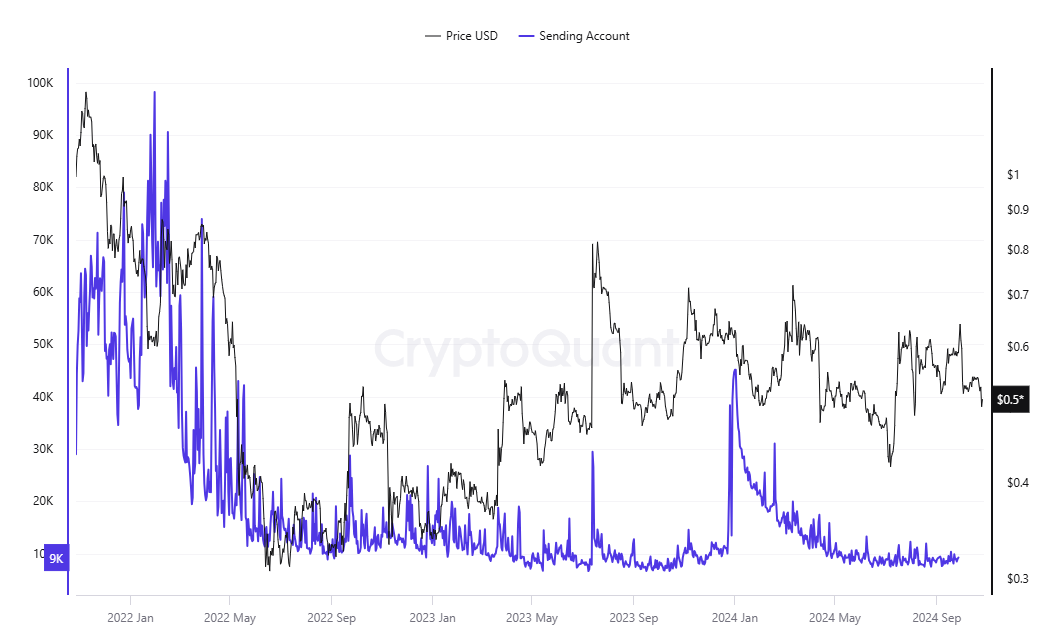

FxNews—Ripple (XRP) has experienced a notable rise in network activity, with active sending addresses reaching their highest level in six months. This uptick hints at increased user engagement.

When blockchain activity increases, there is often a rising interest in the project. This raises questions about how this increase relates to XRP’s overall market sentiment and price trends.

CryptoQuant data showed that active sending addresses on Ripple surged to 12,230, the highest level in the last six months. This rise suggests renewed interest in XRP transactions, possibly from users and developers.

When the number of active sending addresses grows, it often indicates a wider adoption of the network, which could lead to more market activity. However, it’s uncertain if this momentum will last or is just a short-term increase tied to recent developments within the ecosystem.

Ripple’s Sentiment Stays Unclear Amid Network Growth

Despite the surge in network activity, Ripple’s Weighted Sentiment has yet to show a clear upward or downward pattern. The sentiment analysis reflects a mixed view, shifting with market changes rather than sticking to a single trend.

Weighted Sentiment measures how confident the market feels, and the current data suggests that investors are still somewhat cautious about XRP’s short-term outlook. This mixed sentiment might mean that even though network activity is high, investors may wait for more signs of lasting growth before making significant decisions.

- Also read: Litecoin Retreats from $71.5 Fair Value Gap

Ripple (XRP) Technical Analysis

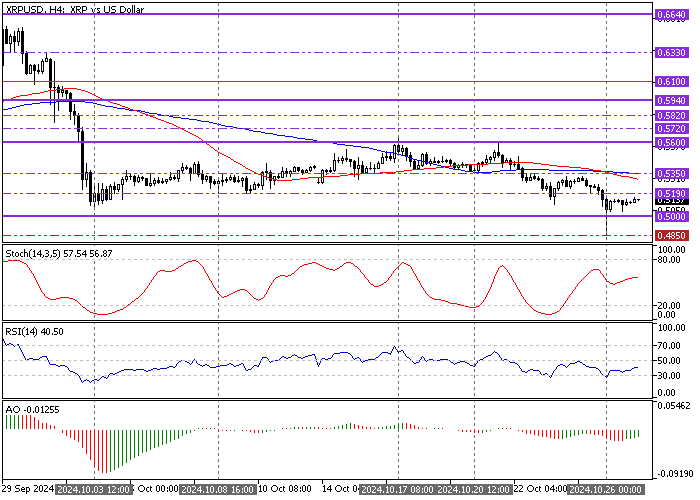

The XRP/USD crypto pair fell to $0.485, its lowest price since September 2024. However, bears failed to stabilize the price below the critical resistance of $0.5, the August 3 low. As of this writing, Ripple trades in a bear market at approximately $0.513, below the 50—and 100-period simple moving averages.

The Awesome Oscillator histogram turned green, moving toward the signal line below. This means there is mild bullish pressure on the XRP price, which could result in the price consolidating near the upper resistance levels.

- Editor’s pick: Ethereum Bearish Outlook – Watching $2450 Support

Ripple Price Forecast

From a technical standpoint, the critical support level rests at $0.5. If bulls maintain the price above this support area, the current uptick momentum could extend to the 100-period SMA at $0.535, backed by the October 20 low.

Furthermore, if the buying pressure exceeds $0.535, XRP’s path to revisit the October 17 high at $0.56 could be paved.

Please note that the consolidation outlook should be invalidated if bears push XRP/USD below the $0.5 mark. If this scenario unfolds, Ripple’s price can potentially decline to $0.45, which is the June 7 low.

Ripple Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.50 / 0.485 / 0.45

- Resistance: 0.519 / 0.535 / 0.560