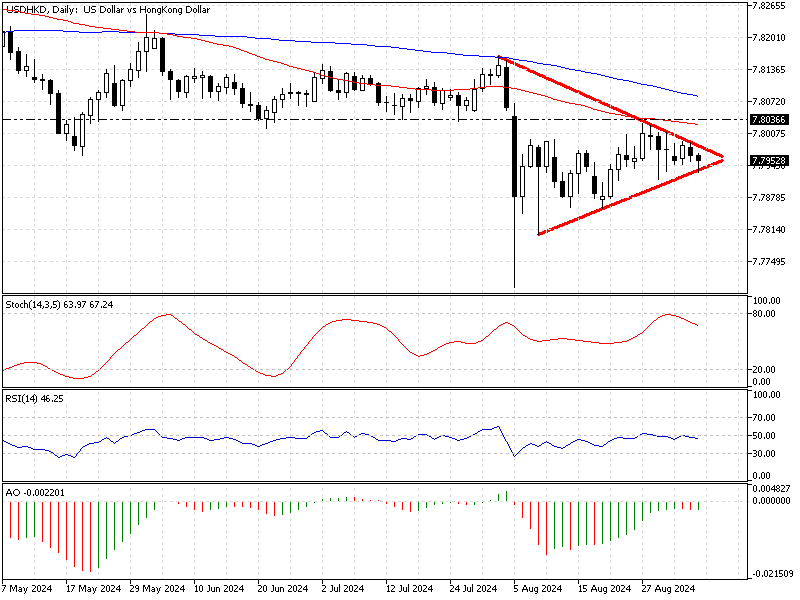

FxNews—The American currency consolidated against the Hong Kong dollar, closing the apex of the symmetrical triangle pattern in the daily chart. As of the time of writing, the USD/HKD currency pairs trade at approximately 7.79, below the 50 and 100-period simple moving averages in the daily chart.

The diagram below shows the price, patterns, and technical indicators utilized in today’s analysis.

USDHKD Technical Analysis – 5-September-2024

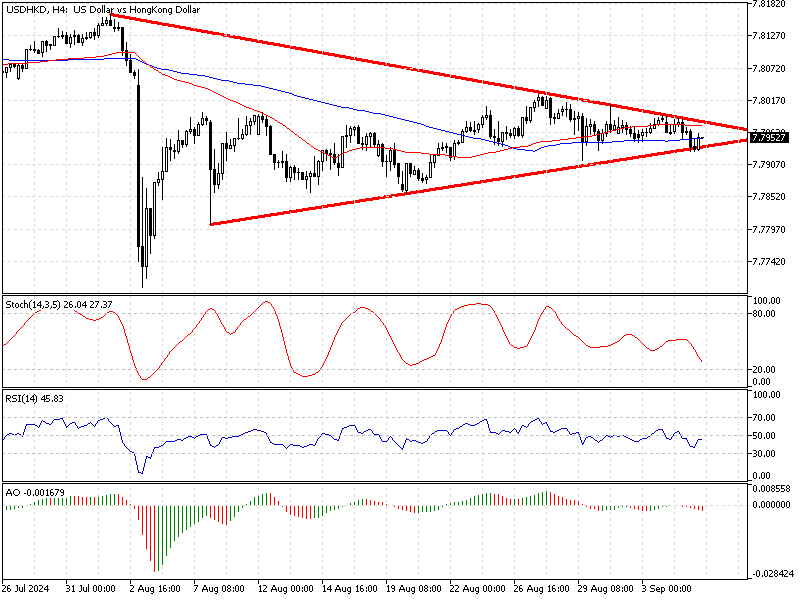

Zooming into the 4-hour chart, we notice the price is moving sideways but slightly bullish, meaning the market lacks volatility. The technical indicators suggest the market is not either overbought or oversold.

- The relative strength index indicator approaches the median line, signaling a neutral market.

- The stochastic oscillator swings in the middle, confirming RSI’s signal for a low-volatility market.

- The awesome oscillator bars are red and small but below the signal line, meaning the USD/HKD pair is slightly bearish.

USDHKD Forecast – 5-September-2024

The primary trend is bearish because the price is below the 50 and 100-period SMA. Therefore, we suggest monitoring the market for short opportunities.

That said, the immediate support lies at today’s low, the 7.792 mark, which is in conjunction with the ascending trendline in the 4-hour chart. If the price dips below 7.792, the downtrend will likely be triggered. If this scenario unfolds, the next supply zone will be the August 20 low at 7.785.

Furthermore, if the selling pressure exceeds 7.785, the next critical support will be the August 8 low at 7.780.

Please note that the USD/HKD bearish scenario should be invalidated if the bulls (buyers) cross and stabilize the price above the September 3 high at 7.799, a barrier that neighbors the descending trendline.

- Also read: USD/SGD Forecast – 5-August-2024

USDHKD Bullish Scenario – 5-September-2024

The September 3 high at 7.799 is the primary resistance that differentiates the bear market from the bull market. If the buyers close and stabilize the USD/HKD price above the 7.799 mark, the trend will likely favor the bull market.

In this scenario, the initial target will be the August 28 high at 7.80. Furthermore, if the buying pressure exceeds 7.80, the next resistance will be 7.81, the July 19 high.

USDHKD Support and Resistance Levels – 5-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 7.792 / 7.785 / 7.78

- Resistance: 7.799 / 7.80 / 7.81

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.