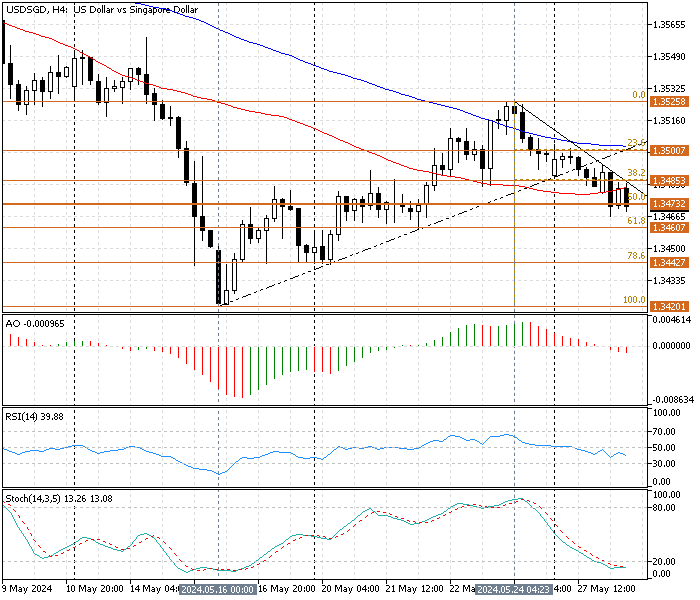

FxNews—The American currency is losing value in a downtrend against the Singapore dollar. As of writing, the USD/SGD pair trades at about $1.347, below the descending trendline and slightly below the immediate support at the %50 Fibonacci support level at $1.347.

USD/SGD Technical Analysis 4-Hour Chart

The 4-hour Chart above shows that the price has dipped since May 24. In today’s trading session, it reached the 50% Fibonacci retracement level at $1.347. The 50% Fibonacci is like a pivot that could confirm the market shift from a bear market to a bull market. Therefore, we will focus on price action and market behavior around this level.

Technical Indicators Explained in the 4-Hour Chart

- The awesome oscillator bars are red, below zero, and depict -0.0009 in the description, indicating the market is bearish, and the downtrend will likely continue.

- The relative strength index indicator hovers below the median line at 40, signaling the market should decline to the lower support level.

- The stochastic oscillator is in the oversold zone. In this analysis, we set the stochastic settings at 14, 3, and 5, giving us a smoother edge for bigger time frames like the 4-hour Chart. The %K line value is 13. That is highly oversold, suggesting a consolidation phase or a trend reversal could be on the horizon.

These developments in the technical indicators in the 4-hour Chart suggest the USD/SGD currency pair is in a downtrend. Still, the market became oversold today after the price dipped from the 38.2% Fibonacci level at $1.347. Hence, traders and investors should approach the market cautiously.

USDSGD Forecast – May-28-2024

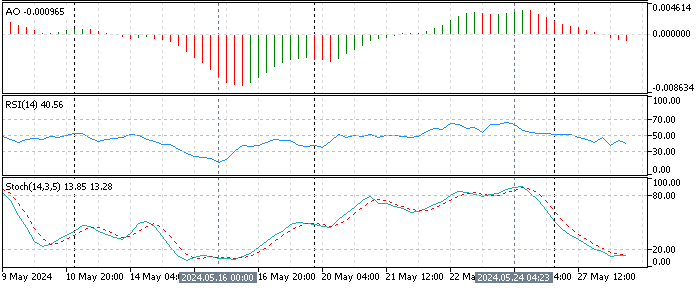

From a technical perspective, the USD/SGD pair is in a downtrend. The following support is the 23.6% Fibonacci retracement level at $1.346. For the bearish trend to resume, the price should hold below the immediate resistance at the 23.6% Fibonacci level ($1.350).

According to the oversold stochastic oscillator in the 4-hour Chart, the market anticipates a pullback from a range area from 50% to the 61.8% Fibonacci level. In case the market initiates a consolidation phase, the following demand zones can provide a decent entry point to join the bear market:

- $1.347

- $1.350

Traders and investors should monitor the demand zones above and seek bearish pullback confirmation, such as candlestick patterns.

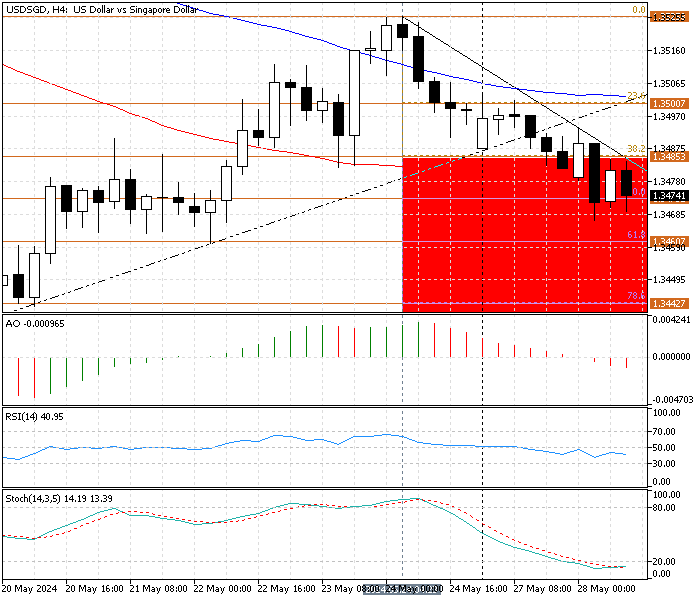

USD/SGD Bullish Scenario

The bearish technical analysis and outlook should the stochastic oversold signal result in the price closing and stabilizing above the 23.6% Fibonacci level at $1.350. Notably, the $1.350 resistance is robust because it is backed by SMA 100.

If this scenario comes into play and the price exceeds EMA 50, the path to testing the May 23 high at $1.352 will be paved. Traders and investors should wait to see what happens if the price reaches that mark.

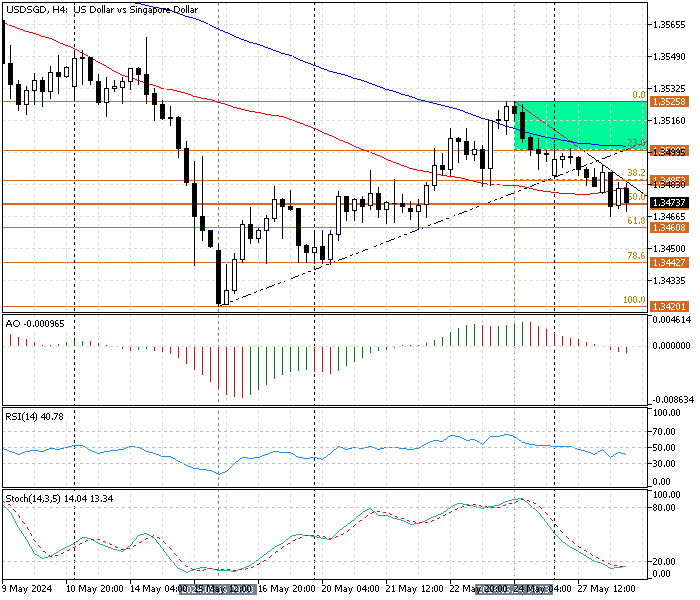

Key Support and Resistance Levels

Traders and investors should closely monitor the below USD/SGD key levels to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $1.347, $1.346, $1.344, $1.342

- Resistance: $1.347, $1.350, $1.352

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.