If you’re new to the world of currency trading, you’ve probably heard about the Forex bar chart. But what are they, and why are they important? Don’t worry! In this article, we will explain everything in a way that’s easy to understand, even if you’re starting. These charts are helpful because they show how currency prices move over time, giving you a significant advantage when deciding when to buy or sell.

Ready to learn more? Let’s explore the superficial world of Forex bar charts and start learning!

What is the Forex Bar Chart?

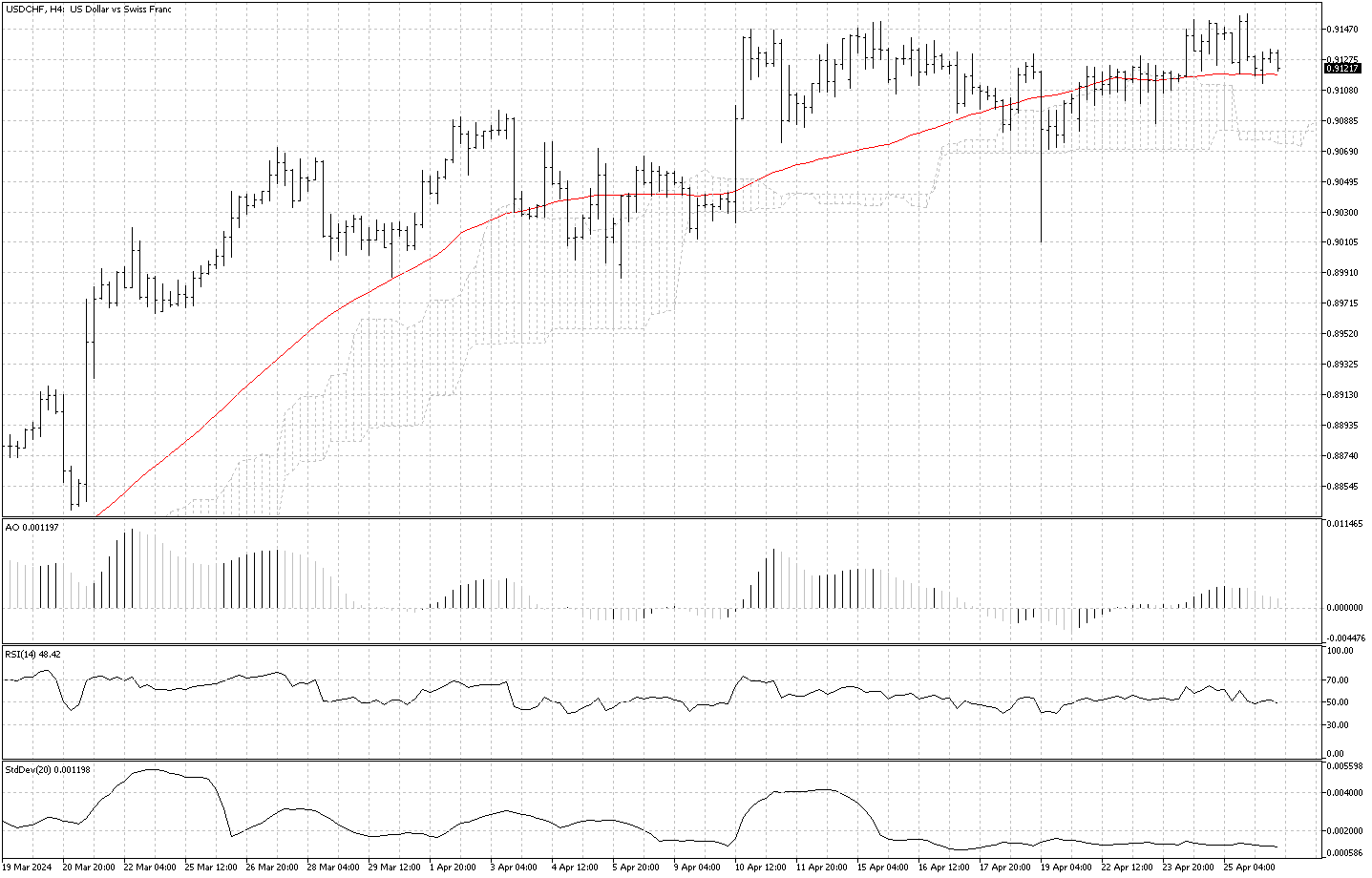

In Forex trading, a bar chart is like a picture showing how currency prices change over time. Each “bar” on the chart tells us four main things about the price of a currency during a specific time:

- The opening price (how much it cost at the beginning).

- The closing price (how much it costs at the end).

- The highest price it reached.

- The lowest price it dropped to.

The bar has a vertical line and two small horizontal lines. The top of the vertical line shows the highest price, and the bottom shows the lowest price. A small line to the left shows the opening price, and the closing price is a small line to the right.

Why Are Bar Charts Useful in Forex Trading?

1. Seeing the Price Action: “Price action” means how prices move over time. Bar charts help traders see patterns in these movements, essential for making good trading decisions.

2. Making Decisions: The bar chart helps traders see if other people in the market are feeling positive or negative about a currency. For example, if the closing price is much higher than the opening price, it might mean people are feeling good about it, and it could be an excellent time to buy.

3. Avoiding Risks: Bar charts show how much the price of a currency goes up and down during a specific time. This helps traders decide where to set their stop-loss orders, which are like safety nets to prevent losing too much money if prices go the wrong way.

How Do Traders Use Bar Charts?

1. Spotting Trends: In Forex trading, it’s vital to know the general direction in which the price of a currency is moving. If the bars are going up, reaching higher and higher prices, we call it an “uptrend.” If they’re going down, hitting lower prices, it’s a “downtrend.”

Example: Imagine a series of bars where each one is taller than the last, meaning the highest and lowest prices are increasing. This pattern suggests a strong uptrend, indicating a good time to buy.

2. Predicting Changes: Sometimes, specific shapes or patterns in the bars can suggest that the prices are about to go in the opposite direction.

Example: Let’s say there are two high bars with a lower bar in the middle, like a valley surrounded by two mountains. This is called a “double top” and might mean the prices will drop.

3. Finding Breakout Points: A “breakout” is when the price moves outside a specific range it’s been stuck in, which might start a new trend.

Example: Picture a series of bars moving sideways between two levels. Suddenly, a new bar reaches a price higher than the range. This could be a breakout and a sign to start buying.

4. Comparing Past and Present: Traders compare old bar charts with current ones to guess what might happen next.

Example: If the price reached a certain point in the past before going down, and it’s at that point again now, traders might expect it to go down like before.

Tips for Using Bar Charts Effectively

1. Look at Different Time Frames: Check the currency prices in various time frames – one hour, day, or week – to get the whole picture.

2. Use Technical Indicators: To make better decisions, combine bar charts with other tools like moving averages or the Relative Strength Index (RSI).

3. Stay Objective: Don’t just see what you want to see. Look at the charts honestly to understand what’s happening.

4. Keep Checking: The Forex market changes quickly, so keep looking at the charts to stay updated.

5. Keep Learning and Practicing: Learn new ways to read charts and practice a lot. Some trading websites let you practice using a demo account before using real money.

Conclusion

Forex bar charts are great tools for helping traders understand the currency market. They can show whether prices are going up or down, whether they might change direction, and whether there are any patterns to watch out for. By learning how to read these charts, traders can make better guesses about what might happen and make smarter decisions about when to buy or sell.

Remember, practice makes perfect, so keep studying and using those charts; they’ll become valuable tools in your trading journey!