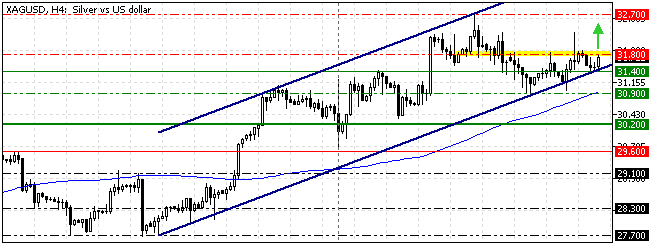

FxNews—Silver trades in a bull market above the 50- and 100-period simple moving averages at approximately $31.6. Recently, the bears broke below the ascending trendline and the $31.4 resistance but failed to maintain the pressure. As a result, the Silver price returned above $31.4.

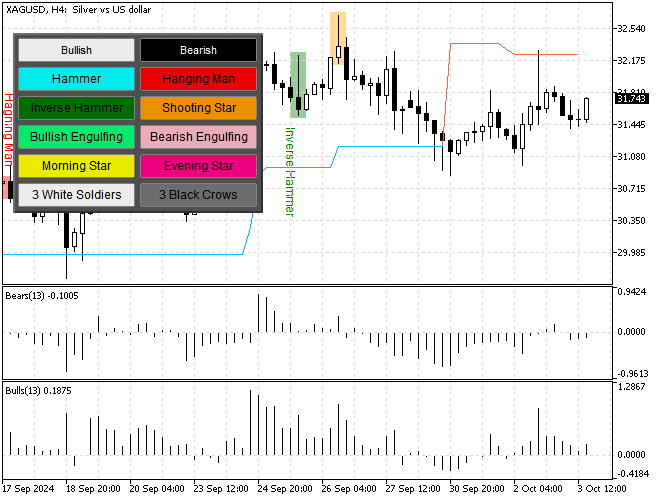

The 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators used in today’s analysis.

Silver Technical Analysis – Seeking New Highs

The Awesome oscillator histogram flipped above the signal line, meaning the uptrend strengthens and gains more momentum. Additionally, the Stochastic and Relative Strength Index indicators depict 47 and 53 in the description, signifying the market is bullish and not saturated by bids.

On the other hand, the market is still below the Supertrend indicator, which suggests that the trend might shake and reverse.

Overall, the technical indicators suggest the primary trend is bullish, and the Silver price should increase. However, for the uptrend to resume, bulls must surpass a specific resistance area.

Silver Forecast and Signal – 3-October-2024

The immediate resistance lies at $31.8 (October 1st High). If bulls (buyers) close and stabilize the price above $31.8, the uptrend will likely resume.

If this scenario unfolds, the Silver price can potentially revisit the September 2024 high at $32.7. Furthermore, if the buying pressure pulls the price above $32.7, the bulls’ path to the $35.0 psychological level could be paved.

Please note that the bull market should be considered invalid if the XAG/USD conversion rate falls below the 100-period simple moving average or the $30.9 support.

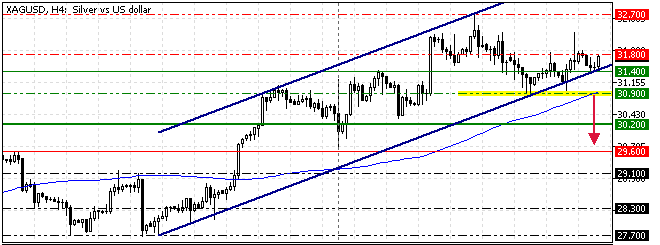

Silver Bearish Scenario – 3-October-2024

The critical support level that divided the bull market from the bear market is $30.9, or the 100-period SMA. If bears (sellers) push the price below $30.9, a new bearish wave will likely emerge. If this scenario unfolds, the consolidation phase from $32.7 could extend to the following critical supply zone at $30.2, the August 2024 high.

Furthermore, if the XAG/USD price dips below $30.2, the next bearish target could be the September 18 low, the $29.6 resistance.

Silver Support and Resistance Levels – 3-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $31.4 / $30.9 / $30.2 / $29.6

- Resistance: 31.8 / $32.7 / $35.0