USD/CHF began its uptrend from 0.9-, trading at approximately 0.911 as of this writing. In Switzerland, inflation rates dropped again in December, suggesting that the Swiss National Bank might lower interest rates further this year.

Rate Cut Looms with March Forecast

A 0.25% rate cut could occur as early as March. Furthermore, December’s consumer price inflation slowed to 0.6% from November’s 0.7%, aligning with predictions and continuing a trend of inflation rates below 1% for the fourth consecutive month.

Analysts predict inflation will decrease next month, likely influenced by expected reductions in electricity costs. The Swiss National Bank anticipates the yearly inflation rate to average 0.3% in 2025, a decrease from 1.1% in 2024 and projected to be 0.8% in 2026.

USDCHF Technical Analysis – 8-January-2025

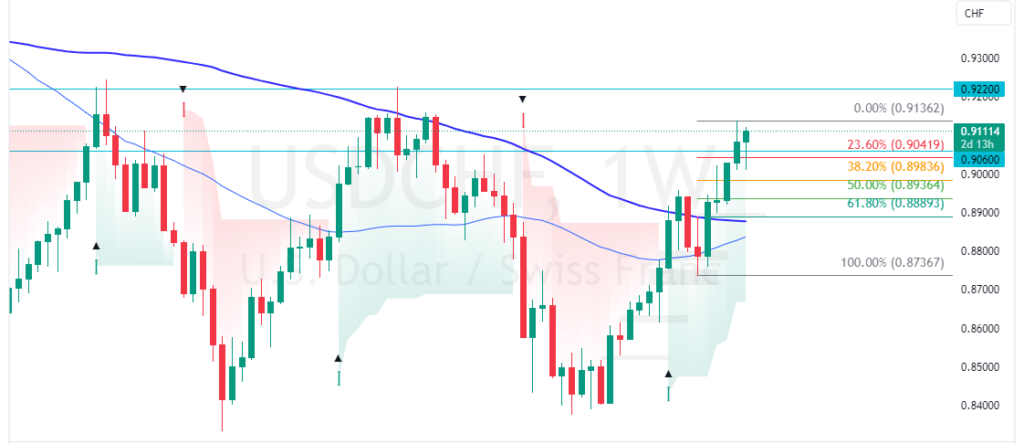

The currency pair began its uptrend trajectory after it neared the 100-period simple moving average, which is active support. As of this writing, USD/CHF is approaching the 0.913 resistance.

The Stochastic Oscillator depicts 83 in the description, meaning the U.S. dollar is overbought, at least for a short while. On the other hand, RSI 14 and Awesome Oscillator are rising, suggesting the bull market should prevail.

The critical resistance level is at 0.913. From a technical perspective, if bulls (buyers) close and stabilize above 0.913, the uptrend will likely resume. In this scenario, the next bullish target could be 0.922.

Please note that the bullish strategy should be invalidated if the USD/CHF falls below the 38.2% Fibonacci support level at 0.898. In this scenario, the dollar’s value could drop to 0.893 against the Swiss Franc.