FxNews—Poland’s annual inflation rate rose to 4.9% in September 2024, the highest rate since December of the previous year. This was an increase from August’s 4.3%.

The most significant price rise was observed in food and non-alcoholic drinks, increasing from 4.1% in August to 4.7% in September. Costs for housing and utilities went up from 9% to 9.7%, and health expenses saw a sharp increase from 2.7% to 6.1%.

Communication costs rose slightly from 1% to 2.6%, and expenditures for recreation and culture grew from 4.1% to 5.4%.

September Sees Slight Rise in Consumer Prices at 0.1%

Despite the overall increase, some sectors saw declining prices. Transportation costs dropped slightly more than the previous month, from -1.4% to -1.5%. The prices for clothing and footwear also decreased from -1.4% to -1.8%.

On a month-to-month basis, consumer prices saw a modest increase of 0.1% in September, consistent with initial estimates and unchanged from August.

USDPLN Technical Analysis – 18-October-2024

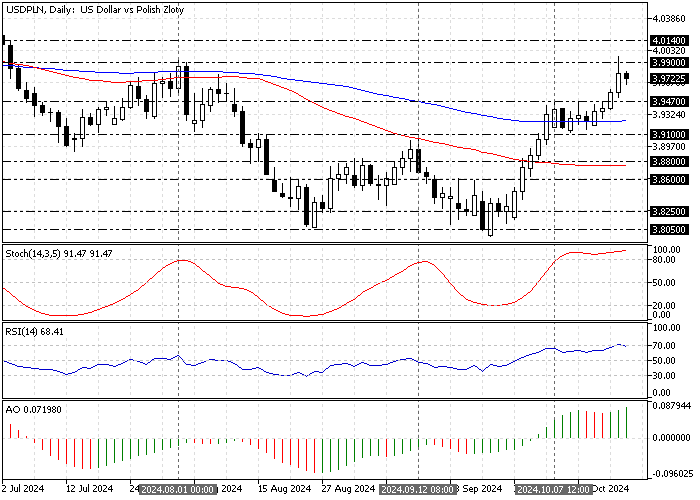

FxNews—The daily chart above clearly shows the U.S. dollar is overpriced against the Polish Zloty as the Stochastic Oscillator hovers above 80. Hence, the recent decline in the USD/PLN price was expected.

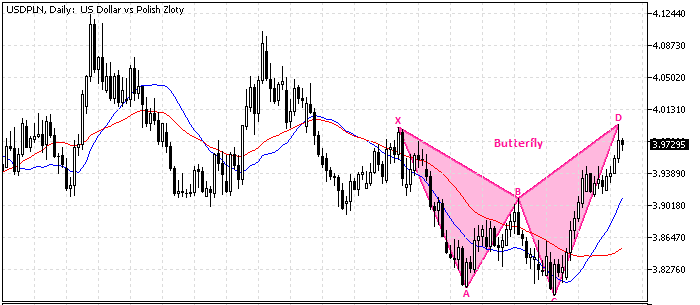

Additionally, the daily chart formed a Butterfly harmonic pattern, which is a bearish signal that could result in a trend reversal, a signal that should be taken seriously.

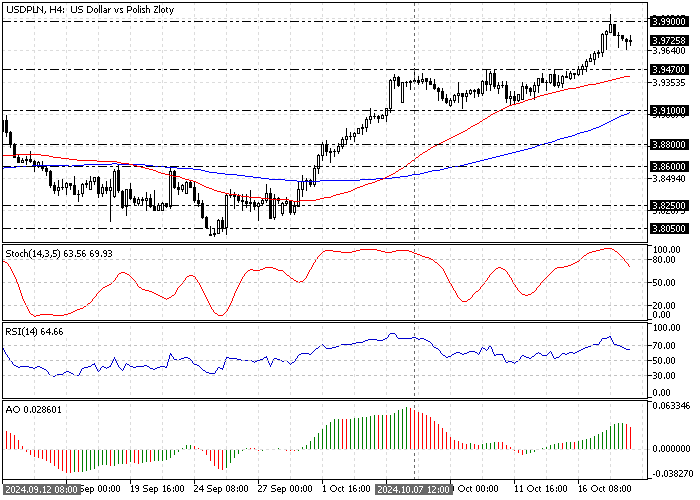

Zooming to the 4-hour chart, we notice the Awesome Oscillator signals divergence, meaning the market could change its direction or start a consolidation phase near the lower support levels. That being said, the primary trend is bullish because the price is above the 100-period simple moving average.

Overall, the technical indicators suggest the primary trend is bullish, but the bears on the USD/PLN price have the potential to push the price to lower support levels.

USDPLN Forecast – 18-October-2024

As mentioned in this article, the USD/PLN is overbought, and the U.S. Dollar is overpriced against the Polish Zloty. Hence, joining the bull market at this price is not advisable.

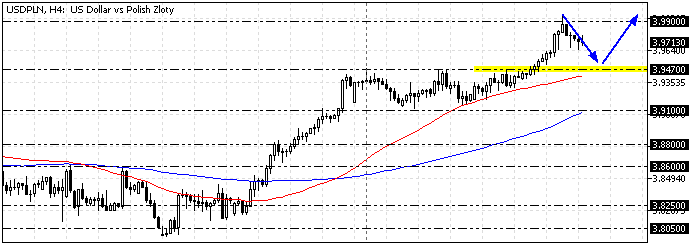

Due to Stochastic‘s overbought signal, the butterfly harmonic pattern, and the Awesome oscillator‘s divergence signal, we expect the USD/PN price to dip. In this scenario, the price can potentially test the October 7 high at 3.947.

We suggest traders and investors closely monitor 3.947 for bullish signals such as a candlestick pattern. Furthermore, if selling pressure exceeds 3.947, the next supply zone will be the September 12 high at 3.91.

Conversely, if bulls pull the price above the 3.99 critical resistance, their path to the 4.013 will likely be paved.

USDPLN Support and Resistance Levels – 18-November-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 3.947 / 3.91 / 3.88

- Resistance: 3.99 / 4.01