling activities amid low prices.

2024 May Mark First Drop in Natural Gas Production

Experts now suggest that the average natural gas production in 2024 might see its first decrease since 2020. Furthermore, the LNG feed gas supply is anticipated to stay below record levels in the coming weeks as several companies, including Cheniere Energy and Cameron LNG, perform maintenance work at their facilities in Louisiana.

NATGAS Nears Next Support as Prices Dip

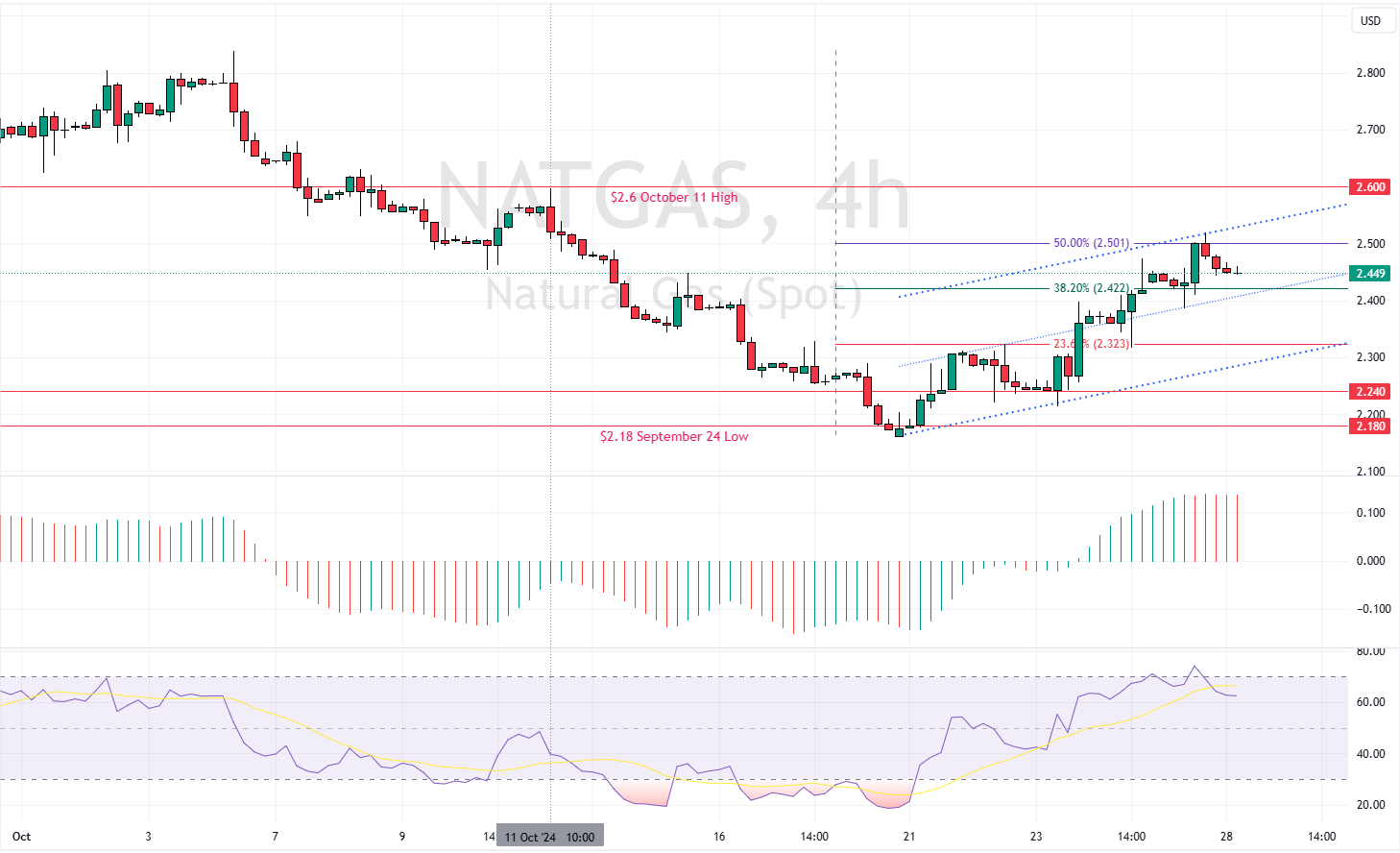

The U.S. Natural gas price dipped from $2.5, a resistance level backed by the %50 Fibonacci retracement level. This decline was expected from a technical perspective because the Relative Strength Index (RSI 14) was overbought.

As of this writing, NATGAS trades at approximately $2.45, declining toward the 38.2% Fibonacci retracement level at $2.422, the immediate support.

- The Awesome Oscillator histogram changes color to red but shows no signs of bearish momentum because the value did not significantly decrease.

Overall, the technical indicators suggest that while the primary trend is bullish because the price trades above the median line of the bullish flag, it can dip further.

Natural Gas Could Fall to $2.32 If Support Breaks.

The immediate support is at $2.42. Suppose bears (sellers) close and stabilize the Natural Gas price below $2.42. In that case, the downtick momentum from the 50% Fibonacci level will likely extend to the lower line of the bullish flag, backed by the 23.6% Fibonacci at $2.32.

Please note that the bearish outlook should be invalidated if the Natural Gas price exceeds the $2.5 resistance. The next bullish target in this scenario could be the October 11 high at $2.6.

NATGAS Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 2.42 / 2.32 / 2.24

- Resistance: 2.5 / 2.6

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.