FxNews—The American dollar has been experiencing a bullish wave since the low of 19.06 (September 18) against the Mexican peso. The uptick momentum resulted in the USD/MXN currency pair closing above 19.41 in today’s trading session, and it is trading at about 19.45 as of this writing.

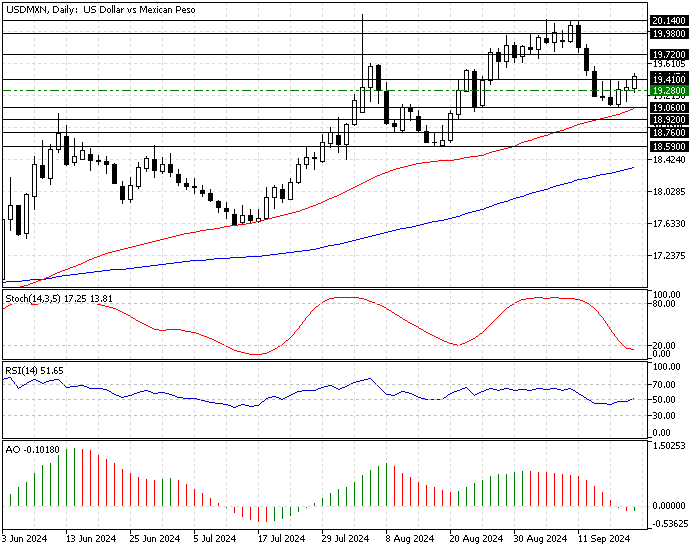

The daily chart below demonstrates the price, support, resistance levels, and the technical indicators used in today’s analysis.

USDMXN Technical Analysis – 20-September-2024

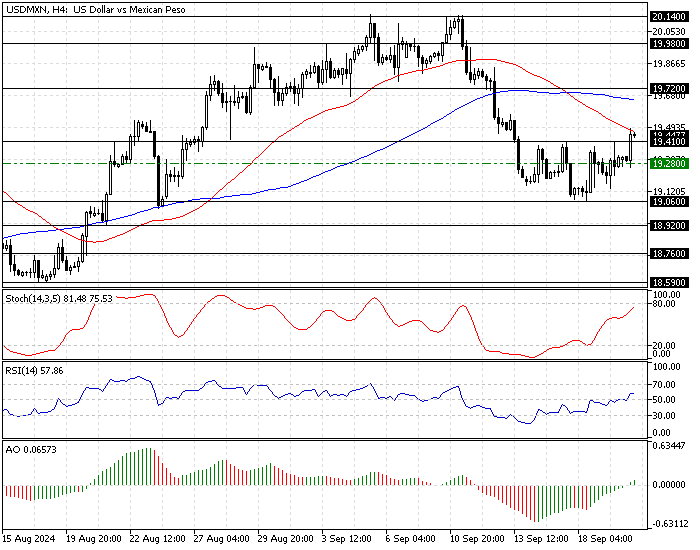

Zooming into the 4-hour chart, we notice the U.S. dollar is testing the 50-period simple moving average as resistance while the Stochastic oscillator depicts 81 in the description. Additionally, the relative strength index (RSI) 14 shows 58.

These developments in the momentum indicators suggest the primary trend is bearish, but the bullish pullback can extend because the USD/SGD price is not overbought. Furthermore, the Awesome oscillator bars are green and flipped above the single line, meaning the uptrend could obtain more momentum.

Overall, the technical indicators suggest the primary trend is bearish, but the USD/MXN can rise and test the upper resistance levels.

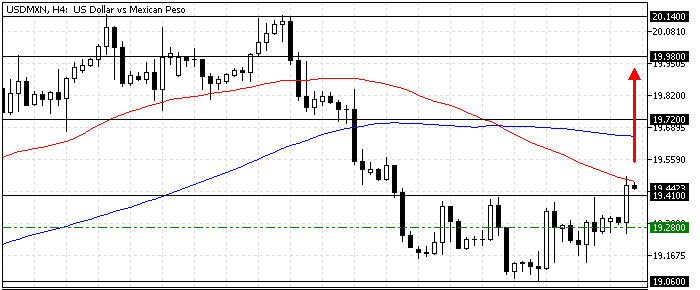

USDMXN Forecast – 20-September-2024

19.28 is the immediate support for the current bullish wave. If it holds above 19.28, the USD/MXN price could rise and target the 100-period simple moving average at 19.72. Furthermore, if the buying pressure pulls the price above 19.72, the following key resistance area will be 19.98, the September 3 high.

Please note that the bullish scenario should be invalidated if the USD/MXN price dips below immediate support at 19.28.

- Also read: USD/HKD Forecast – 20-September-2024

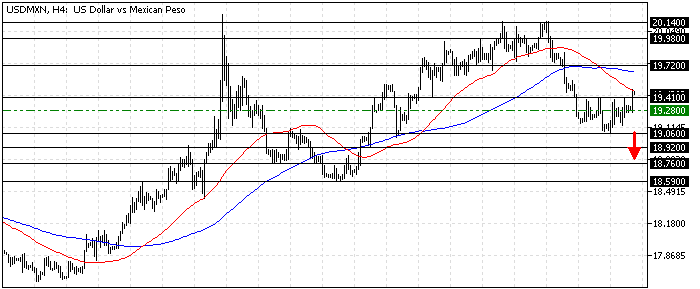

USDMXN Bearish Scenario – 20-September-2024

The immediate support is at 19.28. If bears (sellers) close and stabilize the price below 19.28, the next bearish target could be 19.06 (September 18 Low).

Additionally, if selling pressure drives the price below 19.06, the dip could extend to 18.92 (the August 21 Low), followed by 18.76, the August 9 low.

USDMXN Support and Resistance Levels – 20-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 19.06 / 18.92 / 18.76 / 18.59

- Resistance: 19.41 / 19.72 / 19.98 / 20.14