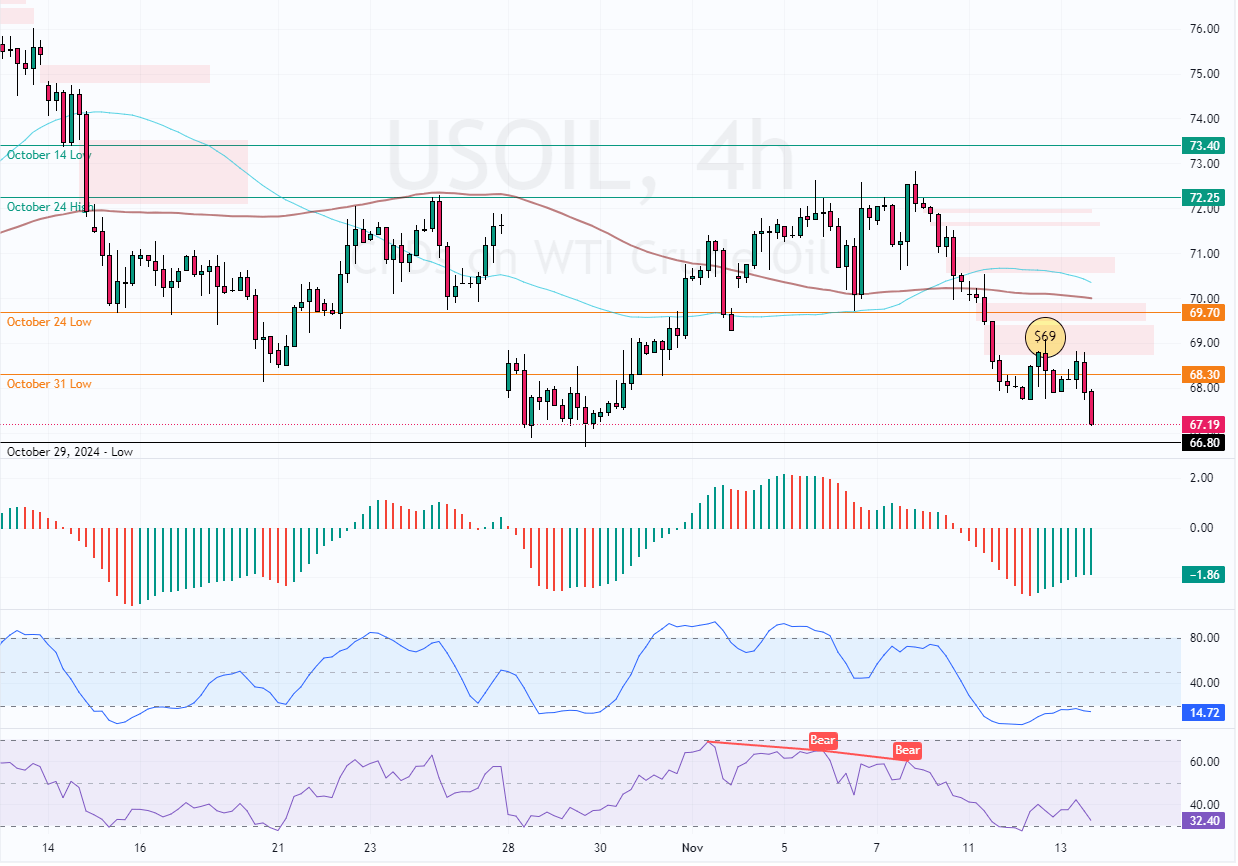

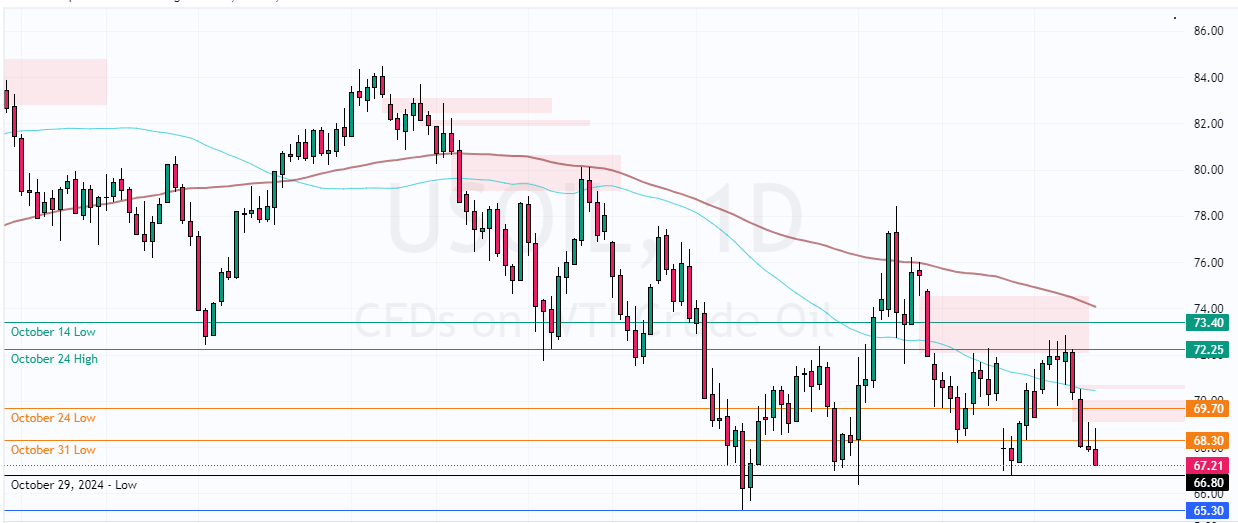

FxNews—Crude Oil began its downtrend after the price tested the Bearish Fail Value Gap area at approximately $69. The market ignores that crude Oil is oversold, as the Stochastic Oscillator signals. The indicator has been floating below 30 since November 11.

Oil Technical Analysis – 13-November-2024

As of this writing, the black gold trades at approximately $67.2, declining toward the October low at $66.8. From a technical standpoint, the Oil market should consolidate after the price reaches the 66.8 support. In this scenario, WTI can erase some losses by rising toward $69.7.

Avoid Bearish Oil Trades in Oversold Market

Please note that the Oil market is oversold. Therefore, joining a bear market when it is saturated with sellers is not advisable. We suggest waiting for the market to consolidate near the 69.3 resistance that offers a decent bid to consider a bearish entry.

- Next read: Expect Lower Gasoline Rates Below $1.97

On the other hand, if sellers push the prices below 66.8, the downtrend will likely extend to the September low of 65.3.

- Support: 66.8 / 65.3

- Resistance: 68.3 / 69.7

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.