FxNews—Sovereign spreads are a financial term describing the difference in interest rates between bonds issued by a specific country and those issued by the most creditworthy governments with AAA ratings.

Understanding the Sovereign Spreads

To understand sovereign spreads, think about buying a car. You have two choices: a new car from a famous and reliable maker (like the US Treasury) and a used car from a less-known maker (like another government). The price gap between these cars is similar to the sovereign spread in bonds.

When sovereign spreads widen, the price gap increases. This can happen for several reasons. For instance, an economic downturn like a recession might make people more cautious with their money or cause them to avoid risks. Also, problems in the credit default swaps (CDS) market, like bond insurance, can affect this.

For example, if the interest rate on a bond from a particular country rises while the rate on a US Treasury bond stays the same, the sovereign spread widens. It’s like the price of a used car increases while the cost of a new car remains steady. This suggests that people view the country’s bonds (or the used car) as riskier than US Treasury bonds (or the new car).

What Determines Sovereign Spreads?

Sovereign spreads are an essential measure, often showing the health and stability of a country’s economy.

But what affects these spreads? In this post, we explore what determines sovereign spreads. This information is helpful for investors, policymakers, and anyone interested in the workings of the global financial world.

The Impact of Credit Risk on Sovereign Debt Rates

Credit risk is the primary concern. It relates to a country’s ability to pay back its debts. If investors think there’s a high credit risk, they’ll want more investment returns, resulting in broader differences in sovereign debt rates. Credit risk usually mirrors a country’s economic and political stability.

Think of credit risk as a person’s trustworthiness in borrowing money. If a friend is known for paying back loans on time, you’re more likely to lend them money without worrying. But if another friend often struggles to repay, you might be hesitant or ask for something extra in return for the risk you’re taking. Similarly, countries with stable economies and politics are safer for lending money, while those with issues in these areas are viewed as riskier.

Investment Risks and the Economic Report Card

The financial health of a country, including its growth in Gross Domestic Product (GDP), price changes (inflation rates), and government budget balance, is crucial in deciding sovereign spreads. If a country’s economy performs poorly or shows instability in these aspects, the spreads may rise, suggesting a greater risk for those who invest in that country.

Think of a country’s economy like a report card in school. The GDP growth is like the grades, showing how well the economy is doing. Inflation rates are like changes in the student’s behavior, indicating whether prices are stable. The fiscal balance is like the balance of homework done, showing if the government is spending more or less than it earns.

Sovereign spreads are like the school’s trust in the student’s performance. If the grades drop, behavior worsens, or homework is unbalanced, the school might trust the student less, just like investors may see more risk in a country with poor economic conditions.

The Impact of Political Stability on Sovereign Spreads

A country’s political stability dramatically influences its environment. Political unrest, unpredictable policies, or problems in governance can lead to uncertainty, causing spreads to widen. On the other hand, stable political conditions tend to narrow spreads.

Think of a country like a ship at sea. If the political situation is unstable, it’s like a stormy sea where the boat rocks a lot, making it difficult to predict its path (representing wider spreads). In contrast, a stable political climate is like calm waters, where the ship sails smoothly and predictably (this means narrower spreads)

The Role of Global Investors in Sovereign Spreads

The differences in interest rates between government bonds of different countries (sovereign spreads) depend on each country’s situation and the wider world financial environment. Things like the amount of money available worldwide and how willing global investors are to take risks can significantly affect these interest rate differences.

Think of sovereign spreads like the prices of different fruits in a market. Each fruit (country) has its price (interest rate). Still, these prices are also affected by how many people are shopping (global investors) and how much money they have to spend (international liquidity). When more shoppers have more money, the fruit prices might increase; similarly, when more investors are willing to take risks, the interest rates can change.

Interest Rates and Their Impact on Government Bond Yields

The varying interest rates between countries, usually influenced by their central banks’ decisions, impact the differences in government bond yields. If a country has higher interest rates than standard benchmark countries, its bond spreads tend to be broader.

Imagine two countries, Country A and Country B. Country A has an interest rate of 5%, while Country B has a lower rate of 2%. Due to Country A’s higher rate, investors see more risk in its bonds than in Country B. As a result, the difference (or spread) in the yields of their government bonds is more significant, with Country A having wider spreads than Country B.

