FxNews—Silver prices surged past $32 per ounce, nearing a high not seen in two weeks. This increase aligns with gold’s gains, driven by the upcoming US election uncertainties and growing tensions in the Middle East, which have boosted the attraction of Silver and gold as safer investments.

With the US presidential election just around the corner, the race between former President Donald Trump and Vice President Kamala Harris is extremely close. As the election draws near, predictions slightly lean towards Trump winning.

- Also read: Election Patterns and Bitcoin’s Next Move

Israeli Forces Eliminate Hamas Leader Sinwar

In a significant escalation of conflict in the Middle East, Israeli forces recently eliminated Hamas leader Yahya Sinwar. This action has heightened concerns about potential broader regional conflicts.

Additionally, China, a major consumer of metals, has shown encouraging economic signs, which have improved metal demand opportunities. This positive data comes when global economic indicators have been mixed.

ECB Cuts Rates Again, Shows Inflation Control

The European Central Bank has reduced interest rates again, marking the third cut this year. This decision reflects their growing confidence in managing inflation effectively.

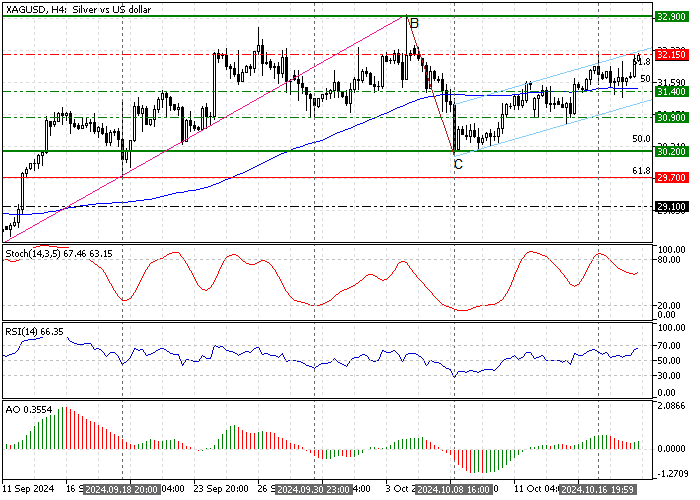

Silver Technical Analysis – 18-October-2024

As of this writing, the XAG/USD pair is testing the October 16 high at $32.15 as resistance. The primary trend is bullish because the price is above the 100-period simple moving average, and the technical indicators suggest the uptrend should resume.

- RSI 14 records 65 in the description, meaning Silver is not overpriced.

- The Awesome Oscillator bars are green, above the signal line, indicating the uptrend should resume.

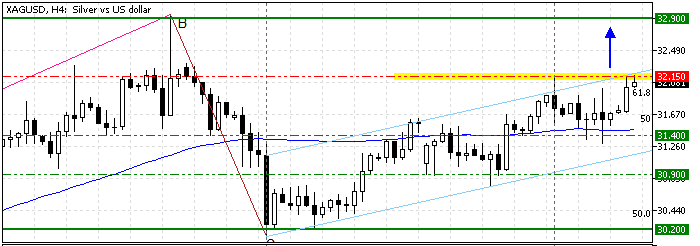

Silver Price Forecast – 18-October-2024

From a technical perspective, if the Silver price exceeds the $32.15 immediate resistance, the bullish wave from $30.2 will likely extend to the October 4 high at $32.9.

Please note that the bullish outlook should be invalidated if XAG/USD falls below the 100-period SMA at about $31.4. In this scenario, the dip could extend to the September 30 low at $30.9.

Silver Support and Resistance Levels – 18-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $31.4 / $30.90 / $30.2

- Resistance: $32.15 / $32.90