In March 2023, Denmark saw a 3.7% year-on-year rise in retail sales, a slight drop from the 5.9% increase noted in February. This marks the seventh consecutive month of growth in the sector. Sales of food and groceries grew by 3.2%, down from 4.2% the previous month. Other consumer goods sales increased by 4.1%, compared to a 7.9% rise in February.

Clothing sales also grew to 4.4% from 3.9% earlier. On a month-to-month basis, after adjusting for seasonal variations, retail sales saw a modest increase of 0.2%, continuing the growth trend for the second month after a revised rise of 1.9% in February. Source Bloomberg.

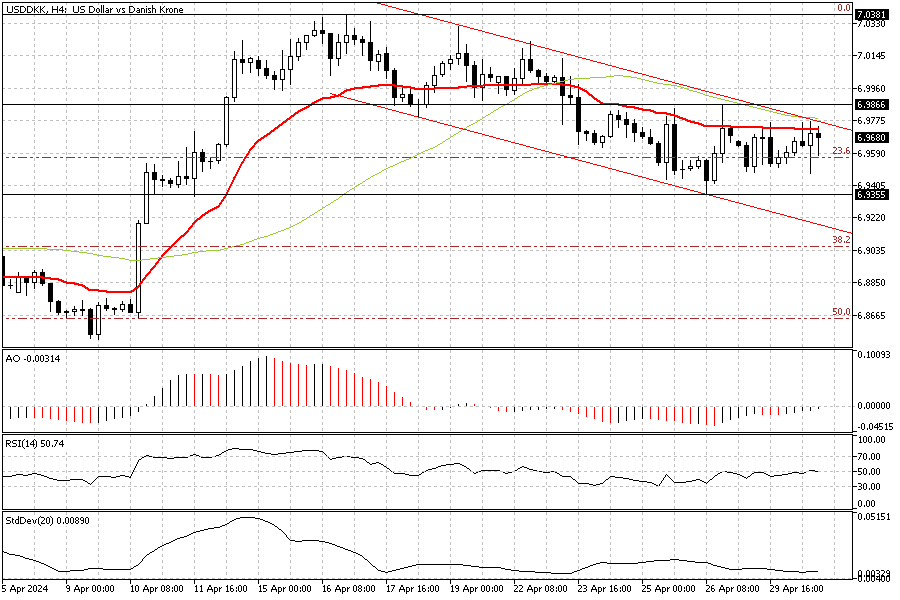

USDDKK Forecast – Navigating the Bearish Trend

FxNews–As of this writing, the U.S. Dollar trades at about 6.961 against the Danish Krone, which is inside the bearish channel, as shown in the USDDKK 4-hour chart. Since the price hovers below the EMA 50 (in green) and VIDA (in red), we can consider the primary trend bearish, and more decline will likely be on the horizon.

The technical indicators signal the continuation of the downward momentum. The awesome oscillator bars are below the signal line, and the RSI indicator returns below zero.

From a technical standpoint, 6.986 is resistance, and the trend remains bearish as long as the price ranges below this level. Therefore, the dip will likely lead to the April low at 6.9355, followed by the lower band of the bearish channel or the 38.2% Fibonacci support level, the 6.907 area.

The USDDKK Bullish Scenario

The bearish technical analysis should be invalidated if the USDKK price rises, breaks out from the bearish channel, and stabilizes itself above the 6.9866 resistance. If this scenario comes into play, the rise will likely target the 7.0 psychological level, followed by April’s peak, the 7.0381 mark.