FxNews—WTI crude oil futures dropped by more than 4%, falling below $69 per barrel on Monday. The decline came after Israel’s airstrikes over the weekend targeted Iran but spared the country’s oil facilities and nuclear sites, reducing concerns about disruptions in energy supplies.

Hopes Rise as Israel Moderates Iran Response

On Saturday, Israeli jets hit military locations in Iran in response to missile attacks launched by Iran earlier in October. Oil prices have been volatile this month due to increasing geopolitical tensions in the Middle East. However, Israel’s measured response was less aggressive than expected, giving hope for further easing of the conflict.

Additionally, concerns about demand remained as data showed weak economic activity in China, the world’s largest oil consumer, with industrial profits falling despite recent government efforts to boost the economy.

Meanwhile, traders closely monitor potential changes in output from OPEC+ and the impact of the upcoming US elections.

Bearish Signals as Oil Tests Recent Lows

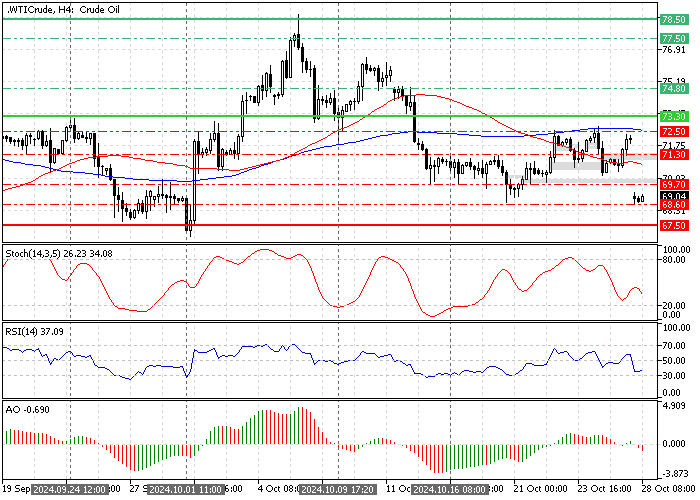

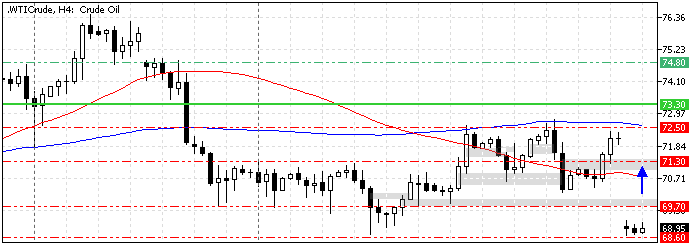

From a technical perspective, Oil is in a bear market because the price is below the 50- and 100-period simple moving averages. As of this writing, Oil tests $68.5 (the October 18 low). In addition to the moving average indicators, the Awesome Oscillator histogram flipped below the signal line, signaling the market is bearish.

Today, the oil market has opened up a massive bearish gap. The price dipped from $72.5 to $68.6, so bulls could partially or fully aim to close the gap. This means prices might reverse to the level where the market closed before the gap.

Oil $69.7 Resistance: Key to Closing the Gap

The immediate resistance is at $69.7, the October 15 low. The Oil price could fill today’s gap if bulls or buyers close and stabilize the price above this resistance. If this scenario unfolds, a new consolidation phase will likely form with a target at $171.3, the October 16 high.

Please note that the critical support for the oil price is $67.5, the October 1 low. The bullish outlook above should be invalidated if the price falls below this support. The next bearish target in this scenario could be the September 10 low at $65.5.

Oil Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 68.6 / 67.5 / 65.5

- Resistance: 69.7 / 71.3 / 72.5