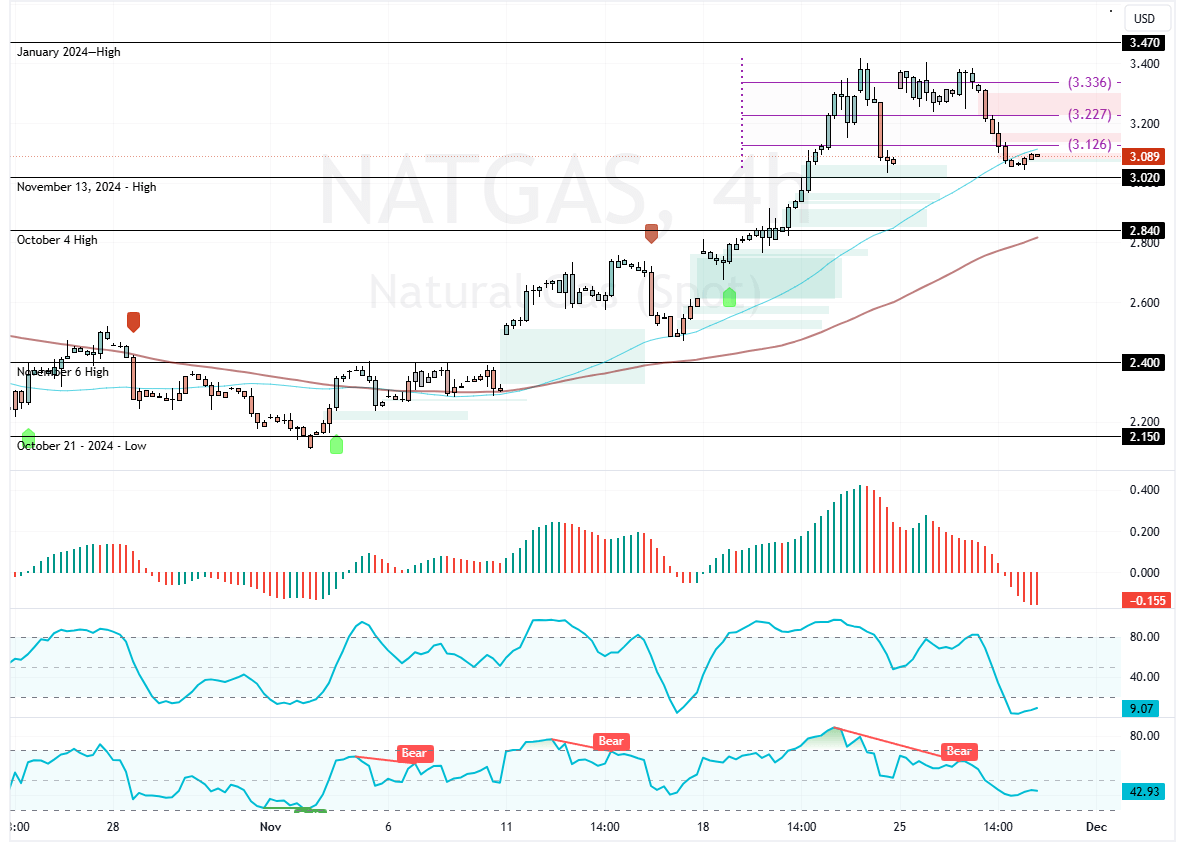

FxNews—NATGAS declined from $3.47 on an RSI divergence signal and overbought singles. As of this writing, the commodity trades at approximately $3.03, testing critical support, backed by the 50-period simple moving average.

Despite the recent selloff, NATGAS’s primary trend should be considered bullish because the prices are still above the 100-period simple moving average.

NATGAS Tests Key Support at $3.02 Amid Bearish Signals

The immediate resistance is at $3.12. From a technical perspective, if NATGAS bulls close and stabilize above this resistance, the next bullish target could be $3.22. Furthermore, if buying pressure exceeds $3.22, the bull’s path to $3.33 could be paved.

- Good read: Watch Crude Oil as Bears Eye $68.3 Breakdown

Please note that the bullish outlook should be invalidated if prices dip below $3.02, the immediate support. If this scenario unfolds, NATGAS prices could experience a further decline toward $2.84, backed by the 100-period simple moving average.