FxNews—The U.S. Securities and Exchange Commission (SEC) has approved changes to stock exchange rules, allowing options to be listed on spot bitcoin ETFs. This decision expands the investment opportunities for products already attracted billions of dollars this year.

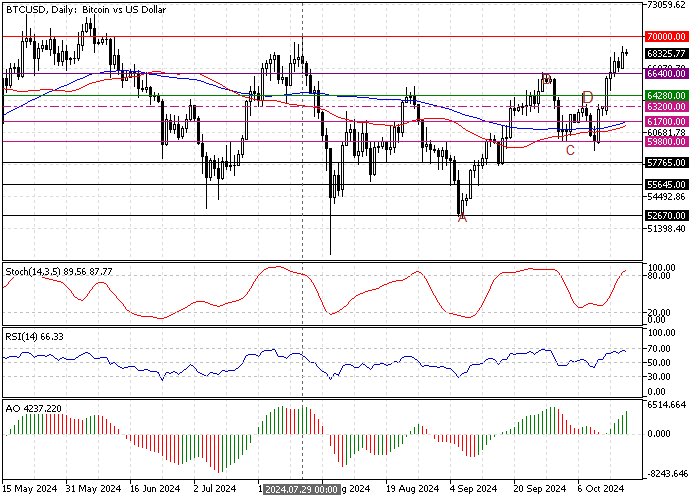

Upon releasing this news, Bitcoin continues its uptrend, aiming toward the July 19 high at $70,000. The BTC/USD 4-hour chart below demonstrates the price, support, and resistance levels.

NYSE and Cboe Get Approval for Bitcoin Options Listing

According to memos released by the SEC on Friday, NYSE can now list and trade options linked to the Grayscale Bitcoin Trust (GBTC), the Grayscale Bitcoin Mini Trust (BTC), and the Bitwise Bitcoin ETF (BITB).

Meanwhile, Cboe Global Markets has also received approval to list options for the Fidelity Wise Origin Bitcoin Fund (FBTC) and the ARK 21Shares Bitcoin ETF (ARKB).

This approval comes after the SEC recently allowed Nasdaq to list and trade options for BlackRock‘s iShares Bitcoin Trust (IBIT). These approvals are part of an ongoing trend of expanding trading options for cryptocurrency-related products.

What Are Bitcoin ETF Options?

Options are financial tools that provide the right to buy or sell an asset – in this case, bitcoin ETFs – at a set price before a specific date. Many believe offering options on bitcoin ETFs could boost institutional interest in crypto, making it more appealing for investors and improving market liquidity.

SEC’s Take on Bitcoin ETF Options

In its statement about the NYSE’s approval, the SEC mentioned that options for bitcoin ETFs could help investors hedge risks, improve liquidity, and reduce price volatility. The move is also expected to enhance market transparency and price efficiency for these ETFs and related products.

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.