Over the past two days, natural gas prices in the United States have jumped more than 5%, reaching around $3.4 per MMBtu. The main driver behind this surge is the colder weather forecast, which boosts expectations for heating demand.

Later today, the Energy Information Administration (EIA) is expected to release data showing a slight increase in national natural gas storage, possibly the last rise of the season. Lower prices in the previous week led producers to cut back on output.

Moreover, recent weather predictions indicate colder-than-usual temperatures on the West Coast and across most of the country, except for the Gulf Coast. Additionally, concerns about gas supplies in Europe as the year ends have pushed LNG feed gas flows to a 10-month high, which reduces the supply available domestically.

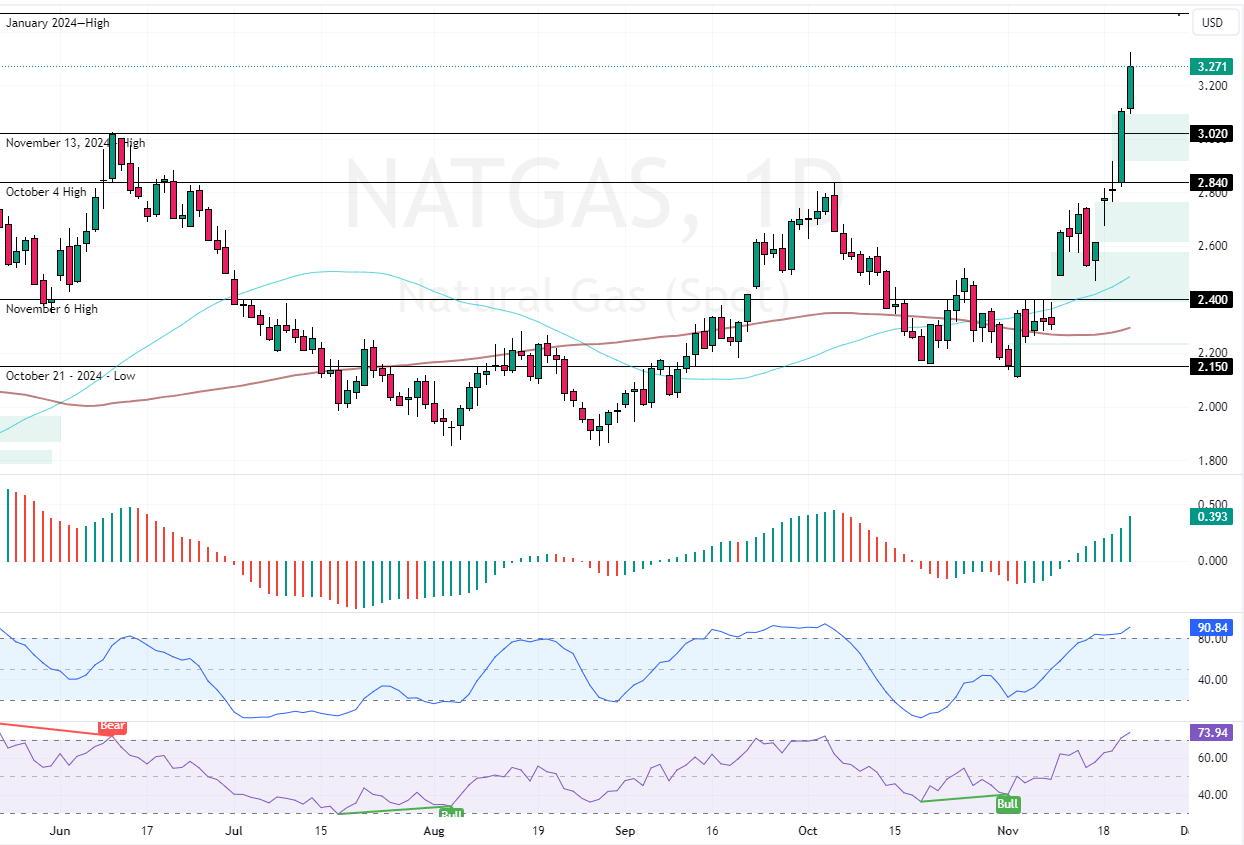

NATGAS Technical Analysis

The U.S. natural gas market exceeded $3.02 critical resistance and is trading at approximately $3.27 as of this writing. This price surge left a bullish fair value gap behind, causing the Stochastic and RSI 14 indicators to step into overbought territory.

From a technical perspective, the primary trend is bullish because the prices are above the 50- and 100-period simple moving averages. However, the momentum indicators hinted that NATGAS is saturated with buyers. Therefore, the prices are expected to consolidate near lower support levels before the uptrend resumes.

In this scenario, the November 13 high at $3.02 could be tested, backed by the bullish fair value gap. This supply zone could provide a decent and low-risk entry point for joining the NATGAS bull market.

Please note that the bullish outlook remains valid as the prices exceed $2.82.