We will first scrutinize Singapore’s current economic conditions in today’s comprehensive USDSGD forecast (US dollar and Singapore dollar). Then, we will meticulously delve into the details of the technical analysis of the USDSGD pair.

Singapore Forex at 17-Month High

Bloomberg—In October 2023, Singapore’s foreign exchange reserves significantly increased, reaching SGD 463.4 billion, up from SGD 460.5 billion in the previous month. This surge represents the highest level since May 2022.

The primary driver behind this increase was the sustained gold and foreign exchange growth, which rose to SGD 453 billion from SGD 450.1 billion in September. However, the Special Drawing Rights (SDRs) and the International Monetary Fund (IMF) reserve positions remained at 8.4 billion and 2 billion, respectively. For comparison, in October 2022, the reserves were at SGD 399.4 billion.

An increase in foreign exchange reserves is generally a positive sign for the economy. It indicates a country’s increased capacity to pay for foreign goods, repay foreign debt, and withstand potential financial crises. Therefore, this growth in Singapore’s forex reserves can be seen as a positive economic development.

USDSGD Technical Analysis and Forecast

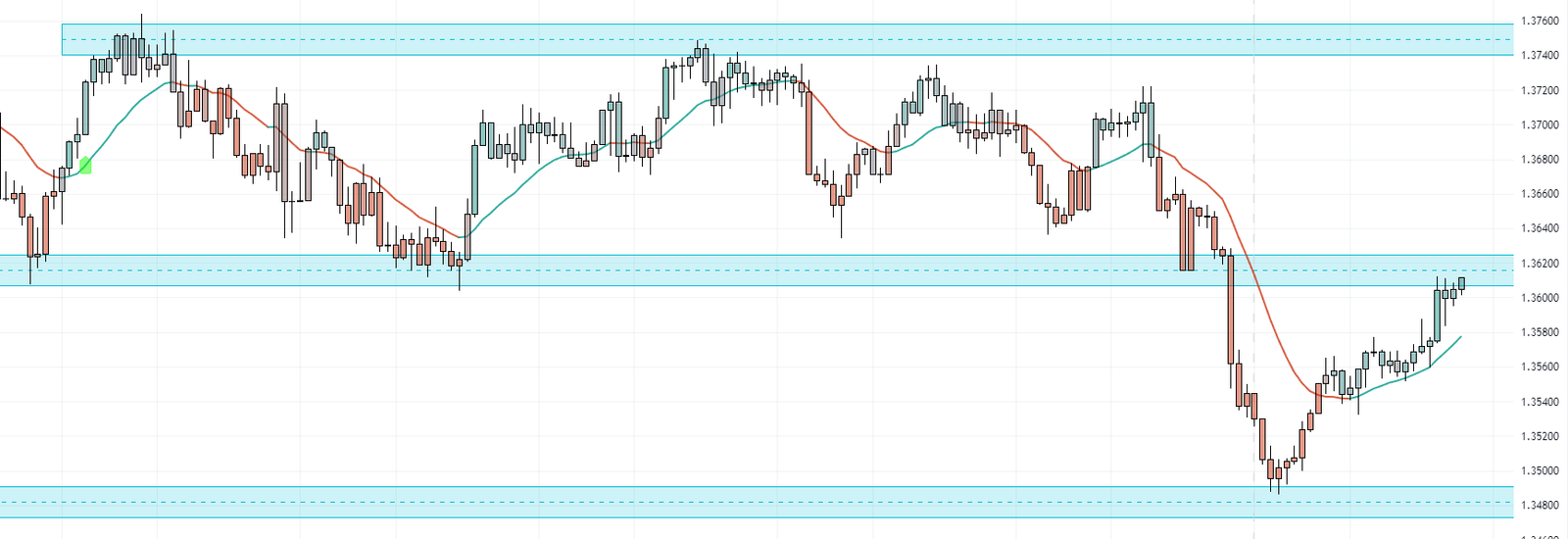

The USDSGD currency pair has shown a significant bounce from its November low of 1.3489. Currently, the bulls are testing a key resistance level at 1.3607. The Relative Strength Index (RSI) is nearing the mid-point level of 50, indicating a potential shift in momentum.

The market outlook is bullish, suggesting a positive trend. However, for a more detailed understanding of the price action and potential trigger points, it’s essential to examine the 4-hour chart. Interestingly, the 4-hour chart shows no signs of bearish intervention regarding candlestick patterns. Given the current market conditions, it’s likely that the bulls could break past the 1.3707 resistance level and aim for the 1.376 area as their next target.

Stay tuned for more updates on the USDSGD market trends and key resistance levels.