FxNews—On Thursday, the 10-year U.S. Treasury note’s yield remained stable at approximately 4%, following two consecutive decreases. The market is adjusting its expectations regarding the Federal Reserve’s potential interest rate reductions.

Rate Cut Chances Dim as U.S. Economy Shows Strength

U.S. interest rates have been scrutinized due to strong anticipations that the Federal Reserve might implement consistent rate cuts soon. Despite these expectations, the resilience of the U.S. economy and firm statements from officials have reduced the likelihood of a significant rate cut of 50 basis points.

This Thursday, investors will closely monitor new data, including weekly jobless claims, retail sales, and industrial production figures. These indicators will help further shape the forecast for interest rates.

The financial markets also evaluate the increasing chances of a Trump win in the upcoming November election. Trump’s policies regarding tariffs, immigration, and taxes are considered likely to drive inflation.

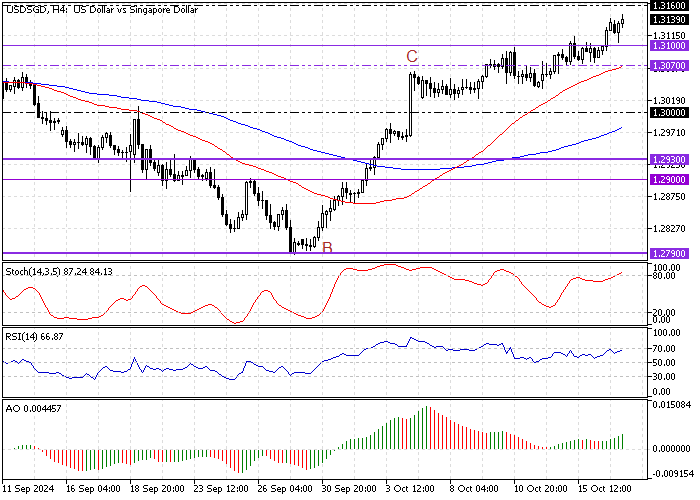

USDSGD Technical Analysis – 17-October-2024

The U.S. Dollar trades bullish against the Singapore dollar, approaching the December 2023 low at 1.316. Meanwhile, the Stochastic Oscillator signals overbought by depicting 92 in the description.

Hence, we expect the USD/SGD pair to consolidate near lower support levels before the uptrend resumes. This is due to the momentum indicators hovering in the overbought territory.

Zooming into the 4-hour chart, we notice the price broke above the September 3 high at 1.310 this week, which triggered the bulls to push the price further. Interestingly, the Awesome Oscillator signals divergence, increasing the possibility of a trend reversal or a consolidation phase.

USDSGD Forecast – 17-October-2024

It is not advisable to join a bull market when it is saturated with buying pressure. Hence, we suggest retail traders and investors be patient and wait for the USD/SGD price to consolidate near the 100-period simple moving average at approximately 1.30. This support area offers a decent bid to join the bull market.

USDSGD Support and Resistance Levels – 17-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.31 / 1.307 / 1.30

- Resistance: 1.323 / 1.33