In today’s comprehensive EURCAD forecast, we will first scrutinize the current economic conditions in Canada. Following that, we will meticulously delve into the details of the technical analysis of the EURCAD pair.

Canadian Market’s Positive Momentum

Bloomberg—The Canadian stock market experienced a significant upswing, with the S&P/TSX Composite Index climbing 1.5% to reach the 19,350 level on Thursday. This upward trend continues the substantial gains from the previous week, as equity markets capitalized on the recovery in government bonds. This positive shift occurred as investors processed a multitude of corporate earnings reports.

Key Performers and Influencers

Tech shares sensitive to policy changes were at the forefront of this rally, mirroring the performance of the US Nasdaq. This surge was further fueled by indications from the Federal Reserve that additional interest rate hikes might not be required. Shopify, a notable performer, saw its shares skyrocket by more than 15%. This impressive growth was attributed to stringent cost management and innovative technology, which enabled the company to regain profitability in Q3.

Financial institutions also experienced significant growth, with RBC, BMO, and TD Bank all recording gains of over 1%. The retreat in government bond yields sparked optimism for reduced delinquency rates, which had previously led to diminished returns.

EURCAD Forecast Indications of a Bullish Trend

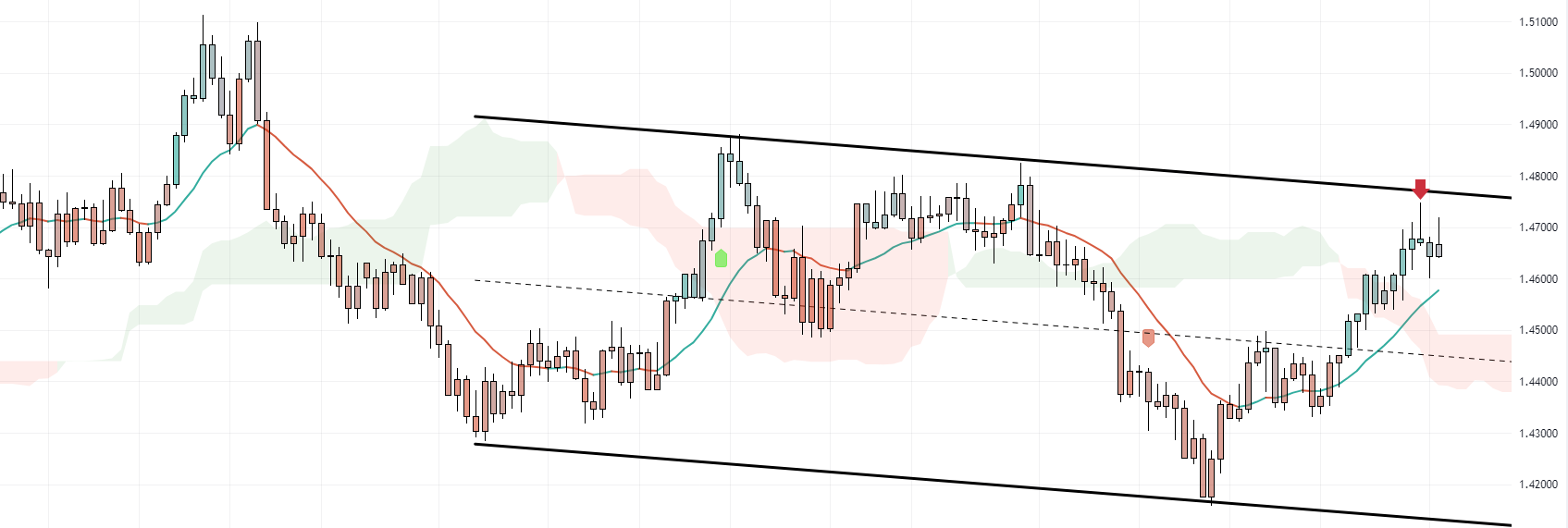

The EURCAD price recently surged to a high of 1.4747, exhibiting an inverted candlestick pattern that touched the upper line of the prevailing bearish channel. This pattern suggests a potential trend reversal or a pullback to lower levels in the currency pair. Despite this, the trend remains bullish, with the EURCAD price comfortably above the Ichimoku cloud.

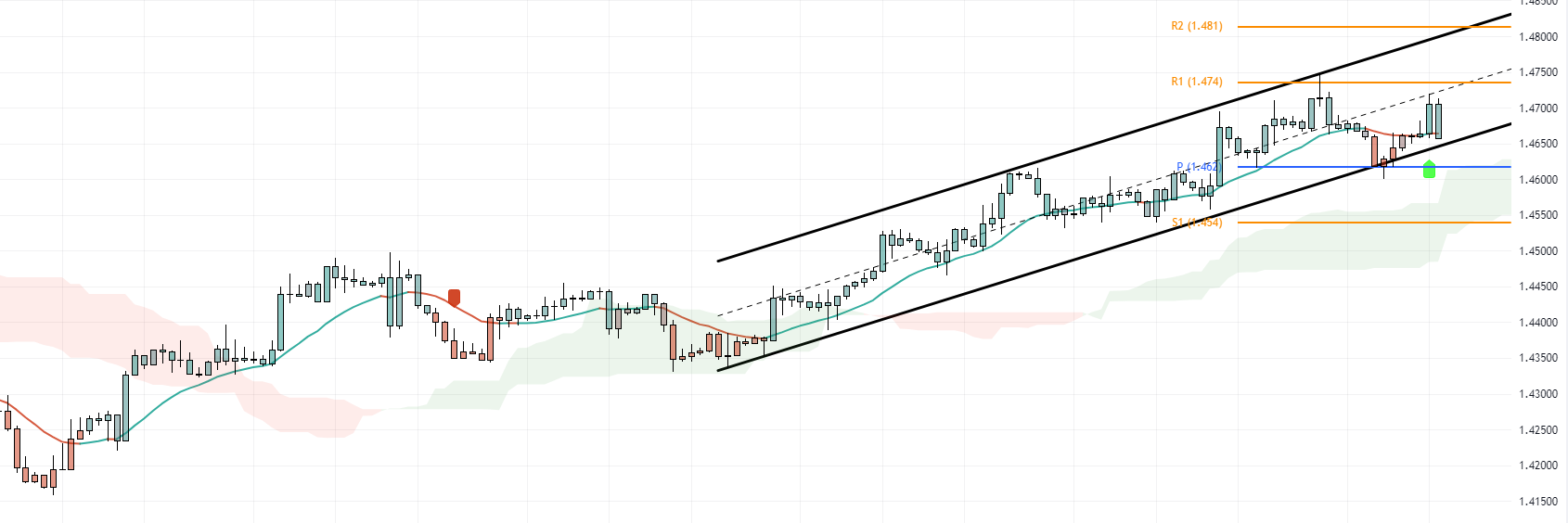

A closer look at the EURCAD 4-hour chart provides a clearer picture of the price action. The pair is trading within a bullish channel and above the Ichimoku cloud. The Machine Learning indicator is currently signaling a buy opportunity for this pair. As long as the price remains above the pivot point, it’s likely that EURCAD will aim for R2 (1.481).

The 1.458 level supports the bullish scenario. However, if EURCAD closes below this level, it would invalidate the bullish outlook. In such a case, the October high at 1.4747 would be considered the new higher low, indicating a possible shift in trend from bullish to bearish.

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.