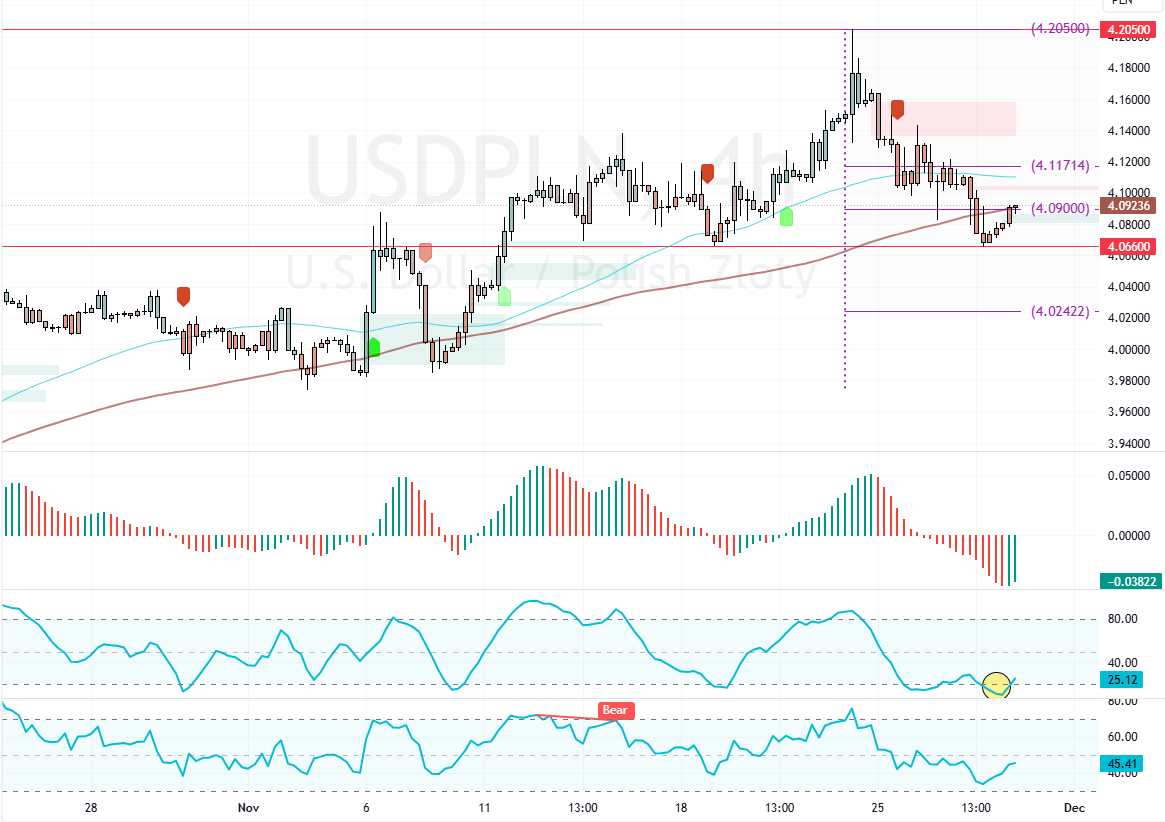

FxNews—The American dollar has been losing ground against the Polish Zloty from 4.205 (November High). However, the downtrend eased near the 4.066 support. As of this writing, USD/PLN trades at approximately 4.08, testing the 50% Fibonacci retracement level as resistance.

The current uptick in momentum was expected because earlier this week, the Stochastic Signalled oversold, meaning the Polish Zloty was overpriced. Meanwhile, the Awesome Oscillator histogram changed color to green but is still below the signal line. This development in the technical indicators suggests the bull market is strengthening.

USDPLN Eyes 4.11 if Bulls Overcome Bullish Barrier

Immediate resistance is at 4.09. From a technical perspective, the current uptick could extend if USD/PLN bulls close and stabilize above 4.09. In this scenario, the next bullish target could be the 38.2% Fibonacci resistance area at 4.11.

On the other hand, immediate support rests at 4.066. If bears push USD/PLN below this level, the downtrend will likely resume. If this scenario unfolds, the next sellers’ target could be the 78.6% Fibonacci support level at 4.02.