FxNews—U.S. stocks saw an uptick during midday trading, primarily due to the tech sector. Notably, Netflix was at the forefront, showing significant gains following its robust quarterly earnings announcement.

The S&P 500 increased by 0.5%, and the Nasdaq 100 was up by 0.7%. In contrast, the Dow Jones showed modest improvements, erasing earlier declines.

Netflix Surpasses Q3 Expectations

Netflix stood out with its third-quarter performance, topping expectations with its earnings, revenues, and subscriber growth. This positive news increased Netflix’s stock, influencing the broader market sentiment.

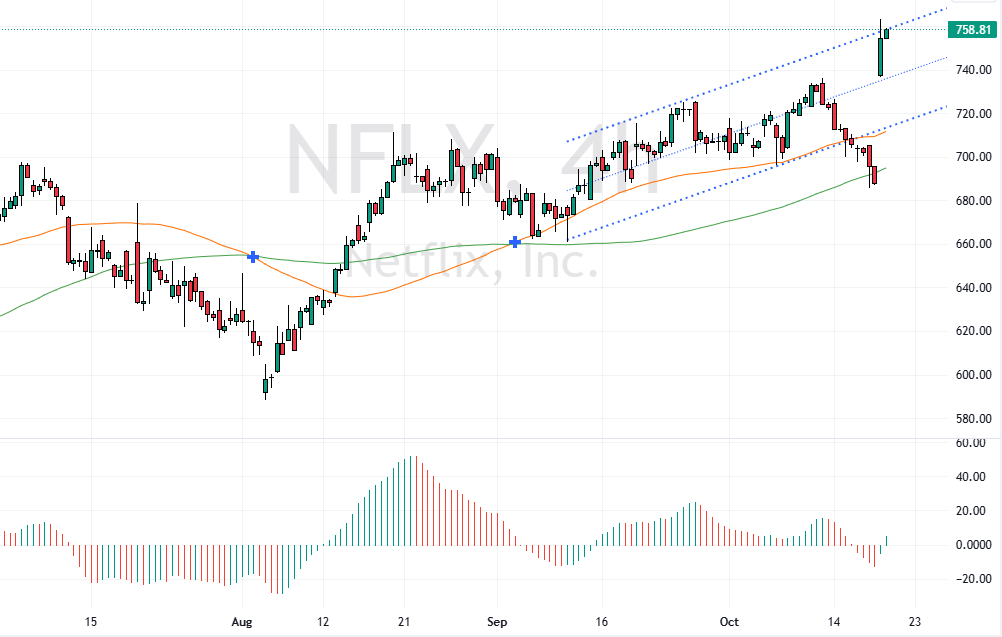

As of this writing, Netflix shares trade at approximately $758.8, testing the upper band of the bullish flag. The Awesome oscillator flipped above the signal line, meaning the uptrend will likely resume.

Apple Shares Up 1.4% with iPhone Sales Surge in China

Apple’s shares also climbed by 1.4% due to a reported boost in iPhone sales in China. Similarly, tech companies Nvidia, Meta, and Alphabet recorded gains, contributing to the market’s overall positive momentum.

Apple shares broke above the August 29 high at $233, trading at approximately $235, testing the middle line of the bullish flag as resistance. The uptrend will likely resume if buyers pull the price above the $237.2 resistance.

P&G and AmEx Earnings Miss, Shares Dip

Not all news was positive, however. Procter & Gamble’s sales fell short of market forecasts, causing a slight drop of 0.1%. Likewise, American Express experienced a more significant decline, dropping by 3.1% due to revenue that did not meet expectations.

Looking at the week’s overall performance, the S&P 500 is poised for a modest increase of 0.2%. The Dow Jones is expected to rise by 1%, marking its sixth consecutive week of gains—the longest streak of the year. Meanwhile, the Nasdaq 100 faced a slight downturn, decreasing by approximately 0.7%.