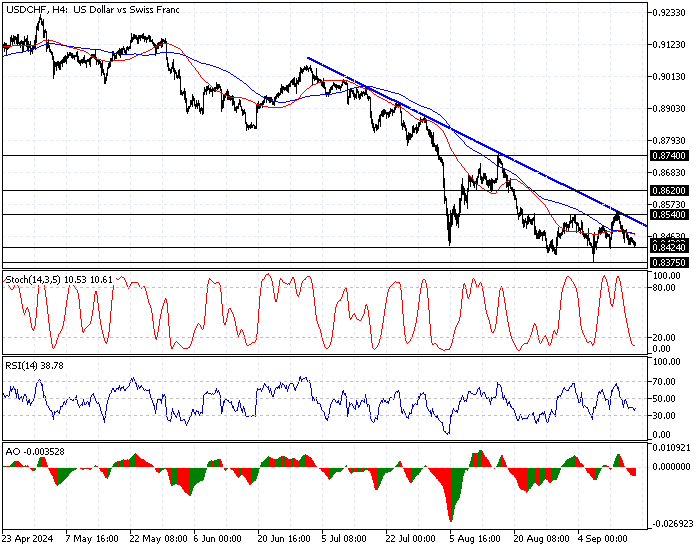

FxNews—The U.S. dollar is in a bear market against the Swiss Franc, testing the September 11 low at 0.842. The robust selling pressure caused the Stochastic oscillator to step into oversold territory. Additionally, the Relative strength index indicates 36 in the description, meaning the dip can resume.

The USD/CHF 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators used in today’s analysis.

USDCHF Technical Analysis – 17-September-2024

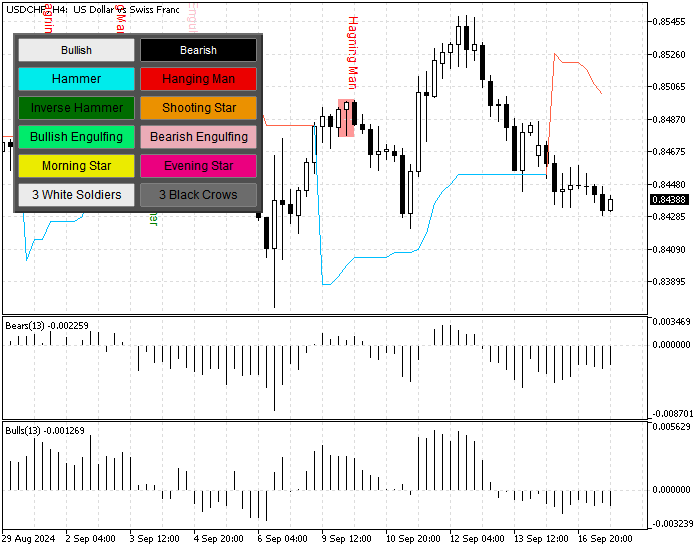

The pair trades below the 50- and 100-period simple moving average, and the Awesome oscillator bars are red and below the signal line, meaning the primary trend is bearish.

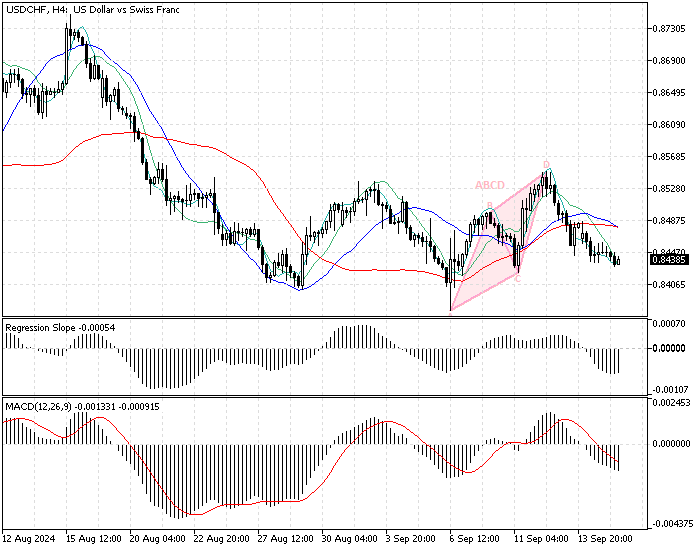

The 4-hour chart formed a bearish ABCD pattern for the harmonic pattern, signaling that the downtrend should continue.

Furthermore, the USD/CHF price dipped below the Supertrend indicator, meaning the bear market gained momentum.

Overall, the technical indicators suggest the primary trend is bearish and it will likely resume to lower support levels after a minor consolidation.

USD/CHF Price Forecast

The September 11 low at 0.842 is the immediate support. If the price exceeds 0.842, the downtrend will likely revisit the September 6 low at 0.837. Furthermore, if the selling pressure pushes the price below 0.837, the bears’ path to the December 2023 low at 0.832 will likely be paved.

Please note that the bearish scenario should be invalidated if the USD/CHF price exceeds 0.854.

USD/CHF Bullish Scenario

The key resistance level to the current downtrend is 0.854, the September 12 high. If the bulls (buyers) cross above 0.854, the next bullish target could be the August 14 low at 0.862.

Additionally, if the price exceeds 0.862, the resistance level will be 0.874, which is the August 15 high.

USD/CHF Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.842 / 0.837 / 0.832

- Resistance: 0.854 / 0.862 / 0.874