FxNews—The U.S. Dollar is in a bear market against the Canadian dollar. Interestingly, the downtrend eased near the ascending trendline in the daily chart.

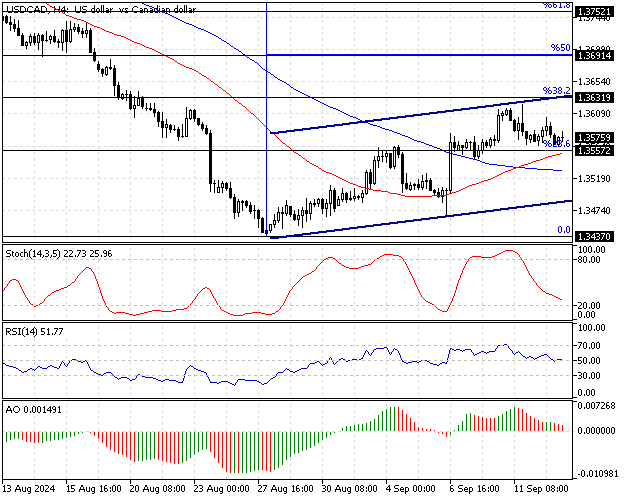

The USD/CAD chart below demonstrates the price, key support and resistance levels, and the technical indicators utilized in today’s analysis.

USDCAD Technical Analysis – 13-September-2024

Zooming into the 4-hour chart, the USD/CAD price shifted above the 50- and 100-period simple moving averages, trading at approximately 1.357 in today’s trading session.

The technical indicators (Stochastic, RSI 14, and Awesome oscillator) suggest the primary trend is bearish, but the market can potentially consolidate near the upper resistance levels.

In addition to the default technical tools, the Super trend indicator signals buy since the price is above its line.

Overall, the USD/CAD price tested the critical ascending trendline as resistance, indicating a new bullish wave.

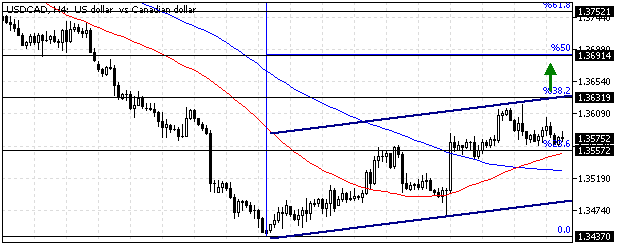

USDCAD Forecast – 13-September-2024

The key barrier for the bulls rests at the 1.363 mark, the %38.2 Fibonacci retracement level. If the USD/CAD price breaks above this mark, the current mild bullish momentum will likely extend to the %50 Fibonacci (1.369).

If this scenario occurs, the 100-period simple moving average will primarily support the uptrend. Please note that the bullish scenario should be invalidated if the USD/CAD price dips below the 100-period SMA.

USDCAD Bearish Scenario – 13-September-2024

The 23.6% Fibonacci at 1.355 neighbors, the 50-period simple moving average plays the immediate resistance. The downtrend will likely be triggered if the USD/CAD price closes and stabilizes below 1.255.

If this scenario unfolds, the sellers can target the August 2024 low at 1.343. However, the bearish scenario should be invalidated if the price exceeds the immediate resistance, the 1.363 mark.

USDCAD Support and Resistance Levels – 13-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.343

- Resistance: 1.363 / 1.369 / 1.375