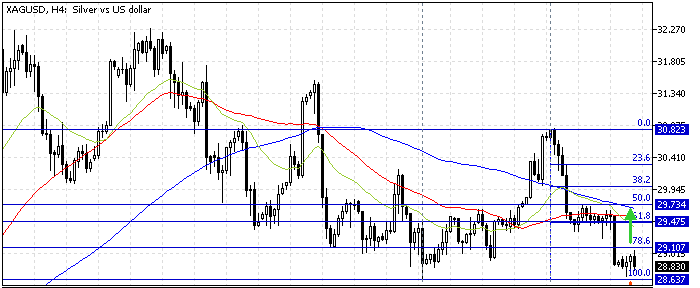

FxNews—Silver has been in a bear market since the bulls peaked at $30.8 ceiling on June 21. The bearish bias eased after the XAG/USD price neared the June 13 low at $28.6, trading at approximately $28.8 in today’s trading session.

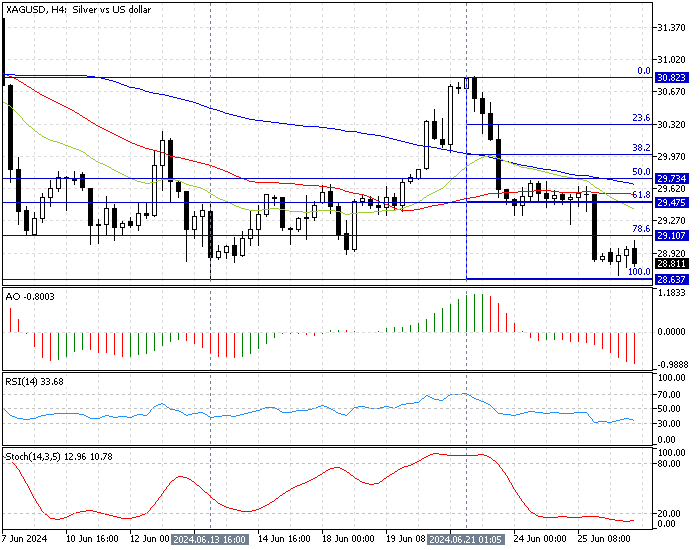

The 4-hour chart below demonstrates Silver’s key Fibonacci retracement levels, the technical indicators, and the simple moving averages utilized in today’s analysis.

Silver Technical Analysis – 26-June-2024

The primary trend is bearish, and as of writing, the bulls are testing the immediate resistance at $29.1, the 78.6% broken Fibonacci level. The technical indicators suggest the downtrend should prevail, but the market might jig into a consolidation phase.

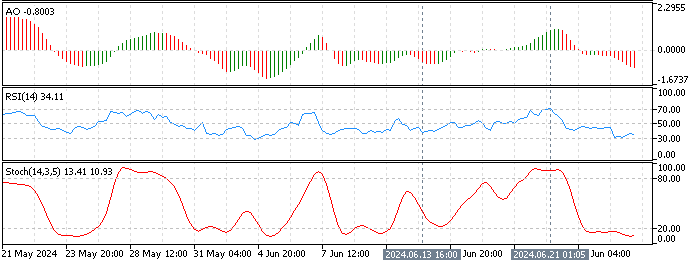

- The awesome oscillator value is -0.70 with red bars and below the signal line, meaning Silver is in a robust bear market.

- The Silver price is below the 25, 50, and 100-period simple moving average, signifying the robust bearish pressure.

- The relative strength index indicator value is 35, nearing the oversold territory, suggesting the market might become oversold.

- The stochastic %K line value records 11 and has been floating in the oversold territory since June 24, signaling an extremely oversold market.

Silver Price Forecast – 26-June-2024

From a technical standpoint, the Silver market is bearish, but the price might bounce from the $28.6 resistance (June 13 low) because the stochastic oscillator signals an oversold market.

If the XAG/USD bulls (buyers) close the price in the 4-hour chart above the immediate resistance at 78.6% Fibonacci at $29.1, the pair could consolidate near the 61.8% Fibonacci at $29.4. Furthermore, if the buying pressure exceeds $29.4, the next bullish barrier will be the 50% Fibonacci at $29.7.

The June 13 low at $28.6 is the key support to the bullish scenario. If the bears (seller) dip the Silver price below $28.6, the bullish scenario should be invalidated.

Silver Bearish Scenario

Key resistance is at $28.6. If the price exceeds this support, the downtrend initiated from $30 will likely initially test the $28.6 resistance, followed by the May 13 low at $28.0.

It is worth noting that the key resistance to the bearish scenario is the 50-period moving average (SMA). If the price exceeds the SMA, the bearish scenario should be invalidated.

Silver Key Support and Resistance Level – 26-June-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $28.6 / $28.0

- Resistance: $29.1 / $29.4 / $29.7

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.