In today’s comprehensive EURAUD forecast, we will first examine the Euro’s current economic conditions. Then, we will meticulously examine the details of the EURAUD pair’s technical analysis.

Eurozone Manufacturing Faces Downturn

Bloomberg—Manufacturing in the Eurozone continues to diminish. In October 2023, the HCOB Eurozone Manufacturing PMI dropped slightly to 43.1 from September’s 43.4, falling in line with earlier estimates of 43. This downturn has been consistent over the past sixteen months, marking a concerning decline in the area’s manufacturing activities, with the latest figures pointing to the most rapid contraction in three months.

The manufacturing sector has seen a considerable drop in several key areas. New orders, purchasing activities, and backlogs are all decreasing quickly, leading to a marked reduction in factory output. The rate at which new orders have fallen is one of the highest ever seen, signaling a major struggle for the manufacturing economy in the Eurozone.

Moreover, the number of factory workers has decreased quickly since August 2020. Companies are becoming more worried about the future, with business confidence dipping to its lowest in nearly a year.

EURAUD Technical Analysis and Forecast

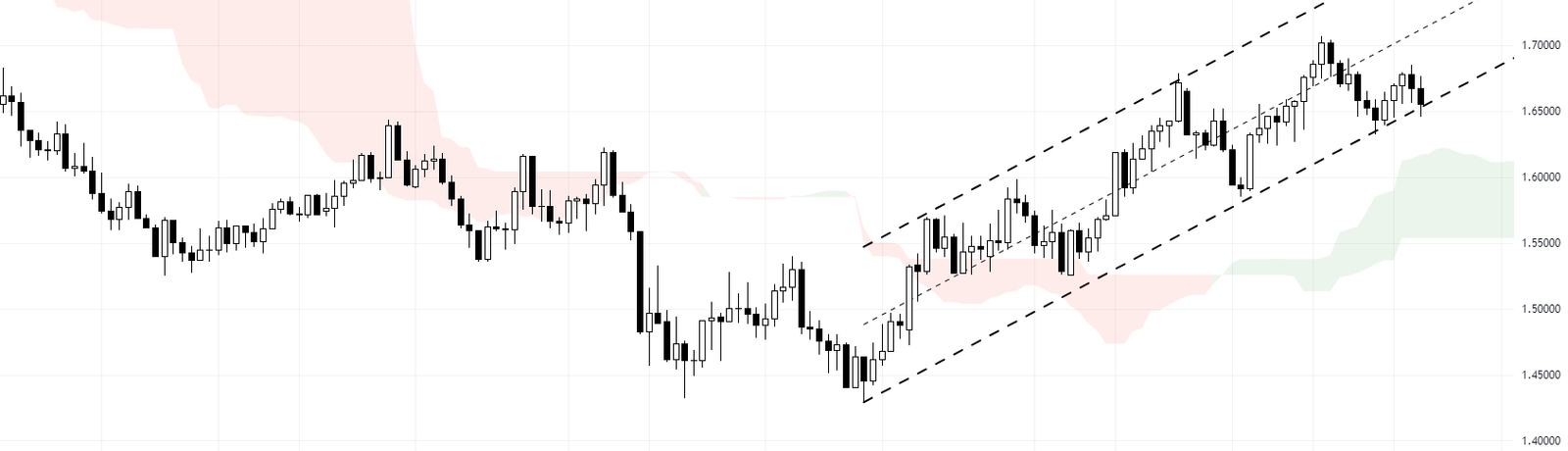

The EURAUD currency pair is currently exhibiting a bullish trend, trading within a weekly bullish channel and above the Ichimoku cloud. This indicates that the trend for EURAUD is bullish, suggesting potential buying opportunities.

Focusing on the EURAUD 4H chart, it’s evident that the bulls have increased buying pressure. This occurred when the pair’s decline reached the 1.6455 resistance level, and it is now testing the 1.6563 resistance level.

With the rising RSI indicator value and the Awesome Oscillator displaying a green bar, a close above 1.6563 could pave the way for EURAUD to reach 1.6700. This level aligns with the upper band of the young bearish channel.

The 1.6455 level supports this bullish scenario. However, if this level breaks, it would invalidate the bullish scenario. Remember to always consider these forecasts as part of your overall trading strategy.