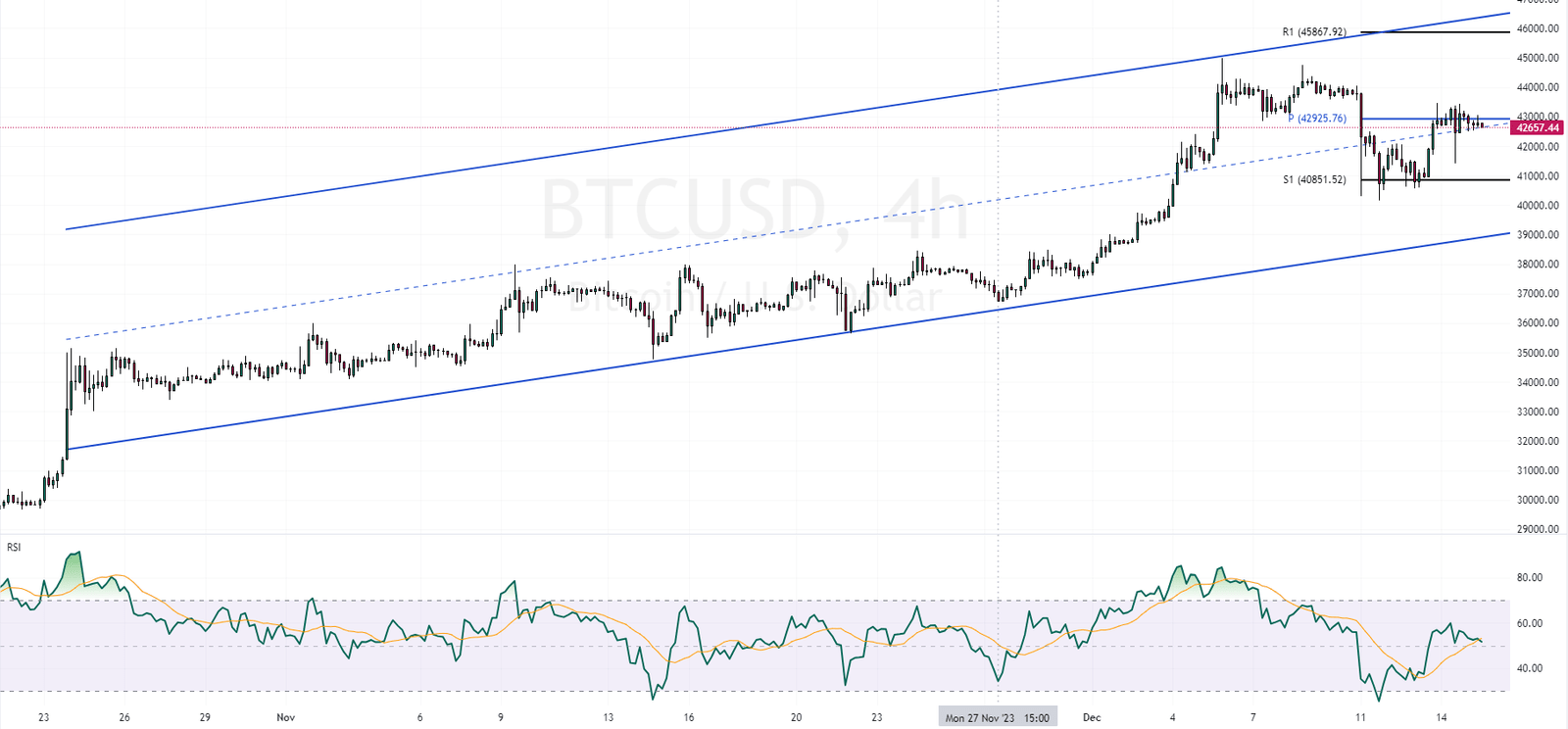

Bitcoin is currently positioned near the central line of its bullish flag pattern. This median line plays a crucial role in determining its next move.

BTCUSD Technical Analysis – Bitcoin at a Crossroad

According to the BTCUSD 4-hour chart, the weekly pivot point is at $45,925. Meanwhile, the RSI (Relative Strength Index) isn’t offering a clear direction at the moment. It’s fluctuating around the midline, leaving the market’s next trend somewhat uncertain.

The Bullish Scenario

Should Bitcoin manage to maintain its position above the pivot point, there’s a good chance the upward trend will persist. In this case, the next target for bullish traders would be the R1 resistance level, situated near $45,867.

The Bearish Scenario

Conversely, if Bitcoin falls below the pivot, which seems plausible given the current candlestick patterns, it could signal a bearish turn. The next target in such a scenario would be the S1 support level, around $40,851.

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.