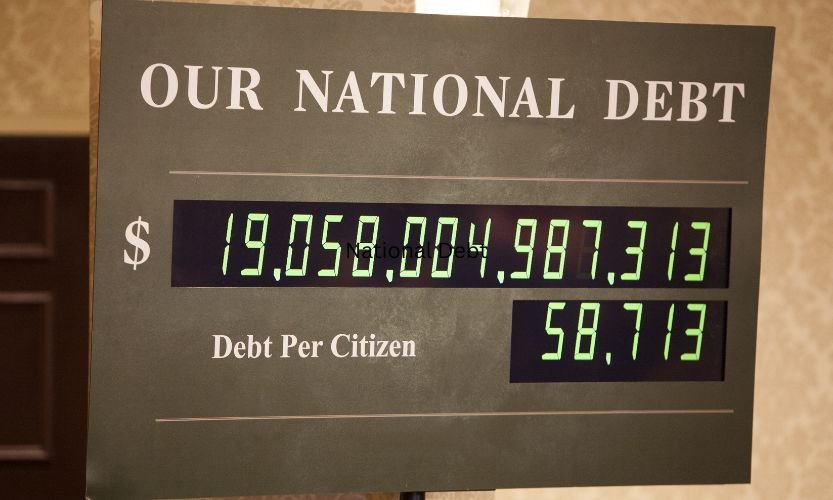

National Debt and Its Impact on Sovereign Spreads

When a country has a high national debt or its debt is not managed well, it becomes riskier. This risk can increase the difference in interest rates (sovereign spreads), as there’s a higher chance of being unable to pay back the debt or rearrange how it’s paid.

Imagine a person who has borrowed a lot of money. If they keep borrowing more and don’t manage their debts well, people will start to worry that they might be unable to pay back. As a result, lenders will begin charging them higher interest rates for new loans because lending to them has become riskier. This is similar to what happens to countries with high or poorly managed debt.

Sovereign Spread Influencers: Commodity Prices & Exchange Rates

External factors play a crucial role in the financial stability of countries, especially those heavily dependent on them. For instance, sudden changes in commodity prices or significant shifts in currency exchange rates can significantly impact a country’s sovereign spread.

Imagine a country that depends mainly on oil exports. If global oil prices suddenly drop, this can lead to a broader sovereign spread for that country. This means the country’s government bonds become riskier to investors, leading to higher borrowing costs.

Credit Ratings: A Risk Indicator for Lenders

The credit ratings and future projections given by leading agencies are critical. When these ratings or projections are negative, they usually lead to more significant differences in the amount lenders charge, showing more risk involved.

Imagine a student’s report card as a credit rating. If the report card shows excellent grades (positive rating), the student is seen as flourishing and capable, similar to how a good credit rating suggests a company is financially stable. On the other hand, if the report card has poor grades (negative rating), it indicates the student might struggle, just as a negative credit rating suggests a company might have financial difficulties. This affects how others perceive and interact with the student or the company, like how investors view the risk of lending money.

Speculation and Its Impact on Sovereign Spreads

At times, investors’ feelings and speculative actions can influence spreads regardless of basic economic signs. This point emphasizes the mental and opinion-based side of financial markets.

Imagine a new phone model is about to launch. Before its release, people start talking about how amazing it is expected to be. This excitement isn’t based on actual performance or features; it’s what people think and feel. As a result, more people want to buy it, increasing its perceived value.

Similarly, in financial markets, sometimes investors’ emotions and guesses about a stock or market can affect its value, even if the actual economic facts don’t support such changes. This is what we mean by market sentiment and speculation involving spreads.

Financial Crises: A Domino Effect in Global Economy

Economic or financial crises in one country or region can spread to others, affecting financial stability. This spreading effect is a crucial feature of our interconnected global financial system.

Think of it like a cold spreading in a classroom. If one student catches a cold, there’s a good chance others will, too, because they are all in close contact. Similarly, if a financial crisis hits one country, neighboring countries or those with close economic ties might also feel the impact, just like students in a classroom sharing germs.

Final Words

Sovereign spreads are more than simple numbers; they give us insight into the complex and interconnected world of international finance. Knowing what affects these spreads is crucial in evaluating the risks and opportunities of investing in government bonds. It also helps in understanding countries’ economic and political stability. For investors and government officials, paying close attention to these factors is crucial for successfully dealing with the constantly evolving world of global finance.

We recommend perusing this analysis, which focuses on the complexity of sovereign spreads, to enhance your understanding of how sovereign spreads function in market analysis.