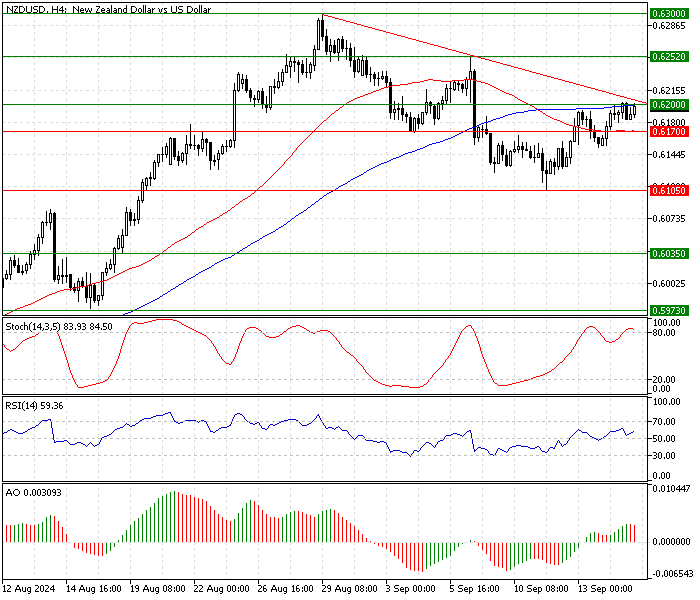

FxNews—The New Zealand dollar tested the 100-period simple moving average and the descending trendline at approximately $0.620 in today’s trading session.

The 4-hour chart below demonstrates the NZD/USD price, support, resistance levels, and technical indicators used in today’s analysis.

NZDUSD Technical Analysis – 17-September-2024

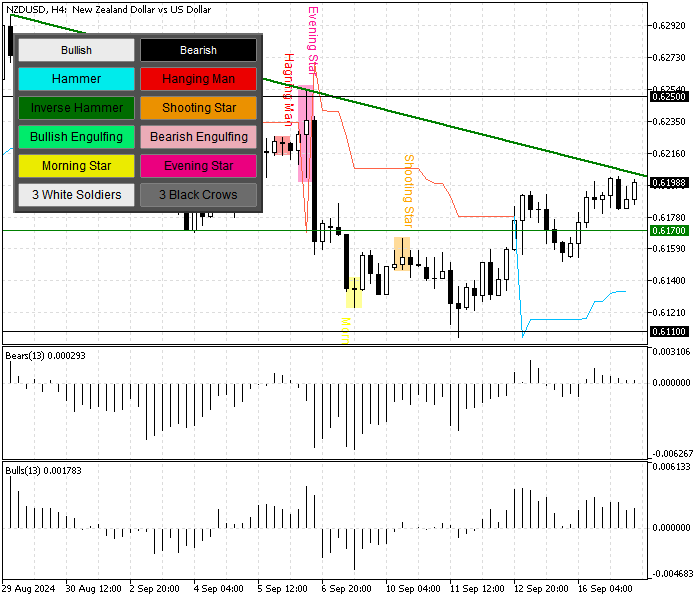

The buying pressure from $0.610 caused the Stochastic oscillator to step into overbought territory, meaning the NZD/USD was saturated with buying. However, the relative strength index indicators depict 58 in value, meaning the New Zealand dollar has room to grow higher against the U.S. dollar.

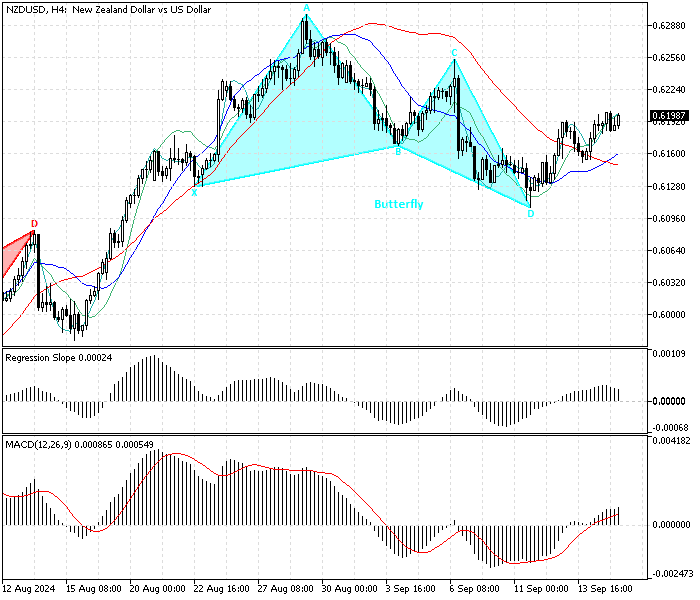

As for the harmonic pattern, we notice a bullish ‘butterfly’ pattern has emerged in the 4-hour chart, meaning the uptrend will likely resume.

The NZD/USD price is also above the supertrend indicators, another bullish signal.

Overall, the technical indicators suggest the current uptrend can extend further if the bulls exceed the 100-period simple moving average.

NZD/USD Price Forecast

Immediate support is the $0.620 (September 13 High). From a technical perspective, the bull market will likely target $0.625 (September 6 High) if the NZD/USD price closes and stabilizes above the $0.629 mark.

Furthermore, if the buying pressure pushes the price above $0.629, the following resistance area will be the August 2024 high at $0.630.

NZD/USD Bearish Scenario

If the bulls fail to surpass the $0.62 mark, a new bearish wave will likely begin if the NZD/USD price dips below the immediate support at $0.617. If this scenario unfolds, the decline in the New Zealand currency can extend to $0.610 (September 11 Low).

Furthermore, if the selling pressure drives the price below $0.610, the next support level will be $0.603 (August 9 High).

NZDUSD Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $0.617 / $0.610 / $0.603 / $0.597

- Resistance: $0.625 / $0.630