As we approach the fourth Bitcoin halving, it’s crucial to understand its potential impacts on the global economy and the future of cryptocurrency. In less than 200 days, Bitcoin’s fourth halving event is expected to occur. This event, which happens every four years, halves the supply rate. Here’s a simple guide to understanding this event and its potential impacts.

Countdown to the Halving

There are about 193 days left until the next halving, which is scheduled for April 2024. The Bitcoin halving is a feature programmed into Bitcoin by its creator, Satoshi Nakamoto. It occurs every 210,000 blocks or about every four years. When the network reaches a specific block number, miners’ reward for verifying transactions is cut in half.

For example, the original reward was 50 bitcoins per block. After the first halving in 2012, it dropped to 25 bitcoins per block. This system controls the rate of supply, which decreases over time. So far, Bitcoin has had three Halvings.

What Does the Fourth Halving Mean for Miners?

The upcoming halving will reduce the reward from 6.25 BTC to 3.125 BTC per block, lowering the inflation rate from 1.7% per year to 0.84%. At current prices and with 900 BTC issued daily, miners make about $24 million daily in new bitcoins. If bitcoin prices remain stable, this daily income would drop to $12 million.

Understanding the Impact of the Fourth Bitcoin Halving

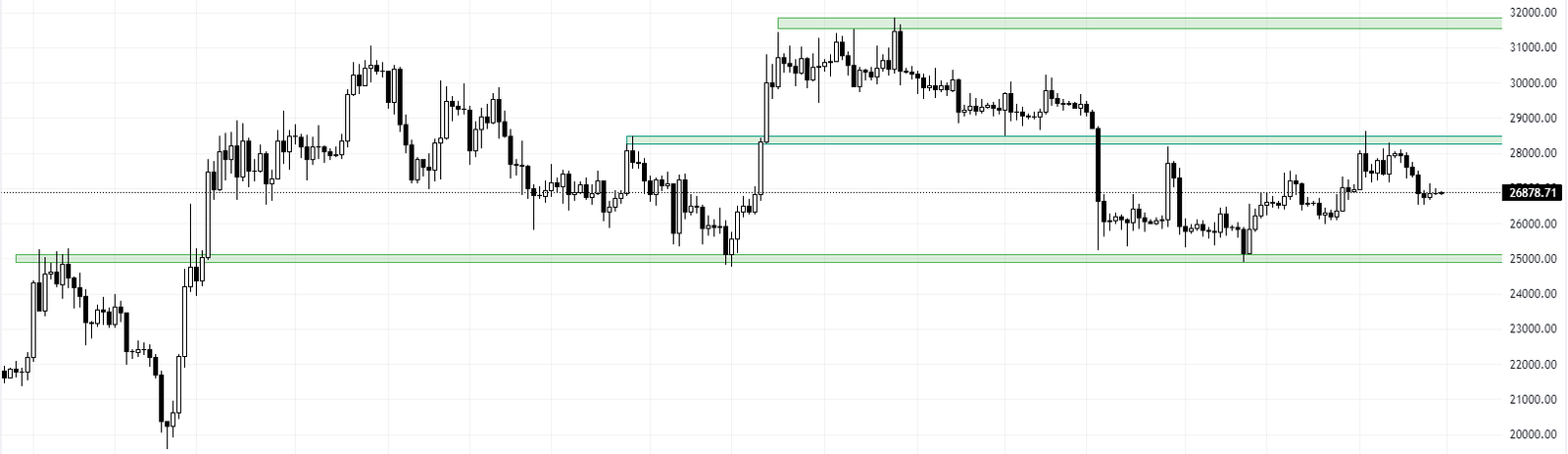

Before the 2012 halving, bitcoin’s price rose from under $5 to over $13. This ensured that mining remained profitable despite the reduced block reward. The price also increased before the 2016 halving and again in 2020.

The Future of Bitcoin Mining

FxNews – While prices have increased during past Halvings, it’s not guaranteed to happen again. Mining could become unprofitable if Bitcoin’s price doesn’t rise around the halving time. This could force many miners to stop operations, reducing the network’s hash rate and security. However, mining can remain profitable if Bitcoin’s value increases enough to offset the reduced block reward. Miners could also benefit from transaction fees if Bitcoin’s usage and adoption grow significantly.

After the 2024 halving, miners will receive 3.125 BTC per block. The 2028 halving will reduce this further to just 1.5625 BTC. If each four billion people made a daily Bitcoin transaction with a fee of $0.01, this would total $40 million in daily fees. This could support miners even after block rewards disappear.

Even though the Bitcoin system allows us to predict when halvings will happen and how they will affect the supply of Bitcoin, we can’t expect everything. We can’t know the price of Bitcoin or how mining will be affected by future halvings. Any ideas about how the network will respond to a reduced supply are just theories until the halvings happen.