FxNews—The U.S. Dollar has been in a robust uptrend against the Mexican Peso since the August 19 low of 18.5. This week, the USD/MXN pair made it to the August 29 high at 19.98, and it is currently testing this mark as resistance.

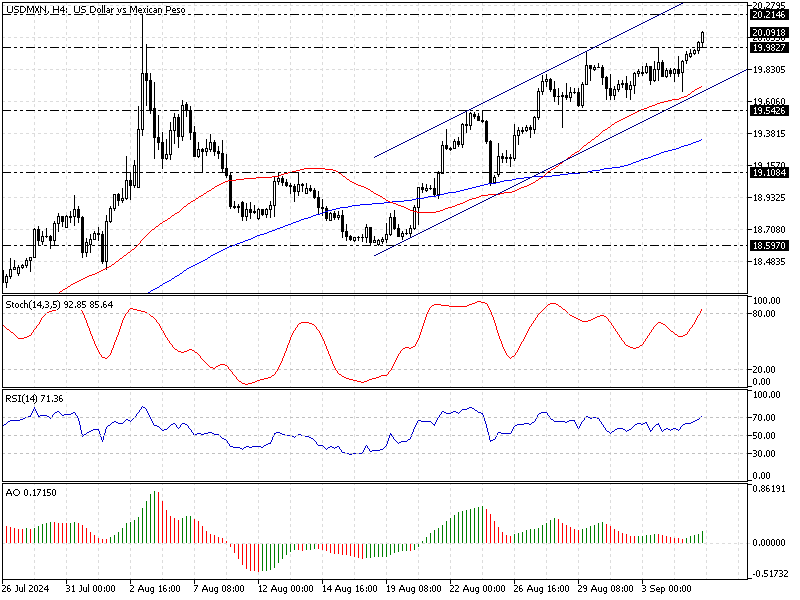

The USD/MXN 4-hour chart below shows the price, key support and resistance levels, and the technical indicators utilized in today’s analysis.

USDMXN Technical Analysis – 5-September-2024

The pair trades inside the bullish channel and above the 50- and 100-period simple moving averages. Meanwhile, the stochastic oscillator stepped into overbought territory, signifying that the American currency was overbought against the Peso in the short term.

- The awesome oscillator bars are green and above the signal line, but the histogram demonstrates divergence. This development in the AO’s histogram suggests that the USD/MXN trend can potentially reverse or consolidate near the lower support levels.

- The relative strength index value is 68, approaching the overbought area, adding credit to the Stochastic oscillator overbought signal.

Overall, the technical indicators in the 4-hour chart suggest the primary trend is bullish, but there is a high chance the market will consolidate near the lower support levels.

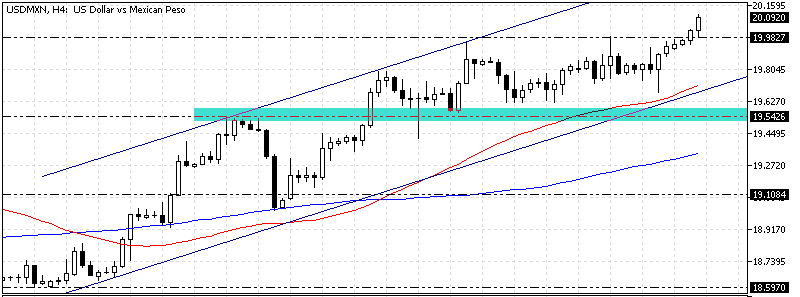

USDMXN Forecast – 5-August-2024

The primary trend is bullish, with the critical resistance resting safely at the August 22 high, the 19.5 mark. Because the momentum indicators signal overbought and divergence, it is not advisable to join the bull market. Hence, we suggest traders and investors wait patiently for the Mexican Peso to erase some of its recent losses against the greenback before they long on the Dollar.

That said, traders should monitor the 19.5 mark for bullish signals such as candlestick or harmonic patterns. This level provides a decent entry point for joining the USD/MXN bull market.

Please note that the bull market should be invalidated if the price breaks below the August 22 high of 19.5. In this scenario, the following support level will be the August 12 high at 19.1.

- Also read: USD/HKD Forecast – 5-Septemeber-2024

USDMXN Support and Resistance – 5-August-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 19.5 / 19.1 / 18.5

- Resistance: 20.2 / 21.0 / 22.0

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.