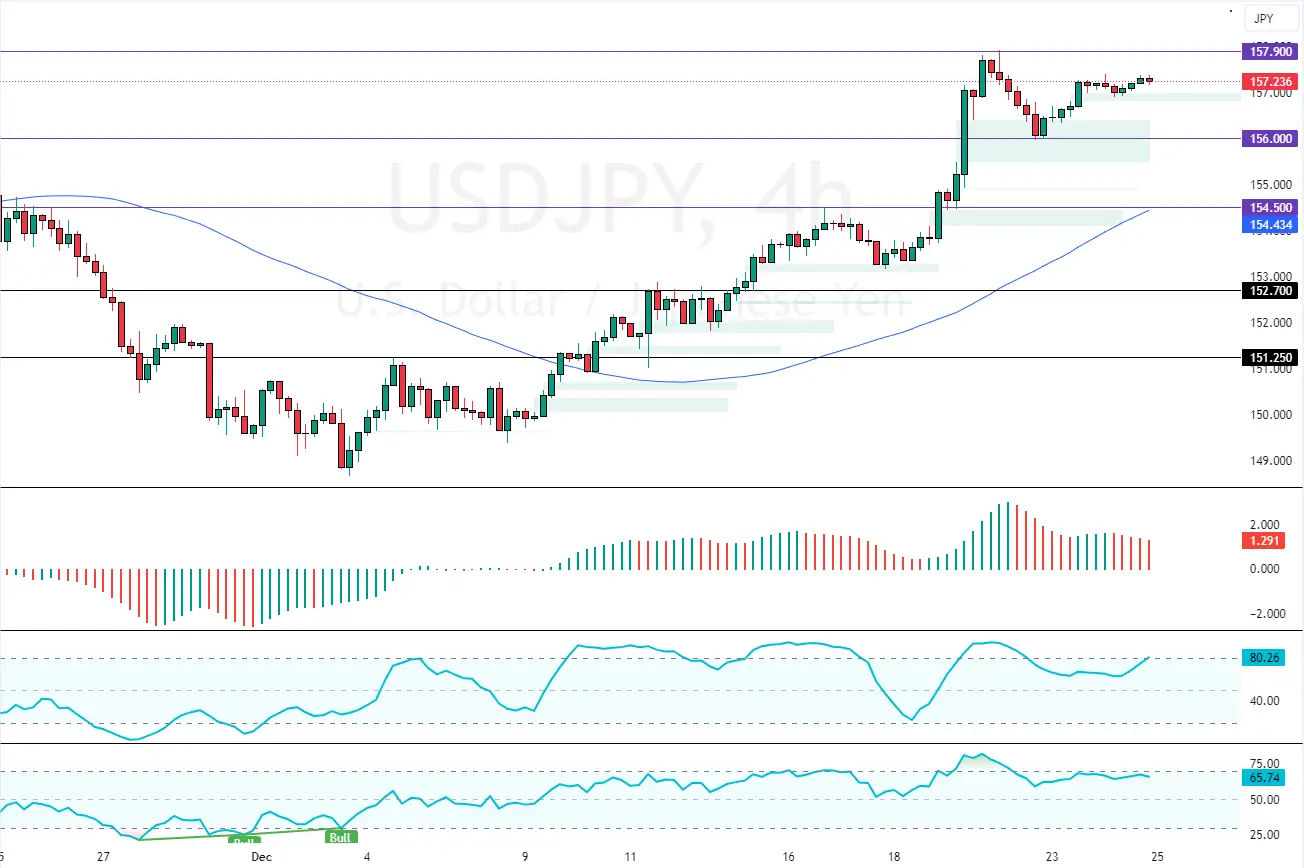

The USDJPY bull run resumed above 156.0 despite the bearish divergence signal given by AO. A close above 157.9 could escalate the uptrend, targeting 159.5.

USDJPY Technical Analysis – 25-December-2024

The U.S. Dollar is in a strong uptrend against the Japanese yen, trading at approximately 157.2 in today’s trading session. The immediate support is at 156.0, keeping the bullish wave valid.

However, the Awesome Oscillator delivers a bearish divergence signal, which could consolidate USD/JPY prices. Additionally, the Stochastic Oscillator depicts 80 in the description, indicating the market could become overbought soon.

But, the currency pair has been ignoring these bearish signals, resuming its uptrend.

USDJPY Bull Run Resumed Above 156

The immediate resistance is at 157.9. If USD/JPY closes and stabilizes above 157.9, the bullish run could extend to a higher resistance level. In this scenario, the next bullish target could be the 159.5 mark.

The Bearish Scenario

Please note that the market outlook remains bullish as long as the currency pair trades above 154.5. However, immediate support is at 156.0. A consolidation phase could emerge if bears push USD/JPY below this level.

In this scenario, prices could dip toward 154.5 key support, backed by the 75-period simple moving average.

| USD/JPY Support and Resistance Levels – 24-December-2024 | |||

|---|---|---|---|

| Support | 156.0 | 154.5 | 152.7 |

| Resistance | 157.9 | 159.5 | 162.0 |