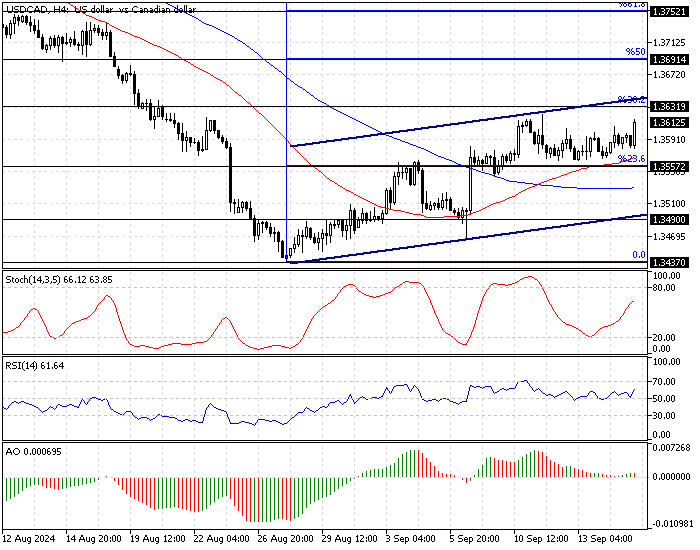

FxNews—The U.S. dollar price is rising against the Canadian dollar from 1.343, the August 28 low. However, the currency pair has been sideways, slightly above the 23.6% Fibonacci retracement level for almost a week.

As of this writing, the pair trades at about 1.360. The USD/CAD 4-hour chart below shows the price, Fibonacci retracement levels, and the technical indicators utilized in today’s analysis.

USDCAD Technical Analysis – 17-September-2024

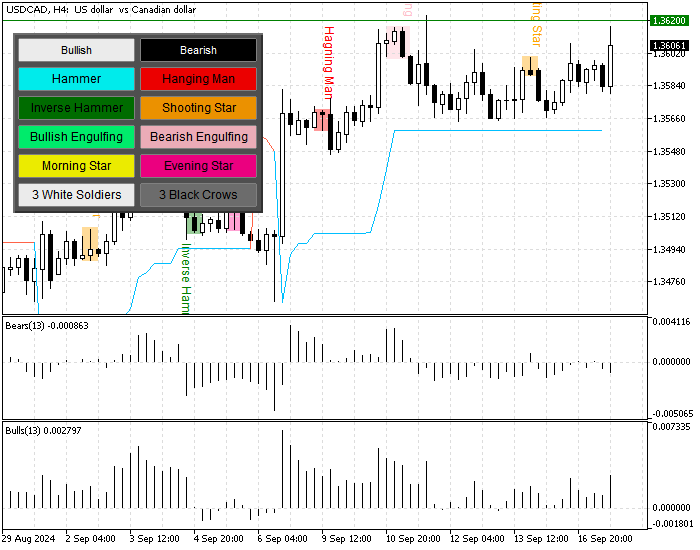

The price is above the 50- and 100-period simple moving averages, so the primary trend should be considered bullish. However, the Awesome oscillator signals divergence, which results in the price moving sideways in a narrow range area.

- The Stochastic oscillator and RSI 14 also indicate a low momentum market.

Furthermore, the Supertrend indicators signal a bull market as the price exceeds the indicator’s line.

Overall, the technical indicators suggest the primary trend is bullish, but the pair must break above the immediate support for the uptrend to resume.

USD/CAD Price Forecast

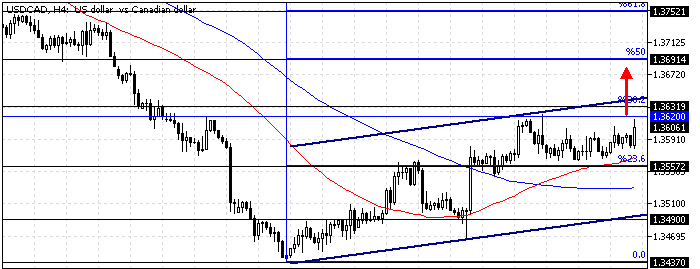

The immediate resistance is at 1.362 (September 11 High). The USD/CAD uptrend will likely resume if the bulls (buyers) push and stabilize the price above 1.362. If this scenario unfolds, the bullish wave from 1.343 can potentially target the %50 Fibonacci retracement level at 1.369.

Please note that the key support area for the bullish scenario rests at the %23.6 Fibonacci mark, the 1.355 mark. The bull market should be invalidated if the price dips below 1.355.

USD/CAD Bearish Scenario

1.355 is the immediate support. If the bears (sellers) close and stabilize the price below this level, the decline will likely spread to the lower line of the bullish flag at approximately 1.349.

Furthermore, if the selling pressure exceeds 1.349, the next support level will be the August low at 1.343.

USD/CAD Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.355 / 1.349 / 1.343

- Resistance: 1.363 / 1.369 / 1.375